Since 1995, the Department of Health and Human Services’ Office of the Inspector General has published warnings and reports outlining the misuse of the hospice benefit. Last year, it listed hospice fraud as the government’s top area for criminal recoveries, after the pharmaceutical and home health sectors. “It’s an open secret that hospice is one of the poster children for fraud and abuse in Medicare,” said David Grabowski, a health policy professor at Harvard who serves on MedPac, the federal advisory panel on Medicare spending.

Some hospices boost profits by signing people up regardless of whether they are dying. Marketers present the program as free home health care or steal personal information to enroll “phantom patients.” Others target assisted living facilities and nursing home residents whose life expectancy exceeds six months.

This guide can help you research your hospice provider and spot common signs of hospice fraud. It is adapted from the Senior Medicare Patrol National Resource Center, a grantee of the Administration for Community Living at HHS, that assists Medicare beneficiaries, families and their caregivers to prevent, detect and report health care fraud, errors and abuse.

Click Read the rest to see the whole thing

|

https://www.propublica.org/article/how-to-research-your-hospice-and-avoid-hospice-fraud

0 Comments

If you drive for any ride-hailing company (like Uber or Lyft), here's something you must know:

In the words of one very experienced lawyer who represents consumers against insurance companies, ride-hailing service drivers "are risking everything by not purchasing a commercial use endorsement" to add to their own personal auto insurance policies. That's because, despite recent improvements to PIP coverage, Oregon did not change the exclusion of personal vehicles used for commercial purposes from collision or liability insurance coverage under the driver’s own personal insurance policy. The typical exclusion reads “There is no coverage for an insured for damages arising out of the ownership, maintenance, or use of a vehicle while it is:

Anyone who drives for any of these companies in their own car IS NOT COVERED for liability (or collision) insurance benefits. Insurance coverage through the ride-hailing company's liability insurance coverage can be as low as $50,000 during certain periods of operation. A wreck, for which the Uber or Lyft driver is responsible, can result in no financial compensation for them for the loss of their vehicle plus they may be on the hook for damages to the other people or vehicle(s) and its occupants that exceeds the $50,000 minimum coverage. The only way around this coverage exclusion is for the driver to purchase a separate commercial use endorsement for their vehicle. The reality is the insurance companies are not educating their insureds about this exclusion and are not ‘offering’ this endorsement to their customers. For them, silence is golden (as in free $$$$$ for them as they keep enjoying your personal insurance premiums but deny claims for any losses arising while you were driving for pay). (Side note: If you are an Uber or Lyft driver, this reminder is probably a good time to re-evaluate driving for these companies at all. When you look at the costs of the insurance and the wear and tear on your own vehicle and your own time, these companies are robbing you blind. The only way they make money on any particular ride is by underpaying you, the driver, who basically eats all the costs of the ride. And as a whole, these ride-hailing companies are dead losers, because their business model makes no sense and only serves to add traffic congestion. There's a tiny sliver of the business that might be profitable to serve, but only if there's about 99% fewer drivers competing to serve that business.) On Veterans Day 2022, the National Park Service will unveil a lifetime pass providing free entrance to national parks for Veterans and their families.

The Interagency Military Lifetime Pass waives entrance fees for the National Park Service and the U.S. Fish and Wildlife Service, and standard amenity recreation fees for the Bureau of Land Management, Bureau of Reclamation, U.S. Forest Service and U.S. Army Corps of Engineers sites for current military service members and their dependents, Veterans and Gold Star Families. Veterans and their families have free access to approximately 2,000 public locations spread out across more than 400 million acres of public lands, which host activities to fit any lifestyle—from serene to high octane, including hiking, fishing, paddling, biking, hunting, stargazing, camping, and much more. The Military Pass has been expanded to include a pass that does not expire for Veterans and Gold Star Family members. The National Defense Authorization Act of 2022 authorized a free lifetime pass to national parks and other federal recreational lands for eligible Veterans and Gold Star Families. In recent years, they were able to receive annual passes. Are you eligible?For purposes of this program, a Veteran is identified as an individual who has served in the United States Armed Forces, including the National Guard and Reserve, and is able to present one of the following forms of valid (unexpired) identification:

The America the Beautiful – the National Parks and Federal Recreational Lands Pass (Interagency Pass) ProgramThe Interagency Pass Program includes a free annual pass for active-duty members of the U.S. Military and their dependents. Current Military service members must show a valid (unexpired) Department of Defense ID. Dependents of current service members must show a valid (unexpired) DD Form 1173 AD or DEC. Other free or discounted passes, including some lifetime passes, are available for persons with permanent disabilities, fourth grade students, volunteers and senior citizens age 62 years or older. How to get your Interagency PassInteragency Passes can be obtained in person while visiting a participating site. Visit Places to Get Interagency Passes for a searchable list and be sure to contact the site before you go, to make sure they are open and have passes in stock. In addition, Military passes, as well as those for seniors and persons with permanent disabilities, are available online through the USGS Online Store with an additional processing fee. Existing passes remain valid. You do not need to obtain a new pass if you already have a Lifetime Senior or Access Pass. For more information about eligibility and passes, visit Free Entrance to National Parks for Veterans and Gold Star Families (U.S. National Park Service) (nps.gov). The participating agencies also offer several fee-free days for everyone throughout the year to mark days of celebration and commemoration. Examples of fee-free days include the birthday of Martin Luther King, Jr., National Public Lands Day, Veterans Day and the signing of the Great American Outdoors Act. Fee-free days and fee policies vary among the agencies, so it’s best to check the agency website or contact the site you plan to visit in advance of your trip. APPLY FOR A VETERAN ID CARD APPLY FOR A VETERAN HEALTH IDENTIFICATION CARD (VHIC) There is an alert sent to elder law attorneys that you might want to review if you are low income and are paying premiums for your Medicare Part D (Prescription) coverage: Excerpts from the alert (available for download below): "You May be Overpaying for Part D Prescription Drug Coverage" "Every year hundreds of thousands of Medicare enrollees with the Low-Income Subsidy (LIS or “Extra" "Help”) overpay for Medicare prescription drug coverage. In 2021, for example, thirteen percent (800,000) of" "LIS enrollees were expected to pay an average of $27/month for Part D premiums in plan year 2022 if they did not switch to a premium free plan. In many cases, the reason these individuals are paying premiums is inertia. People who qualify for the full Medicare Part D LIS do not pay premiums if they enroll in plans with “benchmark” prescription drug premiums. Benchmark plans have premiums at or below a cut-off in each region, which is set yearly by the Centers for Medicare and Medicaid Services (CMS). LIS recipients who are enrolled in a Prescription Drug Plan (PDP) or Medicare Advantage plan with Part D premiums above the CMS cut-off must pay the difference between the benchmark premium and the premium charged by the plan. Sometimes, PDPs lose benchmark status. For LIS recipients who were auto-enrolled in a benchmark plan by CMS, CMS will also automatically move them to a different plan when their current PDP loses benchmark status the following year. However, LIS recipients who pick a plan at any point in their Medicare eligibility (called “choosers”) are not moved automatically if their plan’s costs are above the benchmark in any subsequent year. If these LIS recipients do not affirmatively choose a new benchmark plan, they will have to pay the difference between the benchmark premium and the premium charged by their current PDP. "Choosers receive a notice in early November on tan paper (the “tan notice”) informing them of their new premium and offering them a list of plans available with no premium liability. The tan notice goes to any chooser who will pay a premium for the first time or whose premium will go up. Choosers do not receive the tan notice if they already are paying a premium and that premium stays the same or goes down. "•" ARE YOU PAYING A PREMIUM? If you are not sure, review your options with a State Health Insurance Assistance Program (SHIP) counselor. You can also get help through 1-800-Medicare or on the Medicare.gov website. The best time to review coverage options is during the Open Enrollment Period from October 15 through December 7.

Good piece from ProPublica on avoiding final rites ripoffs: https://www.propublica.org/article/how-to-negotiate-funeral-costs-qa

Revealing National Public Radio piece on how many auto dealers operate. https://www.npr.org/sections/money/2022/08/30/1119715886/inside-the-rise-of-stealerships-and-the-shady-economics-of-car-buying Recently, my truck was stolen, forcing me to get some new wheels. And, for the first time in my life, I've been looking to buy a new car. The process has involved hours of searching. Painful haggling. And encounters with many dealerships that, quite frankly, have been downright duplicitous. The whole thing has been kind of a nightmare.  A fellow consumer lawyer does a great job exploding how Experian is setting traps for consumers to trick you out of your rights. The whole thing is really worth your time to read: https://goldsonlawoffice.com/consumer-protection/how-experian-tricks-people-into-signing-away-their-rights/ If you are having trouble sleeping one night but don’t mind a possible nightmare of being crushed by a multi-billion dollar corporation, you can read Experian’s Terms of Use Agreement here:  After a decade of research, the Federal Trade Commission has issued draft rules to combat the plague of auto-dealer misconduct throughout the sales process. You can help make sure the FTC adopts the strongest possible version of the rules by telling the FTC about your car-buying experiences. The car dealers lobby will be pushing back against pro-consumer rules, so we need everyone who has been subjected to abuse from a car dealer to build the strongest possible case about why the strongest possible rules are so vital. So, please, if you have ever had a bad experience buying a car, turn that bad experience into good by telling the FTC what happened to you. Your story can help the FTC write the strongest regulations. Stick up for consumers by sharing your experiences at this link. And if you are a consumer advocate, urge the FTC to issue stronger car buyer protections on regulations.gov. Agency Order Requires Grill Maker to Fix Warranty and Come Clean with Customers  Sad news, friends. If you are a victim of identity theft, if they manage to get money out of your bank, investment, or retirement accounts, you are probably never getting that money back. You can go to IdentityTheft.gov for a good checklist of things to do if you've been a victim, but they don't suggest anything to help you get the bank or investment broker to take mercy on you and make you whole. (Indeed, from their point of view, if they started paying off on identity theft claims, they would multiply exponentially as people would not take precautions against identity theft.) If you are not a very comfortable Internet user -- such as if you don't know how to set up and use and maintain unique strong passwords for each different site you subscribe to or each business you patronize on the Internet, you might want to consider NOT doing any business on the Internet and asking for trusted friends to buy things for you and you give them cash or checks for those things. If you aren't able to clearly recognize spam and phishing attacks promptly, you may need to adopt a strict "no click" policy of never clicking on anything in an email, just like you would never invite people into your home before looking through the door to see who is out there. (And if you're a super-comfortable Internet user, don't get cocky! People who are experts fall for scams online all the time. Remember, in the old days, you could pretty much only get ripped off by local criminals. Now, every criminal in the world is just one click away from you.)  Consumers' Checkbook, a consumer-oriented site, has a very good article on "certified" used cars -- if you are considering one, you will want to read the whole article carefully before you go shopping. Short excerpt below ... https://www.checkbook.org/puget-sound-area/used-car-certifications-often-not-meaningful/ Used-Car Certifications Often Not Meaningful The current meltdown in "cryptocurrency" (more aptly named griftocurrency) demonstrates that ordinary consumers have no business messing with it.

Here's a great website that keeps track of the KNOWN loot scammed from people via griftocurrency plays https://web3isgoinggreat.com/ Today, the New York State legislature passed an electronics Right to Repair bill: As of mid 2023, manufacturers who sell “digital electronic products” in New York will have to make parts, tools, information, and software available to consumers and independent repair shops. We still await a final signing by the governor, but advocates don’t expect a challenge. . . . New Analysis Finds Consumers Reported Losing More than Anyone who has EVER thought of "investing" in cryptocurrency or "non-fungible tokens" (NFTs) should watch this priceless expose. Friend of John Gear Law Office and outstanding consumer attorney Young Walgenkim, along with a stellar cast of other consumer protection experts, has filed a petition with the FTC to stop one of the worst abuses in the entire US market system, the yo-yo sales scam that auto dealers use. The yo-yo sale is so bad it reminds you of the old saying that "If you think the illegal stuff is bad, take a look at what's legal." Basically, a yo-yo sale is where you are stuck with the bargain you made but the dealer gets to revoke it … in other words, they get you psychically invested into and committed to the car you bought and often into sinking money into the car, and then they pull it back (the yo-yo) and demand that you, the consumer accept a worse deal or give the car back. And, believe it or not, today, that's legal. It’s absolutely a shocking and abusive predatory practice that ought to be outlawed in auto sales just like all other forms of consumer contracts. If the deal isn't binding on them, it shouldn't be binding on you. Read the rulemaking petition below and then contact your congressional rep and your Senators and tell them you agree: If an auto dealer isn't bound by the contract, the consumer shouldn't be either. If a deal's a deal, then it should be binding on both sides or neither side. End Yo-Yo Auto Sales!

Regular Annual Parks Pass cost $80 Cost for Vets: $10 ($5 processing/$5 delivery) Get it here: https://store.usgs.gov/MilitaryPass A clever Twitter user named Pat Dennis posted this perfect gem recently: Pat Dennis @patdennis In all seriousness, I see a LOT of signs of bubbles and scams in the cryptocurrency space.

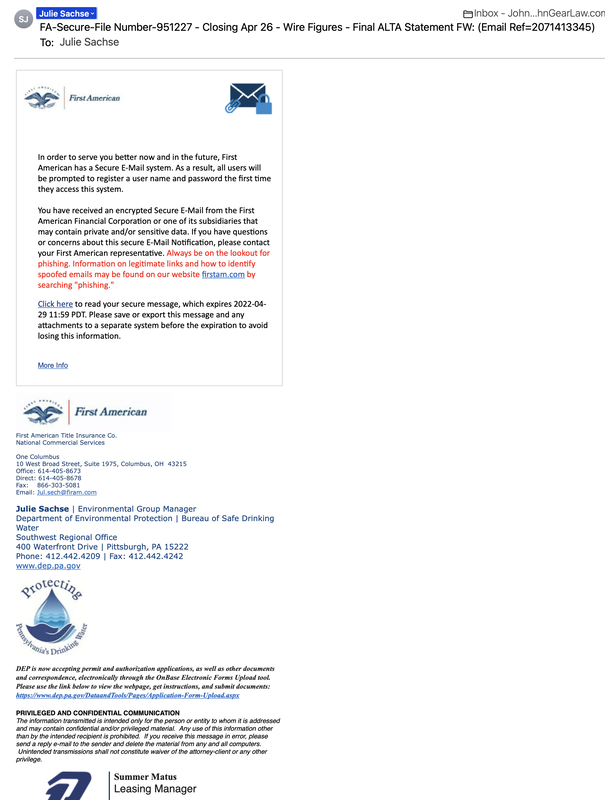

If anyone consulted me, I would advise clients to put no money into cryptocurrency except for money they would happily take to Vegas or Seven Feathers Casino and be absolutely OK with losing. As far as I can tell, sellers are the only ones for whom cryptocurrency is an investment -- for buyers, it's just Beanie Babies for nerds. You might buy low and sell high -- or you might be the one stuck with a roomful of worthlessness. Very helpful article from The Verge below with step-by-step directions on how to avoid getting jobbed out of your right to join a class action against Venmo (which is, in practical terms, probably the only way you'd ever be able to have a hope of dealing with a problem with them that they won't fix for you). Excellent deeper analysis of how Venmo is hoping you won't bother so they've made the process absurd, from the Credit Slips blog. How to opt out of Venmo’s new arbitration clause So we are selling a house right now, which involves signing an absurd number of forms, many of which we have already signed, and that all have to be re-signed by everyone every time so much as a comma changes. So I'm constantly getting emails from the title company demanding that we go to a document signing website to re-sign things.

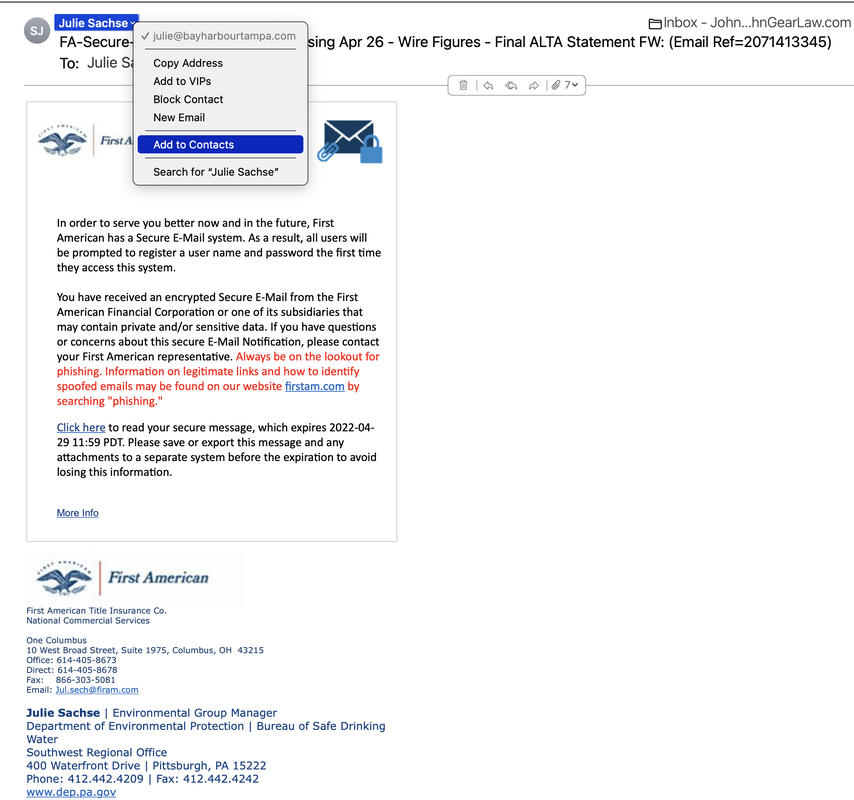

So this afternoon, I got the email in the photo on the left and thought "Great, we've got a closing date!" And I was reaching for my mouse when I remembered that we aren't even using First America Title to do the closing. So the entire email was just bait to get me to click on it -- they send them out by the millions, and some fraction of people end up snared by malware that downloads on their computer when they click on the links in the email. This is called a "spearphishing attack." To confirm it was spearphishing, I hovered my mouse over the sending email address, and sure enough, it has nothing to do with any real title company. It's no doubt a spoofed address for some criminal somewhere. So good reminders: 1. Never click on links in unknown mail, especially mail made up to look all official. 2. Learn to use your mouse to hover over sender email address so you can always double check suspicious emails by seeing the actual sending email instead of just looking at the displayed email (as in the photo on the right). So, here it is, 2022, and the old favorite scams come back like dandelions. This one targets small and medium-sized businesses where either the owner is doing everything themselves and is too busy to read the mail really closely or where someone else opens the mail and sends the invoices to the owner for payment, but doesn't realize that this one is a scam. I've posted about this scam in 2012 and 2019. Remember: It ONLY COSTS $100 to renew your corporate registration ($50 for nonprofits). You DO NOT NEED to pay these criminals $185 to do for you what you can do for $100 in five minutes flat at the Secretary of State Corporations Division Website. You will get a REAL LETTER IN THE MAIL from the Oregon Secretary of State when it's time to renew your corporate registration. Then it will tell you how to go online and renew your registration here: https://secure.sos.state.or.us/cbrbr/renewal.action#stay So don't make it easy or profitable for scammers! Recycle that trash they mailed you, or --- better yet -- use it to train your people in how to recognize scams so that your business stays away from them entirely. IF YOU GOT A NOTICE LIKE THE ONE SHOWN BELOW, IT IS A SCAM TRYING TO RIP YOU OFF! A very convincing fraudulent email - you must learn how to check actual sender email addresses3/28/2022 The scammers are getting better and better all the time.

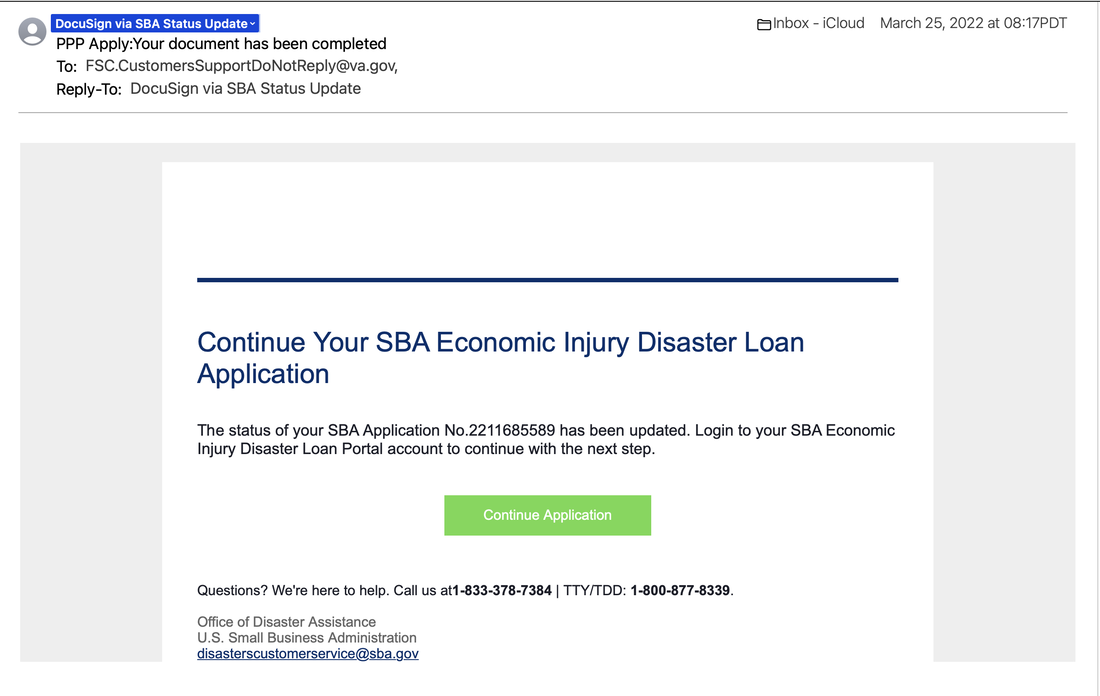

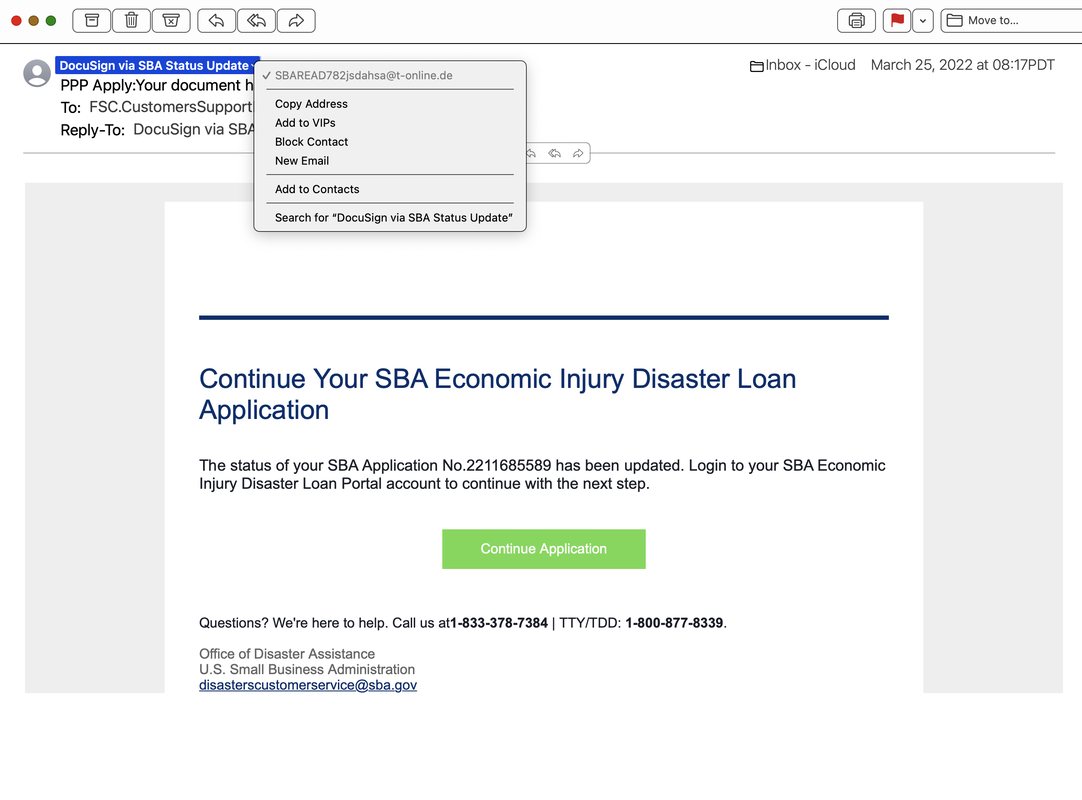

You MUST learn how to use your mouse to hover over email addresses so that the ACTUAL sender email displays, because it is very easy for scammers to fake the email address that appears in the header on your email application. Note how well done this scam email is -- it looks pretty convincing and, to a busy person, the tempting idea of an email about disaster relief money might be just the push they need to click the link -- which leads to disaster, because this is from a scammer operating out of Germany, it is NOT from the US Small Business Administration. Sad but true, we must learn to be appropriately suspicious of every unexpected email, ESPECIALLY any that seem to be offering something for nothing. The top photo is what the email looks like when you glance at it in your inbox. The bottom photo is what you see if you hover your mouse over the (faked) sender email address - hovering the mouse over the email causes the ACTUAL sender email to show up, which is when you see that it's NOT from the Small Biz Administration but rather from someone in Germany (.de is the country domain for Germany). If you could only learn one anti-scam habit, learning to find the actual email sender is maybe the one to know. If you are a homeowner who has not been making payments on your mortgage and now you are having a problem getting back on track with your mortgage, you may be eligible for help from a new legal aid foreclosure defense project, Oregon Homeowner Legal Assistance (OHLA).

If you are low/moderate income and face any COVID-related financial hardship that threatens your homeownership (defaults, lender refusals to modify your loan, etc.) you should seek if OHLA can help you by calling Oregon Homeowner Legal Assistance: 1-855-503-2598. Right to Repair Veterans, active duty can take advantage of Public Service Loan Forgiveness program |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

||||||||||||

RSS Feed

RSS Feed