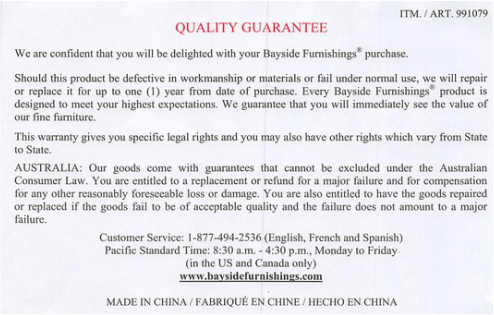

Today, putting together an office desk chair (made in China, of course) I happened to notice how much better the Aussies have it than we do in terms of consumer product warranties (a special interest of mine). Here's the warranty page from the chair:

So Australian Warranty Law is the first thing we need to seize for the betterment of America in "Where to Invade Next - Legal Edition."

RSS Feed

RSS Feed