We need more reporters to be our modern Paul Reveres and to warn us about the anti-American rule being imposed on us with forced arbitration clauses hidden in "take it or leave it" contracts where you have no say and no choice. Full story at: http://www.ocregister.com/articles/arbitration-656044-arbitrator-lindemann.html

0 Comments

I got a disgusting pitch in the email the other day, asking me to guide veterans to the website for this outfit that buys up guaranteed payment streams at a big discount, essentially suckering people who need those payment streams over a lifetime out of their rights to payment in return for fast cash now. Maybe the worst part is the focus on veterans, since veterans' retirement pay and benefits are protected from garnishment, but a big lump sum from some scammy lender is not. In other words, if you sign away your retirement pay or VA benefits to this outfit for ready cash now, when you get the check from them, it will NOT be exempt from garnishment the way your pay or benefits were. And since people willing to trade lifetime benefits for cash now are usually in financial trouble -- or soon will be -- that matters a LOT. I'll give the pitch below so you can see how scammy these people are, but I'll delete their name and URL because I don't want to lead any veterans to them -- quite the contrary. I'm reaching out to you from [Scammy.org], a site dedicated to providing essential information on pensions and annuities. Today we give thanks to all of the brave men and women veterans who serve our country. The only question I have is how these people sleep at night when their entire job is separating the gullible and the desperate from a secure, guaranteed, garnishment proof stream of income and profiting from doing so.

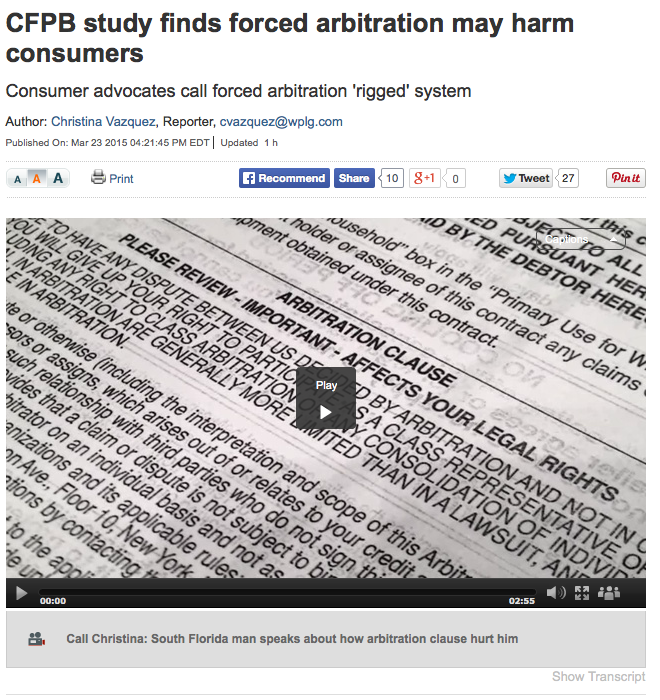

With Your Help, NCLC is Fighting Robocalls to Cell Phones The Consumer Financial Protection Bureau issued its long-awaited report on forced arbitration this week. The report reinforces the conclusions of AFJ’s short documentary, Lost in the Fine Print: Forced arbitration is a bad deal for consumers, depriving them of the chance to stand up for their rights in court. Sign the petition to stop forced arbitration today! Did you know that Wall Street has found a way to cheat, steal, and defraud Americans without ever being held accountable for their actions? It’s called forced arbitration. Buried in the fine print of many bank and credit terms of service are dangerous forced arbitration clauses that kick cheated consumers out of court and instead funnel them into a secretive dispute mill rigged in favor of Big Banks and predatory lenders. With forced arbitration, corporations have granted themselves a license to steal and evade the law. And they are getting away with it. But with your help, this can be stopped. The Consumer Financial Protection Bureau (CFPB) can revoke corporations’ license to steal by stopping the abusive practice of forced arbitration. Join us in telling the CFPB to put Americans’ financial security above Wall Street profits and stop forced arbitration. Sign the petition to the CFPB today! Petition: https://www.change.org/p/revoke-corporations-license-to-steal-stop-forced-arbitration 777 6th Street NW, Suite 200 | Washington, DC 20001 | 202-965-3500  From Rep. Williamson: Today, the Oregon Senate passed HB 2700—the class action accountability bill— by a vote of 17-13. That means the bill is now headed to Governor Kate Brown’s desk for her signature. Thanks to your support and the grassroots advocacy of hundreds of other Oregonians, the Legislature voted to close the loophole that allows at-fault corporations to avoid paying the full penalty ordered by a court when they injure or defraud someone. Because of you, big corporations will no longer be able to duck their responsibilities and avoid paying millions in penalties that they owe Oregon consumers. I was proud to co-sponsor this bill with my colleague Representative Tobias Read. We are grateful to the 50 courageous legislators in the House and Senate who joined us in voting for HB 2700. These men and women stood up to tough corporate pressure and did the right thing for Oregon families and consumers. You can thank these pro-consumer legislators by signing our card today. When Governor Brown signs HB 2700 into law, our state will finally stop letting corporations who injured or ripped off Oregonians off the hook. In the years ahead, remaining class action funds will go to Legal Aid of Oregon to provide services to needy citizens who cannot afford private lawyers and to appropriate charities designated by the judge in each case. We hear a lot about elected officials when they disappoint us. I think it’s also important to recognize committed public servants when they do the right thing. . . . Sincerely, /s/ Representative Jennifer Williamson |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

RSS Feed

RSS Feed