|

A MUST-READ if you are or anticipate being in the market to buy a car anytime soon. And for everyone else, a good article to read anyway -- you never know when someone will smash your car for you by driving inattentively and you will be in the market to buy a car on short notice.

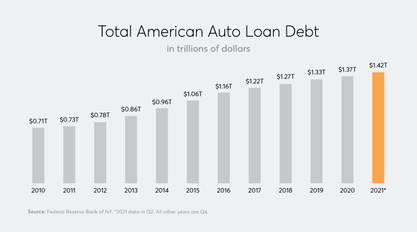

"Surprise, surprise, surprise" as Gomer Pyle used to say. Consumer Reports has a good article on how car dealers rip you off on loans. Well worth a read if you ever consider buying a car. ProTIP: If you can't pay cash and must finance a car purchase, separate the loan deal and the car deal; never do them together with financing from the dealer.* Get your loan approval from your own credit union or bank before you go car shopping so you can know exactly how much you can afford and the dealer can't bamboozle you by negotiating both deals at the same time. And, of course, you have to be willing to walk away from the lot without buying anything. And never buy any used vehicle without having your own independent mechanic to a complete pre-purchase inspection and test drive of the vehicle; if you can't afford the pre-purchase inspection, you can't afford the car anyway. (* With the possible exception for the case where you are buying a new car and the maker is offering zero-percent financing and you are certain that you aren't being overcharged on the car.) Experts say that CR’s analysis suggests a broad problem with the way car loans are arranged in this country: Dealers and lenders may be setting interest rates based not only on risk—standard loan underwriting practice—but also on what they think they can get away with. Studies show that many borrowers don’t know they should, or even can, negotiate the terms of a loan, or shop around for other offers.

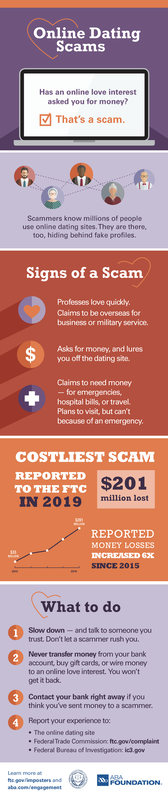

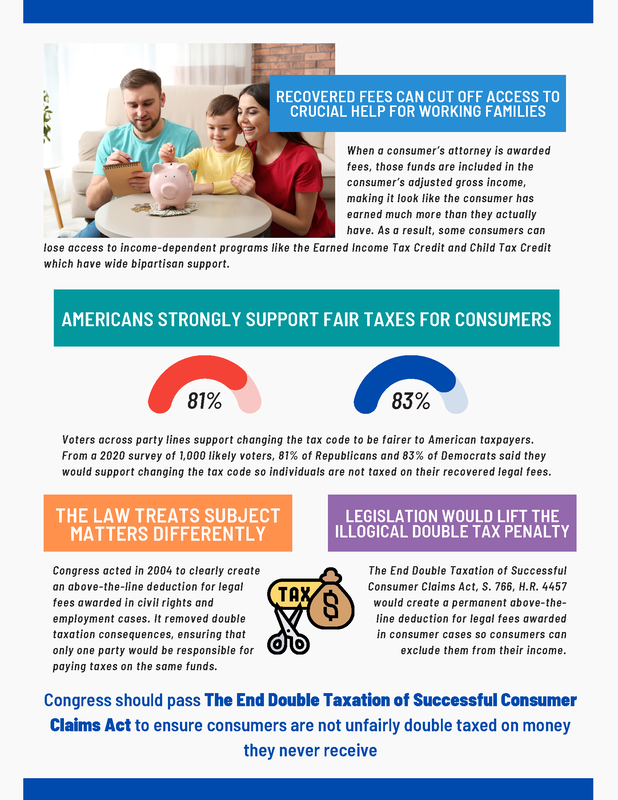

Oregon Consumer Justice (OCJ) is making money available to community-based organizations working to support tenants in accessing rent assistance payments or making applications for rent assistance. There's more information and a link to the application here: https://lnkd.in/gu7JBAzz Many organizations, community leaders, and individuals are hard at work trying to help prevent evictions, which are traumatic and have far-reaching impact on people's well-being. Spread the word about this resource which might help reach community members who don't know there's help available or don't have the ability to access that help. If you have questions, please direct them to either Janet Byrd at [email protected] or Joseluis Maldonado at [email protected]  Good review of some of the most common (most effective) scams that target elders. Always remember these safety rules: 1) Never give any personal/private information to someone who called YOU out of the blue. 2) Never buy anything from someone who found you and pitched you on it. 3) You can just hang up! It's not rude to hang up on scammers. Here are the six common scams in the article -- which is a short good read (just click on the picture). 1) Sweepstakes/lottery ("You have won! You just need to give us your banking info . . . ") 2) "Tech Support" ("We have detected a virus on your system, you need to give us access to your system so we can remove it . . . " 3) "Grandchild in Need" (Grandma, I've been arrested, send money . . . !") 4) Romance ("Send money and I'll visit you . . . ") 5) Social Security ("Give us your bank info . . . .") 6) Natural Disasters/Contractors ("We'll take care of everything, just give us your credit card number and we'll get started. ") The US Chamber of Commerce and other corporate power groups are terrified of the 7th Amendment to the Bill of Rights (right to jury trial) and the "FAIR" act, which would prevent them from forcing consumer and employee disputes into the lawless land of private arbitration controlled by and very favorable to, you guessed it, those same corporate power groups.

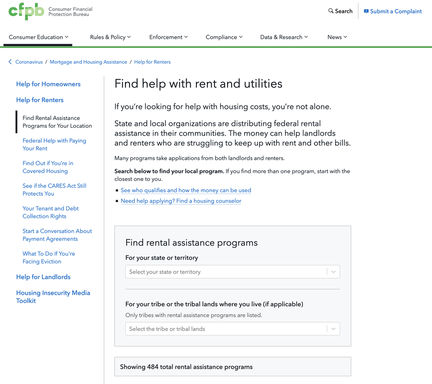

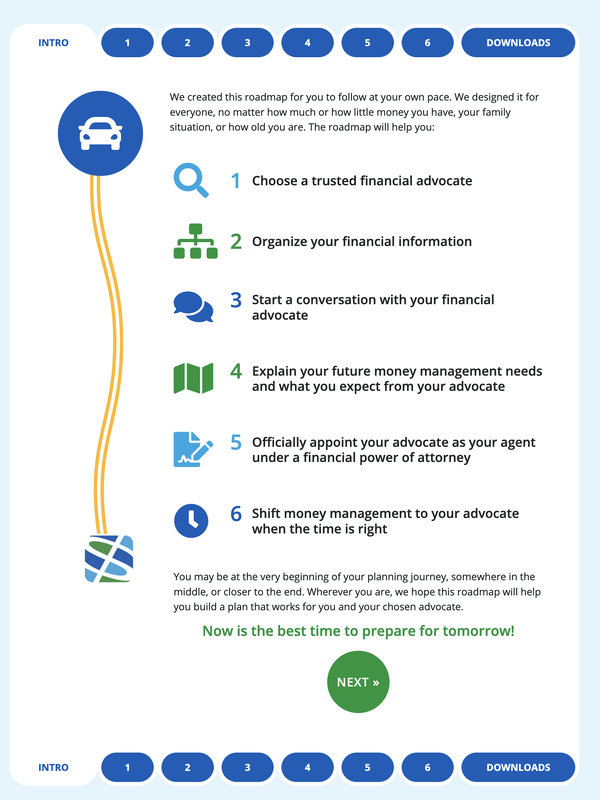

The American Prospect has a great story about an effort by these folks to disguise a corporate lobbyist-written editorial as an one written by a real consumer -- and an offer to pay a consumer attorney a $2,000 bribe if he would help find a consumer to put his name on the already-written editorial. https://prospect.org/power/corporate-lobbyists-seek-grassroots-support-forced-arbitration/  The federal Consumer Protection Financial Bureau (CFPB) has a website where you can see if there is rental assistance money available that you can access in order to help you avoid eviction for failure to pay rent. Check it out if you are behind in your rent or utility payments. https://www.consumerfinance.gov/coronavirus/mortgage-and-housing-assistance/renter-protections/find-help-with-rent-and-utilities/ Cool: Apple offers year-round 10% off Apple products for Vets/Active-Duty + immediate family members7/16/2021 Why You Should Never Use Your Debit Card Some elder advocate organizations have put together a pretty good online resource for helping you know how to keep your money safe as you age. (Elders are the main target of scammers.)

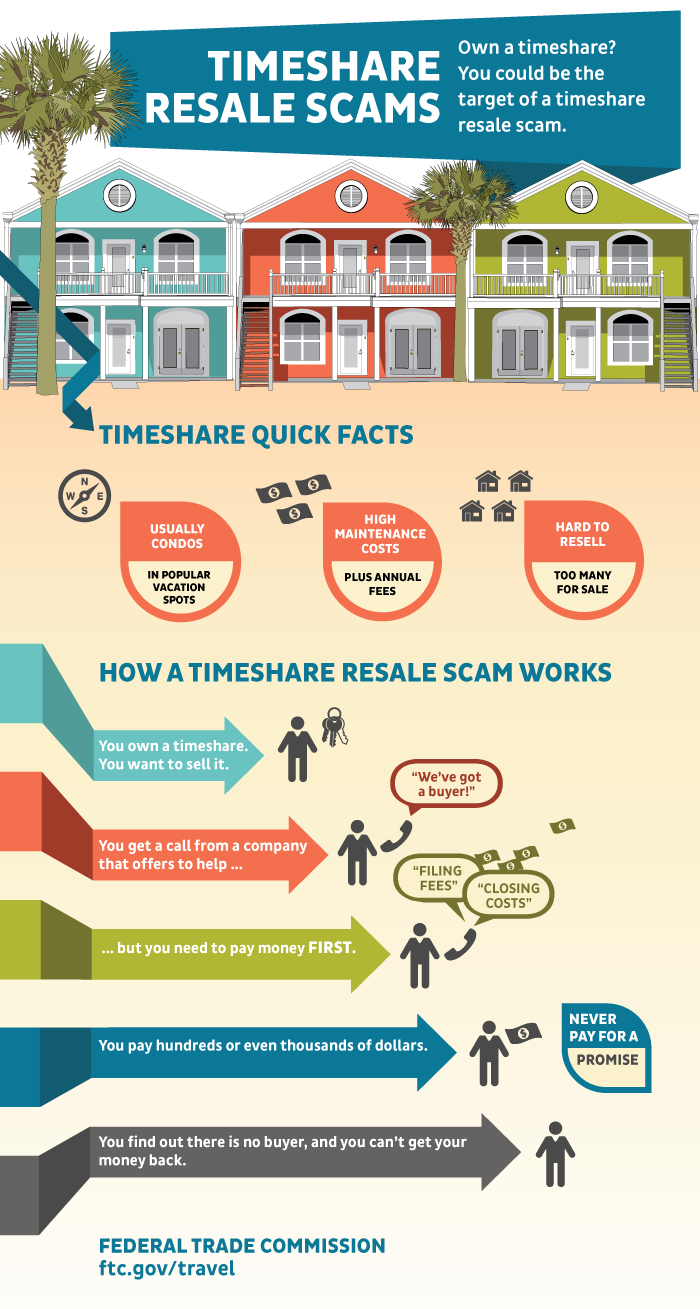

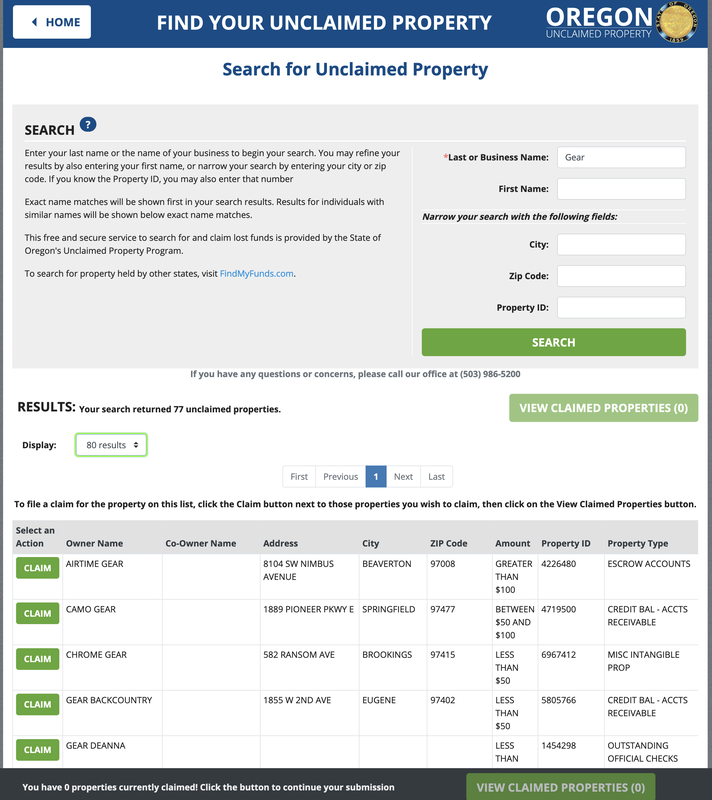

https://thinkingaheadroadmap.org/money-path/intro Even if you think you have everything all set, it's worth looking these pages over. The Thinking Ahead Roadmap is for everyone, not just people with significant assets. It includes information specifically geared towards "solo agers" (who don't have an immediate family member or partner to step in) and people with complex personal situations. This new tool was designed by Dr. Marti DeLiema of the University of Minnesota and by Naomi Karp and Steve Vernon, research scholars at the Stanford Center on Longevity, with support from AARP and the Society of Actuaries. It's based on extensive research through interviews with experts from multiple disciplines (including elder law attorneys on this list - thanks for your help!), focus groups and an online community forum of over 100 older adults. In addition to the website itself, the roadmap is available in PDF form to download, as are additional helpful documents. In the future, it will be available for ordering in print. Please help spread the word about the Thinking Ahead Roadmap to your colleagues, clients, families and communities. Based on the number of people who call me seeking help with timeshares they are unhappy with, I can safely say that, other than herpes, timeshares are just about the worst possible thing you can acquire on a vacation. Maybe the only thing worse than getting involved in a timeshare in the first place is then getting ripped off again while trying to get out of one. The "timeshare exit" field is full of pirate scammers who are only too happy to have another shot at separating you from even more of your money and preying on your desperation to unload what has turned out to be a horrible idea. The FTC has some good guidance you should check out (click the link or download the document below the graphic) if you are even thinking of getting within 100 miles of a timeshare sales pitch, or if you have already been snared and are thinking of trying to unload your timeshare. Oregon has an unclaimed property registry, currently in the Department of State Lands but moving to the State Treasury Office on July 1.

You should check it once in a while - it's quick and easy. Just click https://unclaimed.unclaimed.oregon.gov/oregon.gov/ and enter your name. Death Row gifting club scam prevalent in Oregon Caregiver Act Seminar ODVA's Aging Veteran Services team held an education session on the federal VA's recently-expanded Family Caregiver Program and how ODVA works to connect veterans and their families to earned federal benefits and programs such as these. The video is watchable below. Ana Potter, Director of Aging Veteran Services and Kelly Breshears, Assistant Director of Aging Veteran Services will help walk you through the Family Caregiver Program and what the recent changes mean for you and your family. For those that were unable to join the interactive session, please reach out below with your questions: ODVA AGING VETERAN SERVICES 1-833-604-0885 [email protected] This is a slightly modified letter I just sent to a handful of clients for whom I had prepared transfer-on-death (TOD) deeds. If you have used a transfer of death deed in your estate planning, you should consult your estate planning advisor to be sure you understand the risk involved. SUBJ: Warning: Transfer-on-Death (TOD) Deeds and Insurance Gaps Urge Congress to Support a Congressional Review Act Resolution to Overturn the OCC's "Fake Lender" RuleDear friends and allies, Congress has a short window of time to pass a resolution under the Congressional Review Act to invalidate the Office of the Comptroller of the Currency’s (OCC’s) "fake lender” rule. The fake-lender rule enables predatory consumer and small business lenders charging 179% APR or more to evade state- and voter-approved interest rate caps. ACT NOW! Email your senators and representative to ask them to support the resolution (S.J. Res. 15 or H.J. Res. 35) to overturn the OCC's "fake lender" rule. The rushed “fake lender” took effect in December and protects “rent-a-bank” schemes whereby predatory lenders (the true lender) launder their loans through a few rogue banks (the fake lender), in order to claim that it is a “bank loan” exempt from state interest rate caps. The fake lender rule overrides 200 years worth of caselaw allowing courts to see through usury evasions to the truth, and replaces it with a pro-evasion rule that looks only at the fine print on the loan agreement. Congress can use the Congressional Review Act to overturn the rule with only a simple majority vote in the Senate -- no filibuster. But the deadline is approaching, so Congress must act soon. Please also urge your members of Congress to support the Veterans and Consumers Fair Credit Act, which would stop predatory cost rent-a-bank loans by extending to all lenders, including banks, the 36% APR rate cap that currently protects active duty servicemembers. Tell Congress to overturn the OCC's "fake lender" rule! Thank you! Lauren Saunders Associate Director National Consumer Law Center The author of this piece says "almost never" -- I will go further and say that should be "never" for consumers. Why You Should Almost Never Buy a Salvage or Rebuilt Title Car

Good article by the Oregon Center for Public Policy on the very real problem of wage theft -- employers not paying workers the wages owed. If your employer isn't paying you, or isn't paying you all that you are owed, you should consult an attorney.

There is a serious, well-funded push by many business organizations and chambers to demonize lawsuits and the lawyers who bring them. This is because a lot of lawsuits are brought against businesses who harm ordinary people -- and those are the businesses that make up these organizations and they hate the parts of the legal system that mean that a regular person can force a business to account and be responsible for harms it causes, no matter how much more power and money the business has. They especially hate class actions because class actions are the only practical way for ordinary folks ripped off for small amounts of money can make the business answer for doing so. The war on lawsuits and class actions, campaigns for immunity laws, and the relentless media propaganda against the jury system is fundamentally anti-American -- the Founders thought that access to the jury for civil trials was so important that it's the 7th Amendment to the Bill of Rights. Nice to see someone doing a serious study that shows the other side of the story, about the lawsuits that protect us all. The Center for Justice & Democracy at New York Law School (CJ&D) released today Lifesavers 2021: CJ&D’s Guide to Lawsuits that Protect Us All. The study describes over 125 lawsuits that have led to major safety improvements benefiting large numbers of people, spanning well over 50 years. According to co-author Emily Gottlieb, CJ&D’s Deputy Director for Law & Policy:

thehill.com/opinion/finance/529675-after-5-decades-of-private-credit-reporting-its-time-for-a-change?rnd=1607626407 |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

||||||||||||||||||||

RSS Feed

RSS Feed