Transparency Oregon Initiative Petition 25 requires publicly traded corporations to provide to the Secretary of State a public report of their Oregon taxes.

Corporations make billions of dollars here in Oregon, but pay fewer taxes here than in any other state. The result? Oregon’s families and small businesses pay more than their fair share in taxes, and our schools and basic family services are underfunded.

For years, advocates have worked to make Oregon’s tax system more fair, but corporations have proven willing to spend tens of millions of dollars to avoid even small increases in the taxes they pay. Year after year, corporations and large business associations make wild claims that local businesses will pay the price for any new tax increase — ignoring the fact that small and local businesses currently pay a higher tax rate in Oregon than some of the world’s biggest corporations.

IP 25 brings truth to the debate about corporate taxes. It requires that publicly traded corporations in Oregon reveal the same tax information about their Oregon taxes that corporations do for their federal taxes.

Key provisions of the measure:Oregon Needs Corporate Tax Transparency

- Requires companies that must publicly report their taxes nationally to report their state taxes to the Secretary of State

- The reports would be made public on a website, similar to ORESTAR

- The required information would mirror the required information these companies provide to the federal government, and would not require companies to gather additional data

- The report goes to the Secretary of State to avoid conflict with privacy laws around taxes

- There would be a penalty, limited by the size of the company and capped at $1 million, for not reporting

- The reports would not just include taxes owed, but also tax credits

- The information would be delayed by three years to make sure that “company secrets” are not revealed by tax decisions

Oregon can’t wait for investments in schools and services, and those investments rely on corporations paying their fair share in taxes. If Oregon lawmakers better understood who paid taxes and who did not, they could more fairly design a tax package that would benefit Oregon families and boost Oregon’s economy.

IP 25 provides transparency and honesty to a tax discussion that badly needs it. With an understanding of the taxes corporations pay, we can take an important step in making Oregon’s schools and services as good as families deserve.

|

Here's a measure that everyone who is anywhere on the political spectrum can support -- require that publicly traded corporations submit their Oregon tax data to the Secretary of State so that we can all understand who pays what. Note that there is a three-year delay built right in, so that competitors won't be able to use the data to disadvantage any corporation.

0 Comments

https://www.consumeradvocates.org/we-need-your-help-tell-cfpb-keep-complaint-database-open-public We Need Your Help - Tell the CFPB to Keep the Complaint Database Open to the Public The Consumer Financial Protection Bureau —created by Congress after the 2008 financial crisis to help consumers fight back against unfair and illegal banking and lending practices – is under new leadership, and they are threatening to take down the important online public consumer complaint database. Consumers across the country have submitted more than 1 million complaints against banks, lenders, debt collectors, and credit reporting agencies to the consumer complaint database. Before the CFPB, consumers’ complaints against powerful banks and lenders fell on deaf ears. Some harmed consumers had virtually no place to go to report grievances. The CFPB needs to hear from us now. Tell the CFPB to Keep the Public, User-Friendly Consumer Complaint Database (See Our Model Letter). The new leadership at the CFPB has asked for feedback, and signs indicate that they want to shut down public access to the complaints. Consumers will no longer have a way to review complaints and research the conduct of banks, lenders, debt collectors, and other financial institutions. Submit A Letter: Tell the CFPB to Keep the Database Open and Available to the Public. The CFPB built a great tool that empowers consumers like us to share our grievances with not just the agency but also with fellow customers of our banks and lenders. We can’t let this “new” CFPB take the public complaint database away from us. Let’s fight for it together. 29 May 2018 Another good article in the new National Consumer Law Center series of pieces written to help non-lawyers understand consumer legal issues better. NCLC is a great outfit that helps consumer attorneys help real people all over the US. A Reverse Mortgage Primer: Consumer Advice from NCLC JFK: "Those who make peaceful revolution impossible will make violent revolution inevitable.”5/23/2018 Just something to consider as the Supreme Court keeps up its tireless march to crush real people -- flesh and blood Americans -- under the heel of unlimited corporate power and a privatized, secret "justice" system. The ghost of Justice Powell looks up from the fires of Hell and smiles broadly.

Hardly a day goes by in my practice that I don't rely on resources or refer someone to resources produced by the National Consumer Law Center. They are starting a series of guides for consumers, and they picked a good one to start with. They "encourage readers to share this article with clients, counselors, and others working with families in financial distress" so if you know someone struggling with medical debts, please pass this along. Dealing with Medical Debt: Consumer Advice from NCLC Mike Shurtleff is a good attorney here in Salem who fights on the side of real people. He wrote and posted a great article on LinkedIn describing just another one of the many ways that homeowners can be taken to the cleaners as part of the great real estate scam that modern America has become. He also links to another rundown on the scheme by Willamette Week.

Mike doesn't tackle this directly, but his story reminds me of perhaps the hardest things I see in my practice -- people who don't come see a lawyer even when they're in the middle of the fight of their lives and they're facing battalions of lawyers on the other side, and who had a fixable problem -- before they started trying to take care of it themselves without an attorney. I know it might sound self-serving but I don't mean it that way - I am plenty busy and not trying to drum up business. But I just want you to know: if you are falling behind on your mortgage or getting screwy statements that suggest your mortgage servicer isn't crediting your payments properly, or you have received ANY letters from ANYONE suggesting your home loan could be in default, you need to find a lawyer to help you understand what's going on, and what will happen. Not a notario, not a friend of a friend who went to law school but doesn't practice, not a paralegal, but a real, licensed attorney who does foreclosure defense (like Mike, for example). Sure, there are books you can find discussed on Internet Law School about how the brave lone homeowner successfully ran off the criminal gang of bank thieves, but generally, what happens in those situations (where the homeowner tries to DIY their own mortgage defense) is that they wind up as roadkill on the foreclosure freeway with the lender happy as a clam that the homeowner didn't bring in a real attorney and slow down the foreclosure machine. Sometimes it's even worse: the poor homeowner starts the DIY thing, lets a bunch of deadlines pass, and then finally realizes that they are over their head and the DIY thing isn't working and comes to see an attorney -- too late. Even if you think you can only afford a single consult, make it the FIRST thing you do, AS SOON AS you get that very first letter from someone telling you that your home might be foreclosed.  The New York Times has an article today on interstate moving: Hire Interstate Movers Without Getting Scammed The writer uncritically recommends checking out your mover on the Better Business Bureau site, which is not that helpful in reality. Far better to consult with the Federal Motor Carrier Safety Administration website AND also the attorney general's complaint hotline in your own state and in the home state for the carriers (note the plural) you are considering. For example, you can search for moving company' complaints reported to the Oregon AG on her website. NEVER rely just on a BBB check or just on the moving company's own website or its claims about testimonials from past customers. Here's an old post from this blog that I think still holds up pretty well:Planning an interstate move? Read this before you contact ANY moving companies. Here's the best tip from the NY Times article:

The internet is full of wonders, but it's also full of dangers -- especially the one most people don't think about: every criminal in the world able to access a computer might as well be right next door to you, because on the internet they are as close to you as your local scam artists and hustlers.

The photo below is of an email that was sent as a "spear phishing" attack -- where the con artist gets the gullible target (the mark) to click a link that downloads malware onto your computer. This is a pretty sophisticated version. It was good enough that there was a chance that it was just a clueless sender who didn't realize how suspicious his email looked -- so I sent him the response asking for further information. No response to my query, so I feel pretty safe in asserting that the original email is an attempt to hook me with malware. Be careful out there folks. If you are not expecting an attachment, don't click on it until you confirm that it's legit, and be very cautious about declaring anything legit from someone sending you something out of the blue. Remember, money never calls you on the phone, and it never magically appears in your email inbox either.  This should be simple: Illegal contracts are illegal contracts and are void from the start (“ab initio” in legal lingo). But thanks to the decades-long effort by corporations to populate the Supreme Court with justices who will give corporations equal rights as full citizens, courts now have to wrestle with whether a predatory business entity like this loan-shark lender can trick an elderly veteran out of his 7th Amendment constitutional right to have his day in court or not. So while their consumer customers are fully on the hook when they screw up, the investors in this predatory company get to hide behind the corporate shield so that their yachts, BMWs, and off-shore assets are protected from liability for the company’s wrongdoing — and, on top of that, the pro-corporate activist justices have wildly expanded the reach of the Federal Arbitration Act far beyond the bounds that Congress intended, giving this loan-shark company a good chance of keeping this elderly vet from having his constitutional rights. For more: Oregon veteran may lose access to local courthouse Michael Fuller | May 1, 2018 With the sharply increasing inequality in this country and a Congress seemingly hell-bent on making the situation even more extreme, for many of us among "the 99%" a good bit of estate planning these days isn't about passing stuff on after you die.

For a lot of us, estate planning these days has become about knowing what to pay and how to pay it (which source of funds) to minimize the chance of passing on any debt or impoverishing those left behind. Lifehacker has a good, plain-English article that introduces the ideas. https://twocents.lifehacker.com/what-happens-to-your-debts-when-you-die-1825725750 This is a California case but everything about this case is the same in Oregon -- there are a handful of consumer attorneys in Oregon who focus most or even all of their practice on helping consumers cheated by car dealers.

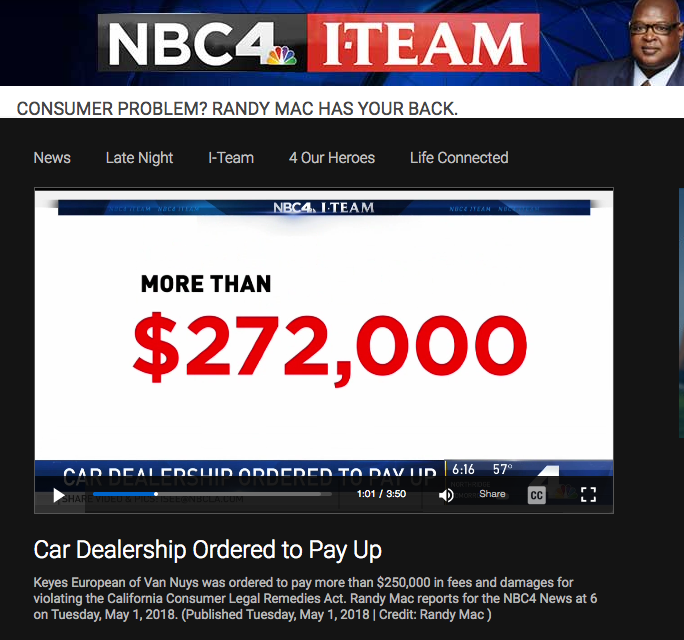

If you have been cheated by a car dealer, learn from this guy who says "Don't give up your rights!" and was rewarded with a buyback of the crap car and $170,000 of punitive damages, attorney fees, and costs on top. (The dealer initially offered a deal that would have the consumer owing $15,000 on a car he didn't have any longer.) Most autofraud cases like this are handled on a contingency fee basis (like this one was), with the attorney fees coming from the dealership at the end of the case, meaning the consumer has to put very little money into the case. https://www.nbclosangeles.com/on-air/as-seen-on/Car-Dealership-Ordered-to-Pay-Up_Los-Angeles-481444161.html |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

RSS Feed

RSS Feed