Since 1995, the Department of Health and Human Services’ Office of the Inspector General has published warnings and reports outlining the misuse of the hospice benefit. Last year, it listed hospice fraud as the government’s top area for criminal recoveries, after the pharmaceutical and home health sectors. “It’s an open secret that hospice is one of the poster children for fraud and abuse in Medicare,” said David Grabowski, a health policy professor at Harvard who serves on MedPac, the federal advisory panel on Medicare spending.

Some hospices boost profits by signing people up regardless of whether they are dying. Marketers present the program as free home health care or steal personal information to enroll “phantom patients.” Others target assisted living facilities and nursing home residents whose life expectancy exceeds six months.

This guide can help you research your hospice provider and spot common signs of hospice fraud. It is adapted from the Senior Medicare Patrol National Resource Center, a grantee of the Administration for Community Living at HHS, that assists Medicare beneficiaries, families and their caregivers to prevent, detect and report health care fraud, errors and abuse.

Click Read the rest to see the whole thing

|

https://www.propublica.org/article/how-to-research-your-hospice-and-avoid-hospice-fraud

0 Comments

There is an alert sent to elder law attorneys that you might want to review if you are low income and are paying premiums for your Medicare Part D (Prescription) coverage: Excerpts from the alert (available for download below): "You May be Overpaying for Part D Prescription Drug Coverage" "Every year hundreds of thousands of Medicare enrollees with the Low-Income Subsidy (LIS or “Extra" "Help”) overpay for Medicare prescription drug coverage. In 2021, for example, thirteen percent (800,000) of" "LIS enrollees were expected to pay an average of $27/month for Part D premiums in plan year 2022 if they did not switch to a premium free plan. In many cases, the reason these individuals are paying premiums is inertia. People who qualify for the full Medicare Part D LIS do not pay premiums if they enroll in plans with “benchmark” prescription drug premiums. Benchmark plans have premiums at or below a cut-off in each region, which is set yearly by the Centers for Medicare and Medicaid Services (CMS). LIS recipients who are enrolled in a Prescription Drug Plan (PDP) or Medicare Advantage plan with Part D premiums above the CMS cut-off must pay the difference between the benchmark premium and the premium charged by the plan. Sometimes, PDPs lose benchmark status. For LIS recipients who were auto-enrolled in a benchmark plan by CMS, CMS will also automatically move them to a different plan when their current PDP loses benchmark status the following year. However, LIS recipients who pick a plan at any point in their Medicare eligibility (called “choosers”) are not moved automatically if their plan’s costs are above the benchmark in any subsequent year. If these LIS recipients do not affirmatively choose a new benchmark plan, they will have to pay the difference between the benchmark premium and the premium charged by their current PDP. "Choosers receive a notice in early November on tan paper (the “tan notice”) informing them of their new premium and offering them a list of plans available with no premium liability. The tan notice goes to any chooser who will pay a premium for the first time or whose premium will go up. Choosers do not receive the tan notice if they already are paying a premium and that premium stays the same or goes down. "•" ARE YOU PAYING A PREMIUM? If you are not sure, review your options with a State Health Insurance Assistance Program (SHIP) counselor. You can also get help through 1-800-Medicare or on the Medicare.gov website. The best time to review coverage options is during the Open Enrollment Period from October 15 through December 7.

Some elder advocate organizations have put together a pretty good online resource for helping you know how to keep your money safe as you age. (Elders are the main target of scammers.)

https://thinkingaheadroadmap.org/money-path/intro Even if you think you have everything all set, it's worth looking these pages over. The Thinking Ahead Roadmap is for everyone, not just people with significant assets. It includes information specifically geared towards "solo agers" (who don't have an immediate family member or partner to step in) and people with complex personal situations. This new tool was designed by Dr. Marti DeLiema of the University of Minnesota and by Naomi Karp and Steve Vernon, research scholars at the Stanford Center on Longevity, with support from AARP and the Society of Actuaries. It's based on extensive research through interviews with experts from multiple disciplines (including elder law attorneys on this list - thanks for your help!), focus groups and an online community forum of over 100 older adults. In addition to the website itself, the roadmap is available in PDF form to download, as are additional helpful documents. In the future, it will be available for ordering in print. Please help spread the word about the Thinking Ahead Roadmap to your colleagues, clients, families and communities. Oregon doesn't call this a "living will" although that might be a term you are familiar with. In Oregon, you can document your wishes and appoint someone to speak for you if you cannot speak for yourself -- that person is called your "Health Care Representative." Use the form from your health care provider or you can download it at the link below (make sure you use the current form, which took effect on 1 January 2019.

Click here to get to page to download the Oregon Advanced Directive form FDIC Consumer News: Protecting Seniors from Financial Abuse We are launching a new “Tell YOUR Story” tool that will enable residents, families, ombudsmen, and those who work with them tell their story about nursing home or assisted living care. The short answer to "How do criminals steal from the elderly?" is "by phone, mostly." And new phone-based payment services that let you send money to others without even leaving your house make it crucial that you remember this key survival rule: MONEY NEVER CALLS YOU ON THE PHONE. And if you think you've found the exception to this rule, call an attorney or a trusted friend with good sense to discuss the offer before you do ANYTHING that the caller suggests. If you have truly found the exception to the rule, it'll wait for you to conduct a thorough investigation. If you feel ANY pressure to seize the opportunity at all, that's the clearest sign of all that it's a SCAM. Remember, the phone and internet means just one thing for sure: Every criminal in the entire world is just one click or phonecall away from you. In years past, you pretty much only did business with people nearby; now you can be ripped off by someone from a country you can't even pronounce just as easily as by someone who calls you from a boiler-room scam operation in your own hometown. How Criminal Steal $37 billion a year from the elderly Today marks John Gear Law Office's fourth birthday.

I am very grateful to all the clients who have trusted me with their problems and given me the opportunity to help them find solutions. Thanks to your trust and confidence, I have been able to meet my primary practice goal: Making a modest living with a "values-based Oregon law practice" -- where "values-based" means I don't represent the folks trying to take advantage of others, my clients are the ones wronged by those who do. It's not the easiest area of law and it's definitely not the most lucrative, but I think it's the most satisfying. As the Mrs. works towards her M. Div. and ordination as a minister, I am able to have a practice that reflects, rather than conflicts with, the values of a ministry. ADRC is a FREE service to help people learn about public and privately paid options to address aging or disability needs, or to help families and caregivers. Anyone in Oregon can use the service for themselves or their families.  Saw a great comment today by a lawyer who is struggling hard to solve a very difficult (and, now, expensive) estate administration problem involving title to real property. The problem was created by the now-deceased parents of his clients; those parents probably saved all of a few hundred bucks on lawyer fees by doing their own estate planning. The lawyer's comment: "You don't always get what you pay for, but you seldom get what you don't pay for."  Oregon Adds Statewide Abuse Reporting Line: (855) 503-SAFE Today we are happy to announce that Oregon has added another option for reporting suspected abuse of children and vulnerable adults. All our regular local hotline and reporting numbers will continue to take reports as usual, but we have added a single statewide number that provides another way to make these important reports. Oregon's abuse reporting hotline for children and adults, (855) 503-SAFE [855-503-7233], is up and running, and it provides callers with the ability to report suspected child abuse, elder abuse, abuse of people with physical or developmental disabilities, and abuse of people with mental illness or those experiencing a mental health crisis. Callers will be directed that if the report is an emergency requiring immediate attention, to hang up and dial 911. If it is not an emergency, then callers will work through a simple phone tree to ensure their report gets to the right place for response, based on zip code and characteristics of the person they are calling about. Calls can be answered in English or Spanish. Once the calls are routed through the phone tree, they will be directed to local DHS or county offices for Child Protective Services and Adult Protective Services, County Developmental Disability Programs (CDDP) or County Mental Health Programs (CMHP) for response. Not all areas of the state will have a live person to take reports after hours, and some locations will provide voicemail reporting options. All local hotline and reporting numbers will continue to take reports as usual, and the new line adds a single call option for those who want to use it. Oregon's abuse reporting hotline for children and adults is the result of two legislative workgroups, one on child welfare and one on elder abuse, which recommended a single hotline option to simplify reporting for Oregonians who are not familiar with the abuse reporting process. Mandatory reporters are often well aware of local reporting and hotlines and are responsible for most of the reports we receive. Citizens who may only make one or two calls in their lifetimes can be overwhelmed by the seeming complexity of agencies and numbers from which to choose. (855) 503-SAFE [855-503-7233] will solve that problem by providing a single phone number anyone can call from any community in Oregon!  I just had a call from a very nice person who needs caregivers around-the-clock, 365 days a year. One of these caregivers recently stole money from from my friend. My friend said it happened about six weeks ago, and that the person was no longer serving as a caregiver, so she was just going to let it go. I had to explain to her why it was so important that she call the police: Because other people looking to hire caregivers are going to look at the home-care workers' registry and look at the results of the criminal background checks, and if she doesn't file a police report about the theft, this caregiver will appear to have both a lot of experience and no problems in her background. My friend felt uncomfortable; the caregiver is young, and my friend doesn't see herself as vindictive. Basically, she does not want to get the other person in trouble. But of course, it's not my friend who is responsible for the trouble — the thief did that. My friend needs to report to protect others from this person and ultimately to protect herself by making sure that the system for background checks is reliable and complete. Someone who will steal from a disabled person getting 24 hour care is not someone who should be able to find work as a caregiver for other vulnerable people. So you're not being kind by overlooking abuse or thefts like this. Consider what you're doing to the person's next victim. My friend was also concerned that, because it would be her word against the caregiver's, she would not be able to prove that the theft occurred. I made two points about that:

The situation is the same with nonprofits. Many times when nonprofits are ripped off, the tendency among the members as to keep it quiet and not make a big fuss about it. It's also very appealing for the board to say that they were partially at fault for allowing the thief to rip them off, and therefore they don't want the bad publicity to their organization etc. etc. The big problem with this logic is the same as in my friend's case: when crime victims don't report crimes, the criminals are allowed to find new victims and victimize them, because they have no reason to know about the person's past. So, uncomfortable as it is, if someone rips you off, don't make it your job to help them cover it up. If someone abuses you or steals from you, whether you are an individual or as part of an organization, call the police. Let the police and the court system make the decisions on prosecution and any punishment that might occur if warranted. Bottom line: don't help criminals victimize other people by failing to report past crimes. UPDATE: A helpful assistant attorney general points out: "Great points, John. You might also tell your friend and others that they can call the Medicaid Fraud Unit at the Oregon Department of Justice if the care occurs at home and the provider is paid by the State, or if the theft or financial exploitation occurred in a Medicaid-funded facility [note that nearly all nursing homes and assisted living facilities accept Medicaid funding - JMG] whether or not the victim is a Medicaid recipient." Thanks, AAG! You can reach the Medicaid Fraud Unit (MFU) at 971-673-1971. Good story to remind you of something crucial. Perhaps even more important than your will are all the designations you make over time that pass intangible property (financial accounts most often) outside the will. You should have a day every year where you review these -- the first business day after New Years or your birthday or wedding ( or divorce) anniversary ... Just so that every year you actually eyeball the names of the people who are slated to get the assets in those accounts should you die. There are many horror stories of what happens to survivors of people who fail to do this.

Sep11  DHS has a new, free handbook you can download HERE (pdf). If you are an elder thinking about having a family member provide your care, or if you're a family member who is or may someday be asked to provide care for a family elder or other family member with a disability, this is a worthwhile resource.  Prof. Gerry Beyer of Texas Tech posted about the latest in his "Wills Trusts and Estates" blog. He writes: "[R]everse mortgages allow individuals 62 and over to receive money from a bank [now] in return for their home upon their death. . . . Reverse mortgage rules are going to change, which could mean less available funds for borrowers. The changes can also lower the program's high default rate. [New] rules are expected to go into effect as early as October 1. The changes will reduce the number of homeowners that will qualify for reverse mortgages and the maximum amount will be reduced as well. People who apply before October 1 will qualify for the amounts under the rules now. Folks that are considering a reverse mortgage should act quickly if they want the current laws to apply." The always-excellent PBS program "Frontline" focuses its lens on the state of assisted living facilities in America. Spoiler alert: It ain't pretty.

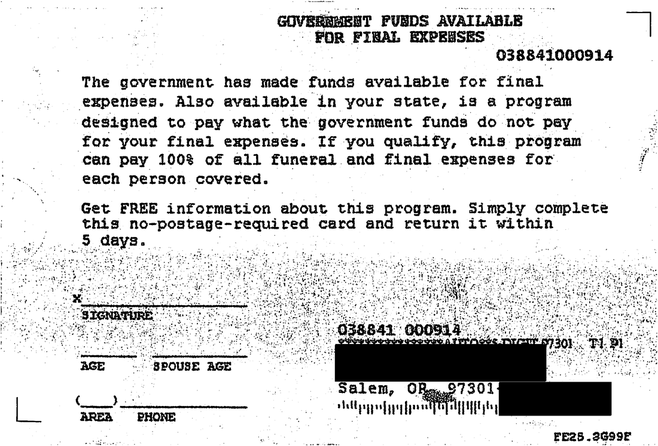

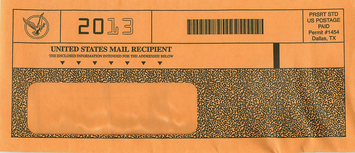

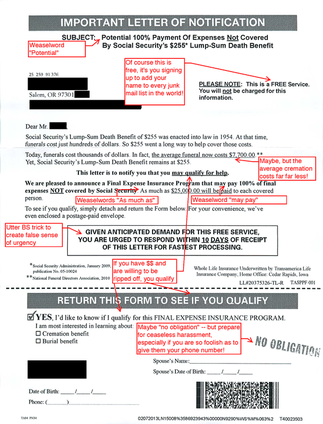

The second Oregon edition of Preparing for Departure ® will be offered this coming fall 2013, in conjunction with the Unitarian Universalist Congregation of Salem. We are busy updating our material and revising the Oregon-specific provisions we added to the course outline last year with our first Oregon edition. If you want to participate in this limited offering event and to be placed on the mailing list for updates and enrollment information about this powerful, one-of-a-kind course, complete the survey at this link and provide your contact information there: (Survey Link coming soon).  These scammers trying to pry your personal information out of you by making it appear that they're from the government. On this one, note the barely readable small print disclosure that they're not, which is at the bottom and is about 1/20th as dark as the typeface that says "GOVERNMENT FUNDS AVAILABLE FOR FINAL EXPENSES" that appears at the top, next to the Pennsylvania Avenue address in Washington DC ( a nice touch, don't you think?) Note the deceptive wording of the interior: The government has made funds available for final expenses. Also available in your state, is a program designed to pay for what the government funds do not pay for your final expenses. If you qualify, this program can pay 100% of all funeral and final expenses for each person covered. The comma after in your state is a nice touch for illiteracy.  Note the attempts to make it seem to come from a government source The folks who prey on the elderly -- the Elderscammers -- never tire of trying to make their scam letters appear to come from an official source (anything that will get you to open them). When you get mail in an envelope that looks like this, your best bet is probably to recycle it immediately without even opening it. If you are really torqued about their deceptive technique and want to make it a bit more expensive for them, here's one thing you can do: Open the envelope, but only so that you can find out if there is a postage-prepaid "Business Reply Envelope" inside (there often are). If there is a BRE, take a dark marker and write "STOP SENDING ME JUNK" on the reply card, and draw a big X over the part where they want you to give them all your personal information. Then stuff everything they sent you into the BRE, seal it, and drop it in the mail. This has proven remarkably effective at getting them to stop sending me any such junk. Sadly, all my elderly neighbors and friends keep me well supplied in examples of this kind of scam. (This one was another come-on for funeral expenses insurance, the biggest ripoff this side of waterline insurance plans.)  Mixed in with the many honest businesses, I'm sad to say that there are a TON of ethically challenged businesses out there too. They especially prey on elders, offering them outrageously overpriced goods and services, using all the time-tested tricks of the trade, trying to make it look like they are doing you a favor, and that you might have to "qualify" to do business with them -- when the only qualification is excessive trust in strangers by you, and a willingness to give out private information to total strangers. These people will use any information they can get to take advantage of you (and they will sell and trade that information to similarly exploitation-minded outfits -- along with the key fact, that you were so foolish as to respond to their mailing). There's a good saying that "Good deals don't call you on the telephone" and the same goes in spades for junk mail like this. Honest businesses don't try to make money off you by selling you wildly overpriced insurance. I wish there was a way to require outfits like this to put a skull-and-crossbones watermark on every page of every letter they send out, because then you'd have a chance of realizing what pirates they are.  (hat tip to "The Housekeeping Report") NCOA Issues Updated Guide for Seniors Considering a Reverse Mortgage The National Council on Aging (NCOA) today issued the 2013 version of Use Your Home to Stay at Home™, the official reverse mortgage consumer booklet approved by the U.S. Department of Housing & Urban Development (HUD). The guide is designed to help seniors understand the pros and cons of a reverse mortgage. Reverse mortgages allow homeowners who are 62 or older to convert home equity into cash while remaining in the home. Amy Ford, director of NCOA’s Reverse Mortgage Counseling Services Network, called the guide “an older homeowner’s best resource when it comes to examining whether a reverse mortgage is right for them.” A free copy of the guide is available (download the pdf by clicking here). |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

||||||

RSS Feed

RSS Feed