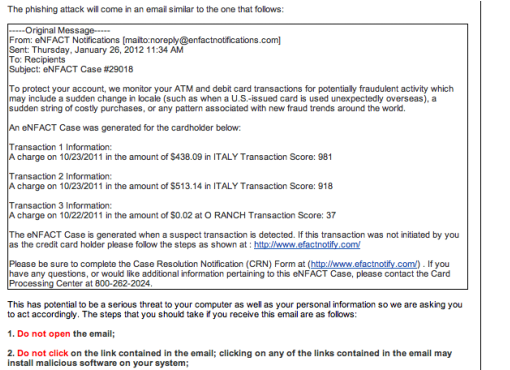

"Phishing" is where the scam artist dangles a lure and tries to lure you to bite on what appears to be a safe-looking link that actually leads you to a specially-disguised website, where they get you to give them your private data, all while making it appear that they are helping you).

Willamette Valley Bank is a local institution, and this email (complete text below, image above) is a well-done warning. Some phishing warnings are so poorly planned that you can't tell whether it's a genuine warning or more phishing. The text of the WVB warning:

Dear Client & Friend,

We recently received a communication alerting us to the fact that there may be an attempted phishing attack in progress. Because we care about the safety of our clients, we are providing you with information and steps to take if you receive this fraudulent email.

Phishing is a form of fraud that is used as an attempt to acquire personal information such as usernames, passwords, and credit card details. The most common way this is attempted is through email.

Emails have been received that reference the "eNFact" product. These emails have been directing recipients to click on a link (shown in the e-mail sample below) which will take them to a mock-Fiserv site which is believed to be installing malicious software onto computers.

The phishing attack will come in an email similar to the one that follows:

[see image above]

1. Do not open the email;

2. Do not click on the link contained in the email; clicking on any of the links contained in the email may install malicious software on your system;

3. If a link is clicked, steps should immediately be taken to protect your computer and/or network;

4. Delete the email from your "Inbox" and "Sent Items.

Please rest assured that your personal information stored on Willamette Valley Bank computers is secure and this threat does not compromise that information. If you have any questions about this at all feel free to contact us:

RSS Feed

RSS Feed