|

A MUST-READ if you are or anticipate being in the market to buy a car anytime soon. And for everyone else, a good article to read anyway -- you never know when someone will smash your car for you by driving inattentively and you will be in the market to buy a car on short notice.

0 Comments

"Surprise, surprise, surprise" as Gomer Pyle used to say. Consumer Reports has a good article on how car dealers rip you off on loans. Well worth a read if you ever consider buying a car. ProTIP: If you can't pay cash and must finance a car purchase, separate the loan deal and the car deal; never do them together with financing from the dealer.* Get your loan approval from your own credit union or bank before you go car shopping so you can know exactly how much you can afford and the dealer can't bamboozle you by negotiating both deals at the same time. And, of course, you have to be willing to walk away from the lot without buying anything. And never buy any used vehicle without having your own independent mechanic to a complete pre-purchase inspection and test drive of the vehicle; if you can't afford the pre-purchase inspection, you can't afford the car anyway. (* With the possible exception for the case where you are buying a new car and the maker is offering zero-percent financing and you are certain that you aren't being overcharged on the car.) Experts say that CR’s analysis suggests a broad problem with the way car loans are arranged in this country: Dealers and lenders may be setting interest rates based not only on risk—standard loan underwriting practice—but also on what they think they can get away with. Studies show that many borrowers don’t know they should, or even can, negotiate the terms of a loan, or shop around for other offers. Urge Congress to Support a Congressional Review Act Resolution to Overturn the OCC's "Fake Lender" RuleDear friends and allies, Congress has a short window of time to pass a resolution under the Congressional Review Act to invalidate the Office of the Comptroller of the Currency’s (OCC’s) "fake lender” rule. The fake-lender rule enables predatory consumer and small business lenders charging 179% APR or more to evade state- and voter-approved interest rate caps. ACT NOW! Email your senators and representative to ask them to support the resolution (S.J. Res. 15 or H.J. Res. 35) to overturn the OCC's "fake lender" rule. The rushed “fake lender” took effect in December and protects “rent-a-bank” schemes whereby predatory lenders (the true lender) launder their loans through a few rogue banks (the fake lender), in order to claim that it is a “bank loan” exempt from state interest rate caps. The fake lender rule overrides 200 years worth of caselaw allowing courts to see through usury evasions to the truth, and replaces it with a pro-evasion rule that looks only at the fine print on the loan agreement. Congress can use the Congressional Review Act to overturn the rule with only a simple majority vote in the Senate -- no filibuster. But the deadline is approaching, so Congress must act soon. Please also urge your members of Congress to support the Veterans and Consumers Fair Credit Act, which would stop predatory cost rent-a-bank loans by extending to all lenders, including banks, the 36% APR rate cap that currently protects active duty servicemembers. Tell Congress to overturn the OCC's "fake lender" rule! Thank you! Lauren Saunders Associate Director National Consumer Law Center Fellow consumer attorney Ian Lyngklip of Michigan produced this helpful video that you should watch if you are stressed about bills during work interruption from COVID-19. Good Washington Post Article on How Car Dealers Rip You Off with Financing

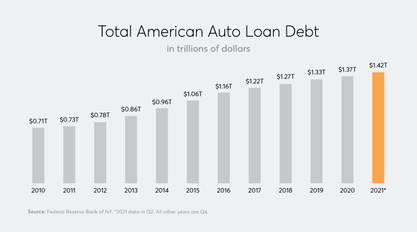

Ian Ayres is the William K. Townsend professor at Yale Law School. As websites such as Cars.com and TrueCar have made car pricing more transparent, auto dealers have turned to boosting their profits with hidden fees on loans. When a consumer chooses in-house financing with an auto dealer, the dealer sends the customer’s financial information to a lender and is told the rate that the customer qualifies for. But it’s legal for the dealer to turn around and charge the customer a higher interest rate. You might qualify for a 5.9 percent interest rate, but if the dealer can get you to agree to a loan at 11 percent, the lender will kick back more than $1,000 to the dealership as pure profit. This discretionary markup of the interest rate allows auto dealers to arbitrarily increase their fees. An analysis by the independent online auto-loan marketplace Outside Financial has found that dealers are charging an average markup of $1,791 per loan. By contrast, in 2003, Vanderbilt University economist Mark Cohen estimated that 10 percent of loans to Nissan’s borrowers were marked up more than $1,600. Now the average loan is boosted more than that. . . . Economists have had evidence for decades that car dealers tend to charge minorities higher prices. A series of studies I authored and co-authored in the 1990s found that auto dealers consistently charge black consumers prices that are hundreds or thousands of dollars more than their offers to white shoppers. These inflated prices can more than double the dealer’s profits compared with selling the same vehicle to a similar white customer. . . . The CFPB and other government agencies should be on the lookout for ways to better curtail dealership lending abuses. Yet instead of stepping up enforcement and protecting customers, the CFPB has rolled back rules on discriminatory lending practices and decreased enforcement of existing protections. Just last year, the Senate used the Congressional Review Act to overturn a CFPB rule that explicitly banned auto lenders from charging discriminatory fees on the basis of race. . . . Turns out I'm not alone in recognizing that most used car dealers (not all, but most) are really just shady payday lenders disguised as merchants. But I've been too optimistic! Below is a quoted comment from an auto industry expert in the midwest. And this ins't me talking or another consumer attorney. This is a car industry guy talking - someone who helps dealers! BHPH = "buy here, pay here" -- the classic small independent car lot. He warns that even the big chain used car places have the same practices! For used car dealers, the car is just the bait for the important part -- selling you an outrageous loan and optional "extras" that give the dealer much more profit than the car ever could. (Because, think about it -- the only reason 99% of the customers step onto the lot at one of these places is that they have such poor credit that they have to buy the car that someone else felt good about getting rid of.) With the horrible increase in economic inequality in the US, this isn't going to change anytime soon. But at least understand what you're dealing with -- if you feel like you have to buy a used car from a dealer, do everything possible to GET YOUR OWN FINANCING first, before you get anywhere within 100 miles of a dealer. Know what you are approved for IN TOTAL as well as in weekly or monthly payments, and walk away the minute the dealer tries to sell you financing. Dealers are pushing out financing terms to absurd lengths to make used cars "affordable," but that just puts you into a negative equity trap (you owe much more than the car is worth) at trade-in time ... if the car even lasts long enough for a trade to be possible.

About Us I am not a bankruptcy attorney, but I have helped many clients understand when they should look into bankruptcy and when there is no need for a bankruptcy filing because the clients have no assets that creditors can reach. If you are concerned that you are drowning in debt and don't know a good bankruptcy attorney to consult, you can make an appointment with my assistant and discuss your situation; I will be happy to refer you to good consumer bankruptcy attorneys if we decide that bankruptcy is appropriate for your situation. Below is another article in the terrific series by the National Consumer Law Center on this important subject. Deciding Whether to File for Bankruptcy: Consumer Debt Advice from NCLC

A consumer-rights leader and expert sends the following comment: From http://ctblueblog.com/  Oregonian opinion columnist Elizabeth Hovde wrote an execrable column the other day that proposed cutting food stamps for the "not so needy" -- you know, the folks with smartphones and on foodstamps. Hovde's column shows that if she ever had any understanding of just how damn expensive it is to be poor in America, her perch of privilege has long since helped her forget that crucial fact. So I wrote a letter to the editor in response, which they ran today (below). If you have no idea what I mean when I say it's really costly to be poor in America, click the image over there, which is to a great book, Shortchanged: Life and Debt in the Fringe Economy, which every politician in America should have to read and pass a test on before being allowed to legislate. Letter: Cellphones don't always signal prosperity Another Oregon attorney writes:  (hat tip to "The Housekeeping Report") NCOA Issues Updated Guide for Seniors Considering a Reverse Mortgage The National Council on Aging (NCOA) today issued the 2013 version of Use Your Home to Stay at Home™, the official reverse mortgage consumer booklet approved by the U.S. Department of Housing & Urban Development (HUD). The guide is designed to help seniors understand the pros and cons of a reverse mortgage. Reverse mortgages allow homeowners who are 62 or older to convert home equity into cash while remaining in the home. Amy Ford, director of NCOA’s Reverse Mortgage Counseling Services Network, called the guide “an older homeowner’s best resource when it comes to examining whether a reverse mortgage is right for them.” A free copy of the guide is available (download the pdf by clicking here).  The good folks at the National Consumer Law Center have just issued a new report that addresses a lot of the problems with student loan lending (pdf download), particularly the problems caused by for-profit "education" mills that really seem to be about something quite different than education.  Lots of good discussion about reverse mortgages lately: http://consumerist.com/2012/06/thinking-of-a-reverse-mortgage-here-are-things-to-watch-out-for-and-some-alternatives.html And for a "straight from the horse's mouth" take on that, note the name of this publication - dsnews, a publication for the "default servicing" industry: Reverse Mortgages Puts Confused Homeowners at Risk of Foreclosure 06/28/2012 By: Tory Barringer The Consumer Financial Protection Bureau (CFPB) released a report Thursday showing that although reverse mortgages are meant to help borrowers in retirement, they are in fact causing problems for many who don’t fully understand them. A reverse mortgage is a type of home loan that lets older homeowners access the equity they have built up on their homes and defer loan payment until they sell the home, move out, or pass away. The original purpose of reverse mortgages was to allow these homeowners to convert home equity into an income stream or line or credit to use in retirement. Borrowers were largely expected to age in place with their loans, living in their current homes until they passed or needed skilled care. Reverse mortgages require no monthly mortgage payments, but borrowers must still pay property taxes and homeowner’s insurance. The report showed that nearly 10 percent of reverse mortgage borrowers are at risk of foreclosure because they failed to pay those costs. “Reverse mortgages are complex and have the potential to become a much more pervasive product in the coming years as the baby boomer generation enters retirement,” said CFPB director Richard Cordray. “With one in ten reverse mortgages already in default, it is important that consumers understand what they are signing up for and that it is the right product for them.” The report found that many reverse mortgage borrowers do not understand how their loan balance will rise and their home equity will fall over time. In addition, the influx of new choices brought on by innovations and policy changes have made the matter too complex for many homeowners. The bureau further found that the tools currently available to help consumers understand the risks and tradeoffs are not enough. The report called for improved methods for housing counselors to help consumers understand their choices. There are many other problems with reverse mortgages as they currently stand, the report pointed out. Many consumers are getting reverse mortgages before the age of 70 (with the most common age for a new borrower being 62, the first age at which reverse mortgages are available), and some are even getting them before retiring. “These borrowers will have fewer resources to pay for everyday and major expenses later in life and may find themselves without the financial resources to finance a future move-whether due to health or other reasons,” said the report. Another problem is that 70 percent of borrowers are taking out the full amount of proceeds as a single lump sum instead of treating the payment as an income stream. As a result, these borrowers have fewer available financial resources later in life. They may not be able to continue paying taxes and insurance on their homes, leading to potential foreclosure. The report found that borrowers who save or invest their money may earn less on the savings than they spend paying interest on the loan. Finally, the bureau addressed the issue of deceptive or misleading marketing materials about reverse mortgages. The report cited examples of mailers that depict reverse mortgages as a government benefit or entitlement program in the vein of Medicare and use images resembling government seals to entice consumers. It can be difficult for consumers to tell that a reverse mortgage is a financial product, not a government benefit. . . .  Given the extreme hardship that many people are suffering as a result of loosey-goosey lending that skyrocketed from about 2001 forward, it's sad that we're already seeing ads suggesting to borrowers that they should not want to be as well-informed as possible before entering into a very serious transaction, probably the biggest financial deal that most people have ever done. Remember, anyone offering to lend you money without a solid appraisal of the collateral is not doing so because YOU will be better protected. Lending without an appraisal just means that they are satisfied that THEY are protected (that there's enough value in the home to secure their interest). Given the outrageous junk charges that lenders cram into loans, the appraisal is the last place to look to save money. Instead of getting a refi (which is just real estate jargon for a new loan) without an appraisal, maybe you should ask them to let you pay for an independent appraisal but cut the cost of it out of the other closing costs they charge, especially the loan application fee. Never think for a minute that the lender is your friend -- because they are not, as millions and millions of Americans are learning to their sorrow. |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed