|

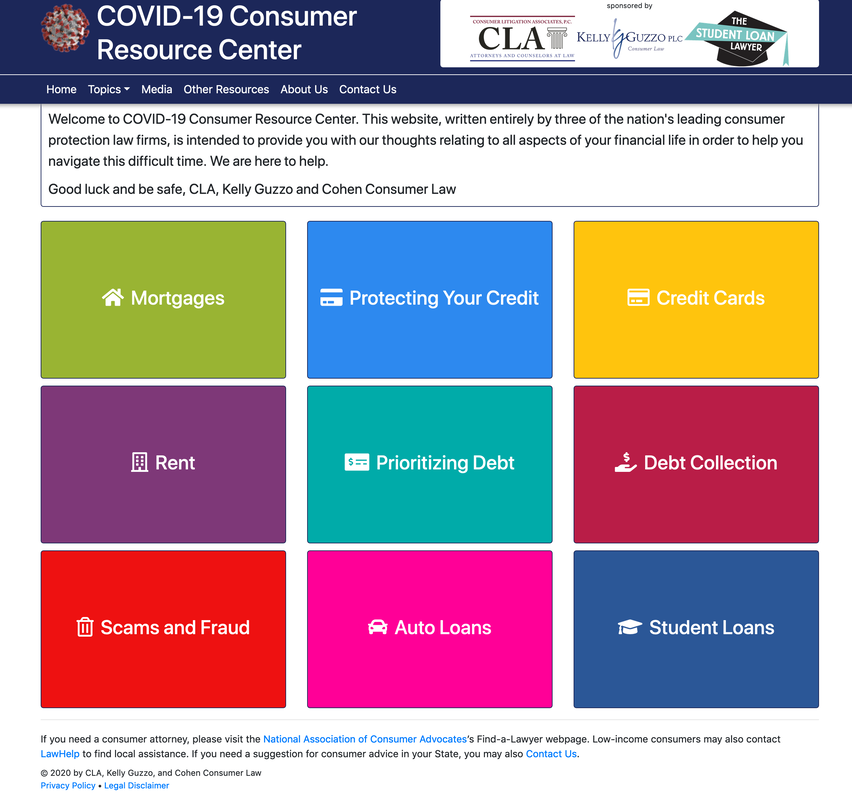

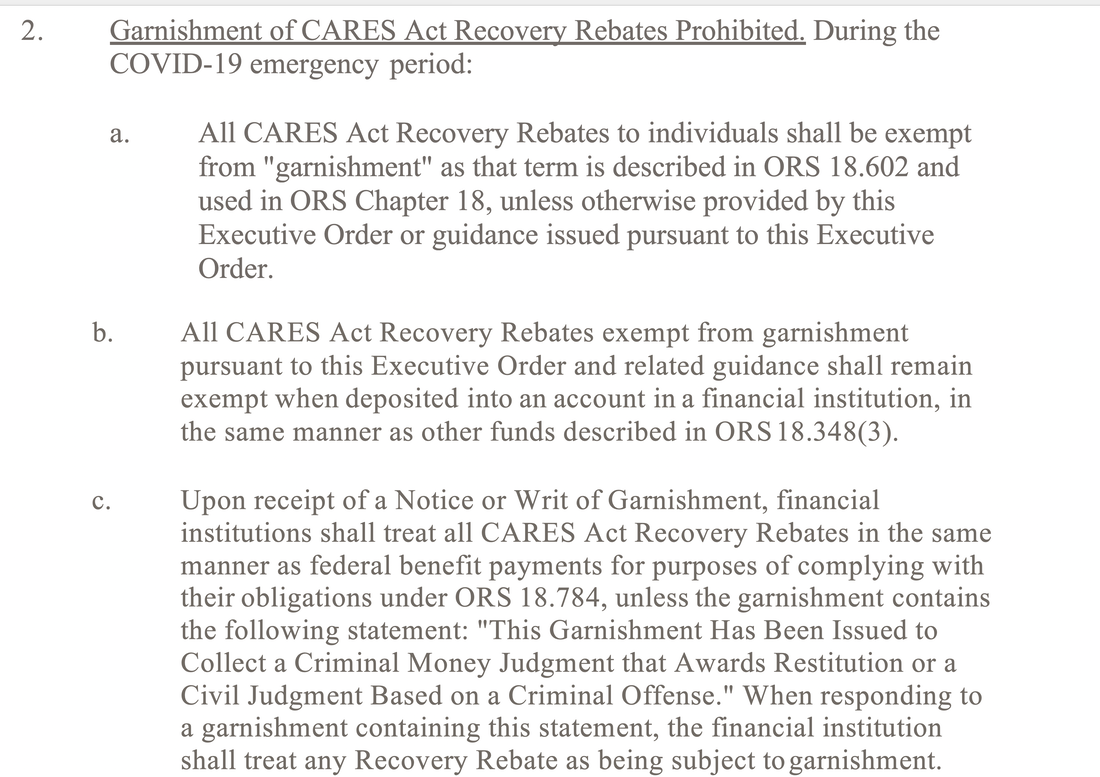

The Governor has wisely ordered that any Oregonian's CARES check be free from garnishments by creditors (except for restitution garnishments for criminal justice debts) during the COVID-19 emergency. The top picture is the key provision. If you want the full text and all the details and definitions, the full order is shown below that and you can download it by clicking on the down-facing arrow. Kudos to Gov. Brown for acting to help Oregon families survive this crisis in this critical period.  The good people at the National Consumer Law Center (NCLC.org) are constantly tracking and updating reliable information about the economic response to the COVID-19 pandemic. They have put together a document with list of frequently asked questions about the $1200 payments, including the most common one about whether these payments are vulnerable to garnishments) (#7 below). I would bookmark their FAQ page and their more comprehensive COVID-19 page if you have other questions. FAQs on Stimulus Payments  The heroes at the National Consumer Law Center (NCLC.org) have made their comprehensive 50th Anniversary guide for debtors called “Surviving Debt” available at no charge for ANYONE. This is an outstanding resource for ordinary folks who don’t want to try to read law books or statutes etc. It’s in clear, plain English. I have given away more than two dozen copies to friends and clients and it’s usually the first book I reach for when someone has a question about how to manage their debts of ANY kind. While you isolate in place, if you are worried at all about your finances, take the time to read the first 10 short chapters and then the chapters for your type of debts. So you don't have to read it all -- just the first couple chapters and then the chapters that pertain to your type of problem. (And if you yourself are able to make a contribution to NCLC, they would welcome it and put it to good use.) Find it here: https://library.nclc.org/SD

|

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed