Agency Order Requires Grill Maker to Fix Warranty and Come Clean with Customers

July 7, 2022

The Federal Trade Commission is taking action against grill maker Weber-Stephen Products, LLC, for illegally restricting customers’ right to repair their purchased products. The FTC’s complaint charges that Weber’s warranty included terms that conveyed that the warranty is void if customers use or install third-party parts on their grill products. Weber is being ordered to fix its warranty by removing illegal terms and recognizing the right to repair and come clean with customers about their ability to use third-party parts.

“This is the FTC’s third right-to-repair lawsuit in as many weeks,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. “Companies that use their warranties to illegally restrict consumers’ right to repair should fix them now.”

Illinois-based Weber manufactures and sells grills and related products worldwide and offers limited warranties to consumers who buy its products that provide for no-cost repair or replacement, should the products have defects or other issues.

The FTC has made it a priority to protect consumers’ right to repair their products. The Magnuson Moss Warranty Act is one of the FTC’s tools to address repair restrictions. It prohibits a company from conditioning a consumer product warranty on the consumer’s using any article or service which is identified by brand name unless it is provided for free.

Following the FTC’s right to repair report Nixing the Fix, the Commission issued a Policy Statement on Repair Restrictions Imposed by Manufacturers pledging to ramp up investigations into illegal repair restrictions.

The FTC recently announced complaints and orders against Harley-Davidson and the maker of Westinghouse outdoor generators for similar issues.

According to the FTC’s complaint, Weber imposed illegal warranty terms that voided customers’ warranties if they used or installed any third-party parts on their grill products. The FTC alleges that these terms harm consumers and competition in multiple ways, including:

- Restricting consumers’ choices: Consumers who buy a product covered by a warranty do so to protect their own interests, not the manufacturer’s. Weber’s warranty improperly implied that as a condition of maintaining warranty coverage, consumers had to use the company’s parts.

Enforcement Actions

- Costing consumers more money: By telling consumers their warranty will be voided if they choose third-party parts, Weber forced consumers to use potentially more expensive options provided by Weber itself. This violates the Warranty Act, which prohibits these clauses unless a manufacturer provides the required parts for free under the warranty or is granted an exception from the FTC.

- Undercutting independent businesses: The Warranty Act’s tying prohibition protects not just consumers, but also independent repairers and the manufacturers of aftermarket parts. By conditioning its warranty on the use of Weber-branded parts, Weber infringed the right of independent repairers and manufacturers to compete on a level playing field.

- Reducing resiliency: Robust competition from aftermarket part manufacturers is critical to ensuring that consumers get the replacement parts they need when they need them and are not at the mercy of branded part supply chains. More resilient and repairable products also lead to less waste in the form of products that could otherwise be fixed.

Under the FTC Act and the Warranty Act, the FTC has the authority to take action against companies violating consumer protection laws, including those engaging in unfair or deceptive acts or practices. The FTC’s order in this case:

- Prohibits further violations: Weber will be prohibited from further violations of the Warranty Act. They will also be prohibited from telling consumers that their warranties will be void if they use third-party parts, or that they should only use Weber-brand parts. If the company violates these terms, the FTC will be able to seek civil penalties of up to $46,517 per violation in federal court.

- Recognizes consumers’ right to repair: Weber will be required to add specific language to its warranty saying, “Using third-party parts will not void this warranty.”

The Commission vote to issue the administrative complaint and to accept the consent agreement was 5-0. The FTC will publish a description of the consent agreement package in the Federal Register soon. The agreement will be subject to public comment for 30 days, after which the Commission will decide whether to make the proposed consent order final. Instructions for filing comments appear in the published notice. Once processed, comments will be posted on Regulations.gov.

- Comes clean with consumers: Weber must send and post notices informing customers that their warranties will remain in effect even if they use or install third-party parts on their Weber grill products.

NOTE: The Commission issues an administrative complaint when it has “reason to believe” that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest. When the Commission issues a consent order on a final basis, it carries the force of law with respect to future actions. Each violation of such an order may result in a civil penalty of up to $46,517.

|

0 Comments

Consumers' Checkbook, a consumer-oriented site, has a very good article on "certified" used cars -- if you are considering one, you will want to read the whole article carefully before you go shopping. Short excerpt below ... https://www.checkbook.org/puget-sound-area/used-car-certifications-often-not-meaningful/ Used-Car Certifications Often Not Meaningful  Reuters has a must-read story with implications for everyone in America: "That evidence was clearly compelling: In a 2004 ruling, Judge Stephens rejected Purdue’s motion that he dismiss the case and sided with the state’s assertion that the material could convince a jury that Purdue’s sales pitch was full of dangerous lies. But Stephens sealed the evidence on which he relied in that ruling. And when Purdue and the state reached a settlement that year, before the case went to trial, the evidence remained hidden, out of sight to regulators, doctors and patients. Over the next few years, as OxyContin sales and opioid-related deaths climbed, more than a dozen other judges overseeing similar lawsuits against Purdue took the same tack, keeping the company’s records secret." Read the whole thing here: https://www.reuters.com/investigates/special-report/usa-courts-secrecy-judges/ I really, really hate fast operators who prey on the elderly. I have a close friend, an elderly woman, who shares all the scam mail she gets with me, so I have a window into a world that most working-age folks are totally unaware of.

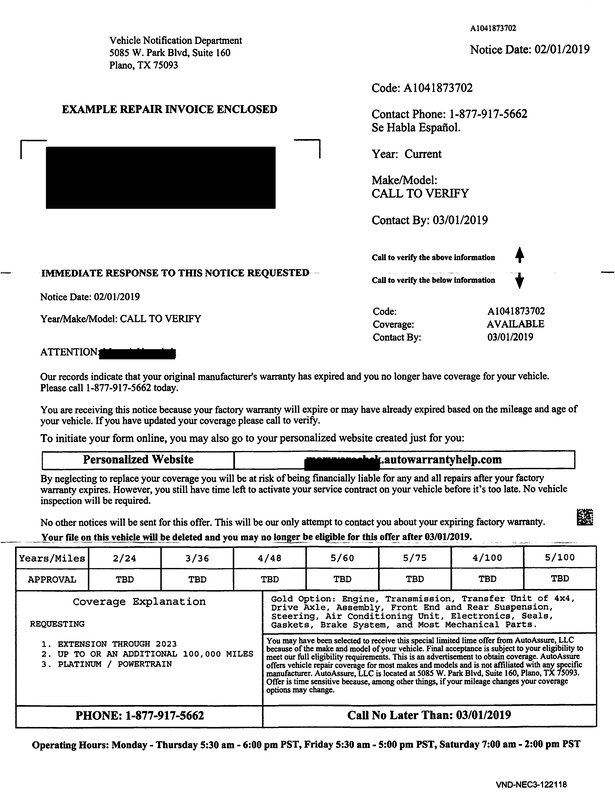

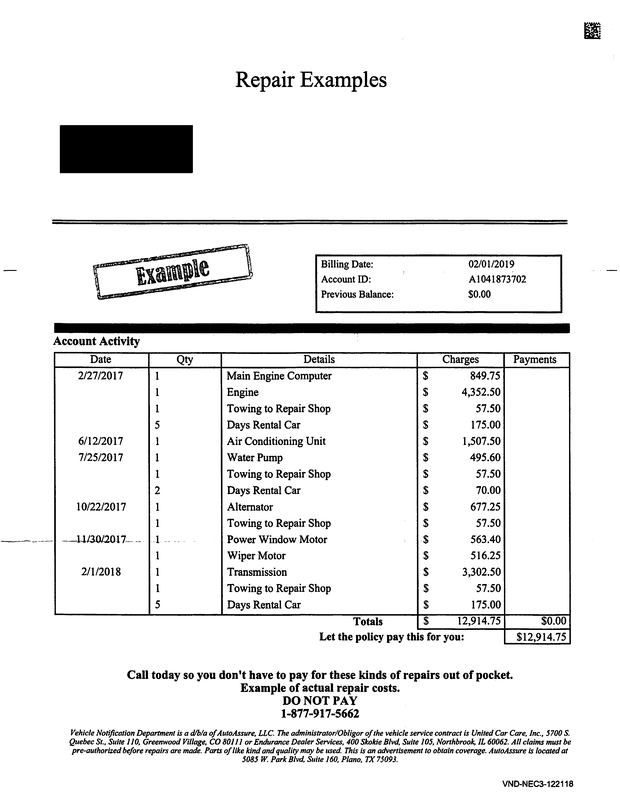

Below is an example of a really nasty bit of business, an offer pitching what is supposedly a way to buy an extended warranty on your old car (it's not really a warranty but a service contract, but most people call it a warranty or extended warranty). What it really is instead is a way for them to hook a suction line up to your bank account and drain it. I know this for several reasons. One is that my friend's car is a mid-1990s sedan. There is no way in hell that anyone honest will sell her a service contract to fix problems with a car of that age. It would never pencil out. Two is that, while I was born at night, it wasn't last night. I have had countless elders come to me to complain about "warranties" that refused to pay when the coverage the elder thought they had purchased was invoked. This whole offer, and especially the table on the back, is the work of sophisticated con artists who know that if they can get elders on the phone, the elders are often vulnerable to sales pitches that play on the fixed-income elder's fear of unexpected/unplanned expenses. The people who staff the phones for these come-ons are really, really good at being convincing and sounding utterly sincere and honest. They will talk your ear off about the high cost of auto repairs, and how their "product" would give the caller "peace of mind." That's what this scam is about -- playing on the fear that folks on fixed incomes have of repair bills, just like the horrible "water supply line" warranties that were being sold around here a few years ago. Believe me, that supposed "example" on the second page of the piece is PURE FICTION and is intended to give the reader the FALSE impression that they are selling something that would PAY for those repairs. (It is a lie, in in other words.) If you EVER get an offer like this that tempts you to respond, DON'T DO IT. Send it to me instead -- I'll gladly review it and discuss it with you at no charge if you let me use it as a consumer education example to help others. And if you can ever show me a mass-mailing come-on that targets the elderly that actually proves to be actually be a good deal after I look into it, I'll not only tell you it seems legit, but I'll give that company a public pat on the back for offering elders a fair deal that benefits them, and not just the company trying to take their money. Excerpts from a great article from the cool folks at IFixIt (IFixIt.org) We’re afraid of warranty stickers, but really, manufacturers should be  The National Association of Consumer Advocates (NACA) offers consumers a great free tool to download and review before shopping for a motor vehicle. You can access the app on your desktop or laptop by going to www.USLemonLawLawyers.com. Or take it with you to the dealer's by downloading it from the Apple App Store or the Google Play Store (Android).  I was impressed by Ms. Gunderson's wish to help her readers and explain things to them correctly -- a difficult task when writing about the law in the few words allowed in a column. I wrote her a note thanking her for mentioning me, and added two suggestions: One, we didn't discuss the small claims court limit, so I didn't know she had found something with the old, lower limit of $7,500. The current limit for small claims court is $10,000. Second, I wish I had thought of NACA.net when we spoke and she asked me how consumers could find an attorney to help with a defective product or service. NACA -- National Association of Consumer Advocates -- attorneys are likely to be much more experienced in handling consumer problems, and NACA attorneys (like me) are all committed on the consumer side of things: to join NACA, you have to agree that you won't represent any business against a consumer. "Never forget, the law is never settled until it is settled right, it is never right until it is just, and it is never just until it serves society to the fullest." |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

RSS Feed

RSS Feed