FTC Reaffirms Consumer Right to Enforce Warranty Protections in Court:

Latest Government Agency to Uphold Right to Day in Court Rather than Forced Arbitration

(WASHINGTON) Consumers will still have their day in court if an auto dealer fails to honor a warranty under a recent decision by the Federal Trade Commission (FTC). Attorneys at the National Consumer Law Center (NCLC) and the National Association of Consumer Advocates (NACA) applauded the FTC’s decision to preserve rules under the Magnuson-Moss Warranty Act that prohibit merchants from forcing consumers into binding, forced arbitration. NCLC and NACA encouraged the Consumer Financial Protection Bureau (CFPB) to follow suit and ban the use of forced arbitration clauses in contracts for consumer financial products.

The decision is important for a number of reasons, including that arbitrators are often paid by businesses and thus have an incentive to rule in their favor. “Secret, unreviewable arbitration proceedings before arbitrators paid by industry could keep unsafe cars on the road and unsafe products in our homes,” said National Consumer Law Center attorney David Seligman.

The Magnuson-Moss Warranty Act ensures that consumers have the right to enforce warranties on consumer products. It also prohibits manufacturers from dodging their obligations under written warranties on the ground that a dealer, not the manufacturer, sold the product. The Act also includes many protections against warranties that appear to promise real protection but hide limitations in the fine print.

The Department of Defense, the National Labor Relations Board, and the Equal Employment Opportunity Commission have also recently concluded that forced arbitration is inconsistent with the rights of consumers and employees. “These agencies and the FTC have recognized that our most hard-fought legal protections are rendered toothless by the proliferation of forced arbitration clauses. Now it’s time for the Consumer Financial Protection Bureau to ban forced arbitration clauses for consumer financial products, too,” said NACA Legislative Director Ellen Taverna.

Under the Dodd-Frank Act, the CFPB has the authority to ban forced arbitration agreements covering consumer financial products under its jurisdiction. In March 2015, the CFPB published the final results of its two-part study, which showed that forced arbitration agreements prevent consumers from protecting themselves against corporate wrongdoing at the hands of banks, payday lenders, auto lenders, and others. Forced arbitration does not provide an alternative dispute resolution mechanism for consumers, but rather a “get-out-of-jail free” card for financial institutions that violate the law.

###

Since 1969, the nonprofit National Consumer Law Center® (NCLC®) has worked for consumer justice and economic security for low-income and other disadvantaged people, including older adults, in the U.S. through its expertise in policy analysis and advocacy, publications, litigation, expert witness services, and training.

The National Association of Consumer Advocates (NACA) is a nonprofit association of more than 1,500 consumer advocates and attorney members who represent hundreds of thousands of consumers victimized by fraudulent, abusive and predatory business practices. As an organization fully committed to promoting justice for consumers, NACA’s members and their clients are actively engaged in promoting a fair and open marketplace that forcefully protects the rights of consumers, particularly those of modest means.

|

0 Comments

Boston Globe From ConsumerAdvocates.org (National Association of Consumer Advocates): |

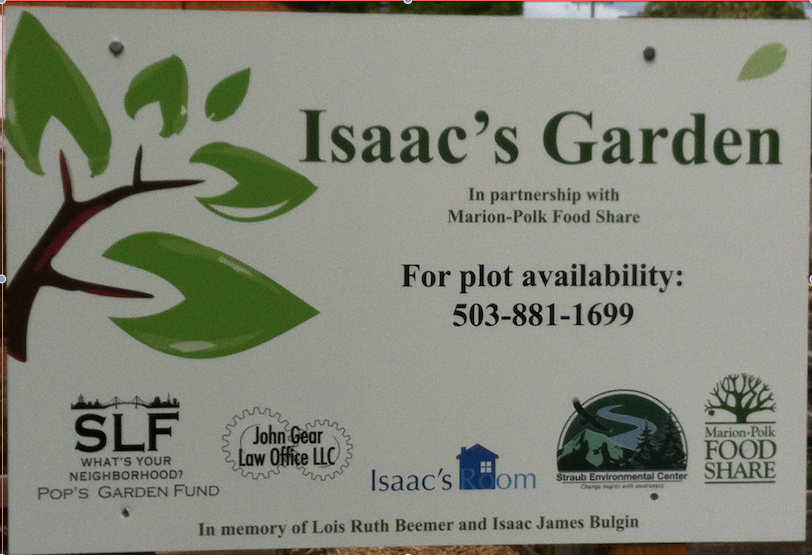

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

RSS Feed

RSS Feed