|

Mortgage Closing Scams: How to protect yourself and your closing funds By Melissa Yu – JUN 03, 2019 Your Mortgage Closing Checklist Closing is one of the most important stages of buying a house. Learn how to prepare and what to expect so you can close with confidence. Closing on a new home can be one of your most memorable life moments. It’s the final and one of the most critical stages in the home-buying journey, but with the exchange of key paperwork and a sizable down payment, it can also be a stressful experience, especially for first-time homebuyers. The FBI has reported that scammers are increasingly taking advantage of homebuyers during the closing process. Through a sophisticated phishing scam, they attempt to divert your closing costs and down payment into a fraudulent account by confirming or suggesting last-minute changes to your wiring instructions. In fact, reports of these attempts have risen 1,100 percent between 2015 and 2017, and in 2017 alone, there was an estimated loss of nearly $1 billion in real estate transaction costs. While it’s easy to think you may not fall for this kind of scam, these schemes are complex and often appear as legitimate conversations with your real estate or settlement agent. The ultimate cost to victims could be the loss of their life savings. Here’s what you should know and how to avoid it happening to you. How it works Scammers are increasingly targeting real estate professionals, seeking to comprise their email in order to monitor email correspondences with clients and identify upcoming real estate transactions. During the closing process, scammers send spoofed emails to homebuyers – posing as the real estate agent, settlement agent, legal representative or another trusted individuals – with false instructions for wiring closing funds. How to avoid a mortgage phishing scam

What to do if it happens to you

While it can be easy to think you’ll never fall for a scam of this nature, the reality is that it’s becoming more and more common, and the results can be disastrous for eager homeowners. By being mindful and taking a few important steps ahead of your closing, you can protect yourself and your loved ones. To learn more about the closing process, including how to prepare for your closing and common pitfalls to avoid, check out our Mortgage Closing Checklist. For information and resources for the each stage of the home-buying journey, visit the Bureau’s Buying a House tool. The resources on mortgage closing scams are part of the Consumer Financial Protection Bureau’s work to protect consumers from unfair, deceptive, or abusive practices. We arm people with the information, steps, and tools that they need to make smart financial decisions.

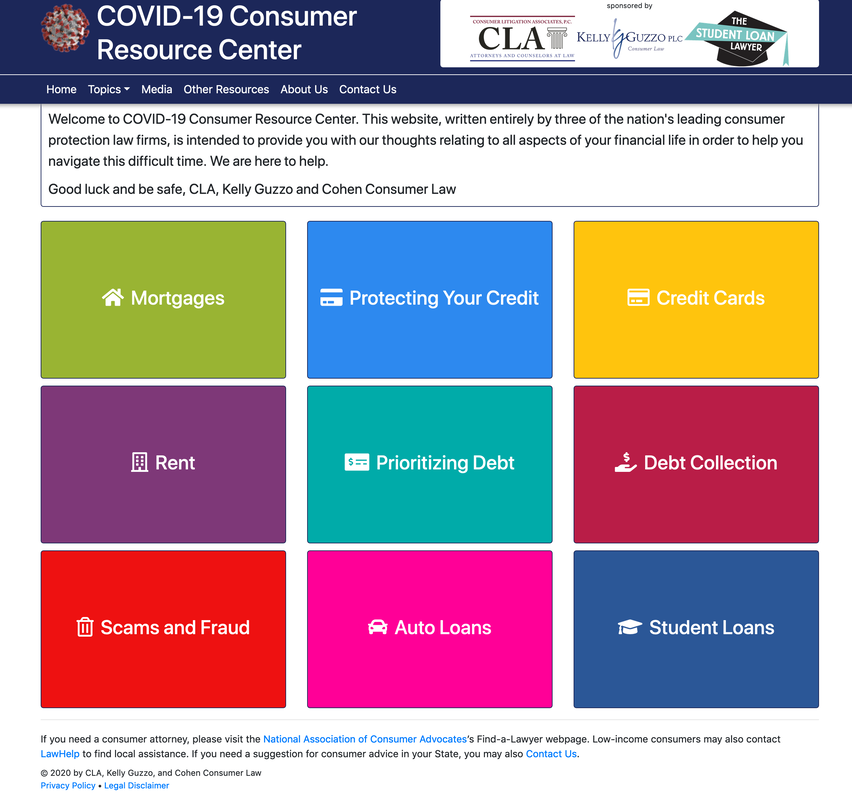

Mark Twain once said that Congress was America's only native criminal class. But that's because Twain didn't live to see today's national banking chains and financial institutions, which all make Congress look like a choir of saints. The case below is yet another example of why you should NEVER accept "paperless billing" when dealing with a big bank or other institution, ESPECIALLY ON YOUR MORTGAGE, which is likely the biggest investment you have. Without a paper bill that you can scrutinize at your leisure and show to other people, it's very unlikely that this scam would have been spotted. The original case<https://f.datasrvr.com/fr1/219/92022/ocwen_first.pdf> Because I see clients who are at risk of or already embroiled in a foreclosure, I see a lot more of the dark and ugly side of mortgage borrowing than the average person does. So I'm not at all convinced that our so-called "American Dream" of home ownership as an aspiration for everyone is a good idea. And I urge anyone thinking about buying property to do your homework very carefully, so that you as well informed and aware of the risks as you already are of the benefits. That said, if you are a vet and have decided that buying rather than renting is for you, you should definitely know about the home loan option available through ODVA.

Prof. Gerry Beyer of Texas Tech posted about the latest in his "Wills Trusts and Estates" blog. He writes: "[R]everse mortgages allow individuals 62 and over to receive money from a bank [now] in return for their home upon their death. . . . Reverse mortgage rules are going to change, which could mean less available funds for borrowers. The changes can also lower the program's high default rate. [New] rules are expected to go into effect as early as October 1. The changes will reduce the number of homeowners that will qualify for reverse mortgages and the maximum amount will be reduced as well. People who apply before October 1 will qualify for the amounts under the rules now. Folks that are considering a reverse mortgage should act quickly if they want the current laws to apply."  (hat tip to "The Housekeeping Report") NCOA Issues Updated Guide for Seniors Considering a Reverse Mortgage The National Council on Aging (NCOA) today issued the 2013 version of Use Your Home to Stay at Home™, the official reverse mortgage consumer booklet approved by the U.S. Department of Housing & Urban Development (HUD). The guide is designed to help seniors understand the pros and cons of a reverse mortgage. Reverse mortgages allow homeowners who are 62 or older to convert home equity into cash while remaining in the home. Amy Ford, director of NCOA’s Reverse Mortgage Counseling Services Network, called the guide “an older homeowner’s best resource when it comes to examining whether a reverse mortgage is right for them.” A free copy of the guide is available (download the pdf by clicking here).

The Washington Supreme Court today announced an important decision, finding --- as the Oregon Court of Appeals just did recently in the Niday case --- that the phony-baloney attempt to dodge recording fees known as MERS can't have it both ways and claim to be just an administrative convenience AND force people out of their homes. Another blow for justice in the Northwest.

The Oregon Court of Appeals has ruled that the hydra known as MERS -- the monstrous placeholding dummy with a million phony vice-presidents, which the mortgage servicing industry created to attempt to evade the requirement (and the fees) that all transfers of interests in mortgages be recorded -- cannot use the streamlined, fast-track nonjudicial foreclosure process in Oregon! Niday v. GMAC Mortgage, LLC et al, "[T]he import of our holding is this: A beneficiary that uses MERS to avoid publicly recording assignments of a trust deed cannot avail itself of a nonjudicial foreclosure process that requires that very thing-- publicly recorded assignments." The nonjudicial foreclosure process was created in the old days when lenders held onto their mortgage loans, which were actually underwritten thoughtfully. Fast forward to the slice-and-dice fast-money 1990s-2000s, when the banksters and money men started financializing everything and you suddenly had a tool that was being used against homeowners in ways never intended, by an entity never imagined by the law, a weird hybrid creature that pretended to be both the beneficiary of the loan (when useful to MERS) and not the beneficiary (again, when useful to MERS). Hurrah for the Oregon Court of Appeals. BULLSEYE! Seems likely the MERS scammers will appeal but, for now, a true shining example of Oregon flying with her own wings and reaching the right conclusion despite a number of other states having missed the mark widely on this issue.

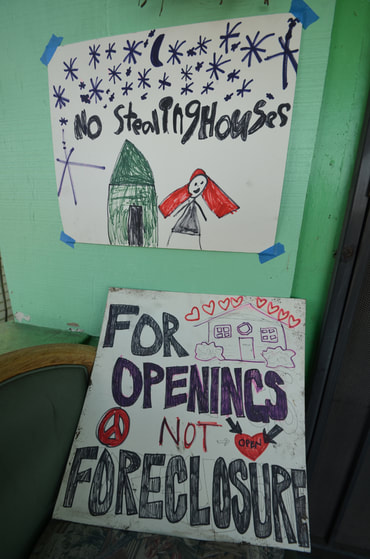

A tremendously important and even courageous decision by a federal judge in Oregon. The banksters are mobbing in Salem, desperately trying to make past illegal conduct OK. Call your representatives and tell them that you expect that they will stand up for Oregon, not for the big banks throwing people out of their homes after having been bailed out to the tune of billions and billions of dollars. TELL THEM:

NO RETROACTIVE APPROVAL FOR THE MERS SCAM! BANKS AND MORTGAGE SERVICERS SHOULD HAVE TO FOLLOW THE LAW TOO! |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

||||||||||||||||||

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed