CNS's Guiding More Good Conference is THIS SATURDAY, February 2nd.

Here's what you need to know...

including workshops such as:“I have attended the Annual Conference in Corvallis a couple times representing different Boards that I have served on. They always have top notch speakers and I find attending to be a great way to get re-energized.” Melissa Metz, Grand Chapter of OR

- Basics of Grant Writing

- Bookkeeping for Tiny Organizations

- Capital Campaign Strategies

- President and Secretary Training

- How to Start a Nonprofit

- Donor Relations Made Easy

- Total Value Budgeting

- and much more!

We're very excited for this full day of informative talks, interactive workshops, and networking opportunities. Below is some information you'll need before the big day!

Registration

Thank you for registering for the conference. If you didn’t register yourself, we have now added your registration so you're good to go!

Check In

Please check in on-site at the registration table (Info Desk in the afternoon). If we have additional information for you, it will be provided at this time with your name tag and program.

Full Schedule

- 7:30 am: Check-in and Light Refreshments

- 8:30am: Welcome and Keynote Address from Anne Kubisch

- 9:30am: Breakout Session 1

- 11:30am: Networking Lunch

- 12:45pm: Breakout Session 2

- 2:00pm: Afternoon Break and Snack

- 2:15pm: Breakout Session 3

- 3:30pm: Close

Location and Parking

LaSells Stewart Center, Oregon State University

875 SW 26th Street, Corvallis, OR 97331

There are two options for parking at LaSells Stewart Center; both require a parking fee:

- Reser Stadium: Located directly across the street from the LaSells Stewart Center on 26th Street and Western Blvd.

- Parking Garage: Located north of CH2M HILL Alumni Center at 26th Street and Washington Way (also accessible from SW Western Blvd.)

There's Still Time to Register!

We are currently expecting around 250-265 participants!

And registrations are still available. If you have colleagues, co-board members, or friends who would benefit from this conference, please spread the word!

- Event page: http://bit.ly/CNSAnnualConference

- Facebook: http://facebook.com/nonprofitstewardship

- Website: http://nonprofitsteward.org/conference

|

0 Comments

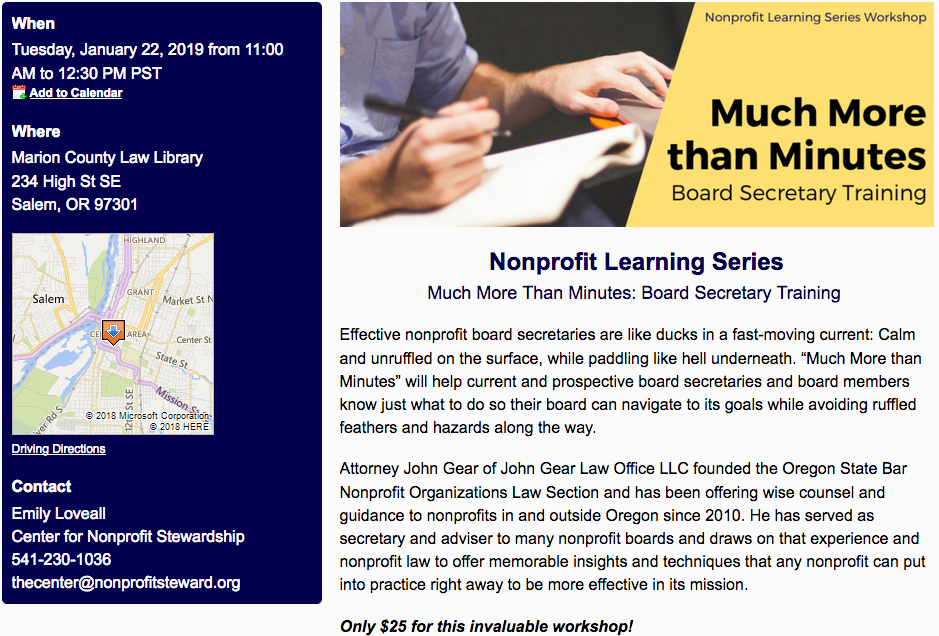

Consumers prefer a paper trail Yesterday's "Much More than Minutes" workshop (above) was part of the Center for Nonprofit Stewardship's Nonprofit Learning Series, which provides small to medium-sized nonprofits affordable and convenient learning opportunities.

If your nonprofit wants a full day of good learning opportunities like this, you'll want to attend the CNS annual conference, Guiding More Good. Click here to find all the information about Guiding More Good on the CNS website. CNS’s 15th Annual Conference is Just Around the Corner! February 2nd, 2019 8:30am – 3:30pm LaSells Stewart Center, Oregon State University Merriam-Webster chooses 'justice' as word of the year

Almost seven years ago to the day, I wrote what became one of this site's perennially most popular posts ("Another Day, Another Scam -- this one targeting small business"), which was a post about a scam operation that sends small (and large, probably) businesses and nonprofits a very hyper-official looking notice about the required annual renewal for their corporate or company registration. The annual registration renewal is something anyone can do for their own business on a cell phone in under 10 minutes (first time, less after that) at no charge. This shady outfit sending the notices wanted something like $100 bucks to do it for you, and they have a very shady way of wording the notice to make it seem like you really ought to send them the money. They don't come out and lie in a way you could prosecute -- but they rely on the fact that a lot of people struggle with bureaucratic forms, and are under such pressure and tension when they think about doing anything involving government that they lose their natural skepticism and thus can be scammed. I thought that maybe the popularity of my warning had helped put them out of business, but in today's mail, I see that they're back. The latest version of the form is similar -- it's still designed to create fear, uncertainty, and doubt in the reader, so that a certain number of them will go "Oh what the hell, I'll just send them the money and they can take care of it." If you get one of these, throw it away. To renew your registration, just go to the Secretary of State's online renewal site and take care of it yourself. Here's what this year's bait for the scam looks like (I added the "NOT APPROVED" stamps). If you're in a business or nonprofit, you have much better things to do with your money than pay someone $100 or more to do something in under five minutes you can easily do yourself in under three.

|

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

RSS Feed

RSS Feed