Things to consider before borrowing a reverse mortgage to delay collecting Social Security By Stacy Canan – AUG 24, 2017 For most people, the amount of money you bring in each month decreases after you retire. Yet your expenses, particularly for health care, may not follow suit. So the question on the minds of many approaching this life stage is: how do I replace or supplement my monthly income when I retire? The most obvious answer might be to claim your Social Security retirement benefits. If you qualify for Social Security retirement benefits, it’s important to think about the best time to claim your benefits. For most people, eligibility for full benefits is between age 66 and 67, depending on the year you were born. Alternatively, you can start to collect benefits as early as age 62, but if you choose to claim early, your monthly benefits may be reduced as much as 30 percent. You can also delay and claim at age 70 to get your maximum monthly benefit. With that in mind, some financial professionals are increasingly promoting that older homeowners consider borrowing a reverse mortgage loan at age 62 in order to delay collecting Social Security. This approach suggests that you use proceeds from the loan to replace the Social Security benefits that you would otherwise receive if you had started collecting Social Security at age 62 until your full benefits age, or later. We looked at different scenarios involving older homeowners for whom their home and Social Security are their main resources and found that generally they are better off if they take their Social Security benefits rather than taking out a reverse mortgage. This is true because, in general, the cost of a reverse mortgage loan will exceed the additional amount of increased Social Security benefits you would collect over your lifetime. That’s because the interest and fees you pay increase each month, and over time those costs wipe out the additional benefit obtained by delaying. When you borrow a reverse mortgage loan, your home is used as a guarantee for the loan, like it is in a traditional mortgage loan. But unlike a traditional mortgage, a reverse mortgage loan is usually repaid when the borrowers no longer live in the home. You won’t make monthly mortgage payments, but you must stay current on paying your real estate taxes and homeowner’s insurance. There are other conditions of the loan that must be met too. If you don’t meet the conditions, the lender can foreclose on your home. If you have the option, working past age 62 is usually a less costly way to delay claiming than borrowing a reverse mortgage loan would be. The additional years of work often provide you more time to save and pay off debts. It may also result in an increase in Social Security benefits by replacing years with low or no earnings, if any, from your earnings record. For those who can’t continue to work, it may be better to accept a lower Social Security benefit amount, rather than owing on a reverse mortgage loan in the future. In addition, the effects of using a reverse mortgage loan to delay collecting Social Security benefits would likely reduce the equity in your home. This loss in equity could limit your options for moving to a new location or handling a large financial shock in the future. We looked at different scenarios involving older homeowners for whom their home and Social Security are their main resources and found that generally they are better off if they take their Social Security benefits rather than taking out a reverse mortgage. New resources We released three new resources to help older homeowners learn what a reverse mortgage is and decide whether borrowing a reverse mortgage is right for them:

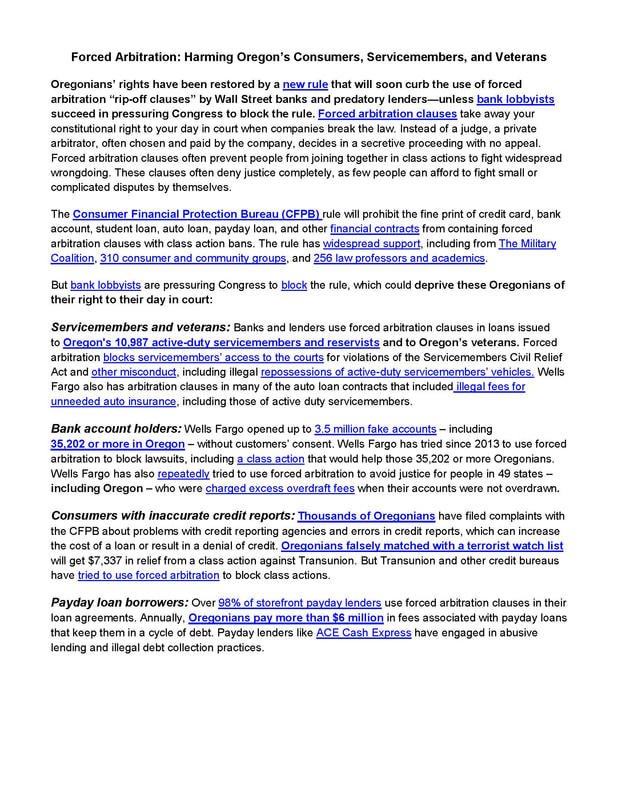

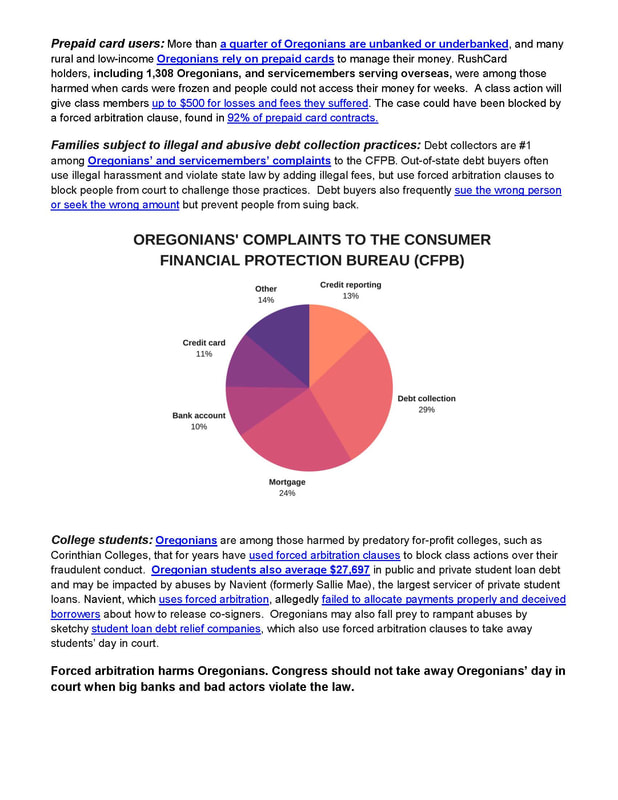

If you have a problem with a reverse mortgage, you can submit a complaint online or call us toll free at (855) 411-CFPB (2372), Monday through Friday, 8 a.m. to 8 p.m. ET. We provide complaint-handling services to people in more than 180 languages and to those who are deaf, have hearing loss, or have speech disabilities through the our toll-free telephone number. (This material reposted with permission from the federal Consumer Financial Protection Bureau blog). For the 7th consecutive year, John Gear Law Office is proud to sponsor the "Empty Bowls" sale at Willamette Art Center, a key yearly fundraiser for Marion-Polk Food Share and our whole community.

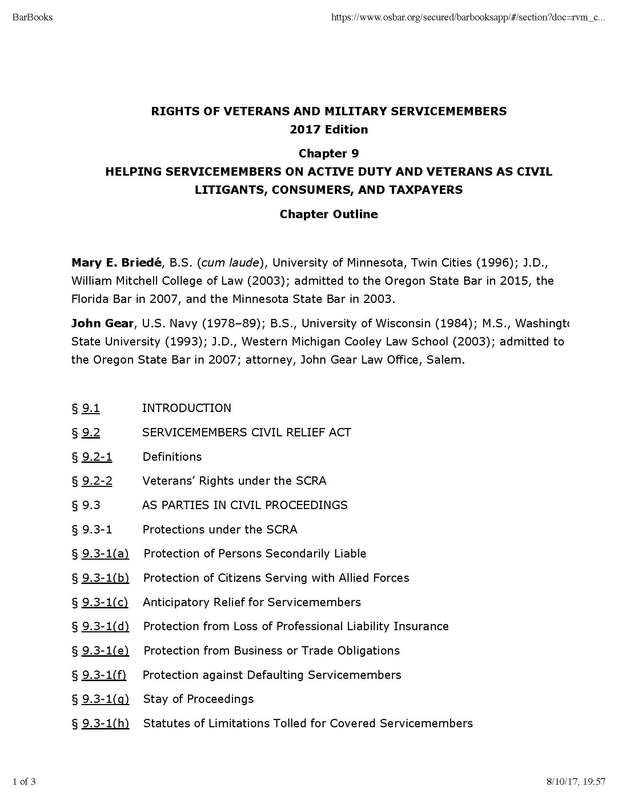

Always the weekend before Thanksgiving, "Empty Bowls" is where you can find top-class craft art, full of creativity and beauty, by local artists, donated to be sold for very low prices, all to fight hunger. Bring your family and friends and all your holiday shopping lists. As always, Empty Bowls is the weekend before Thanksgiving at Willamette Art Center on the State Fairgrounds in NE Salem (Yellow gate - Silverton Road entrance). I am proud to have been asked to help write a chapter in the Oregon State Bar's newest practice guide for attorneys, this one aimed at helping attorneys with representing active-duty servicemembers and veterans.

I got to work with a very bright younger attorney and I think that we delivered something that will help Oregon attorneys who have never served more easily find and use the special statutory protections for servicemembers and veterans in federal and Oregon law. Pop Quiz: Q: What's the difference between a fairy tale and a sea story? A: The fairy tale begins "Once upon a time ..." and the sea story begins "When I was on the (ship name) . . . " Great article in The Hill about three big lies the Big Banksters are pushing to persuade Congress to keep consumers from being able to bring class actions against banks who rip off people millions at a time. An excerpt: Big Lie No. 2: Class actions only benefit the attorneys. We often hear that older Americans want to "age in place." Aging in place means living at home in the community, rather than in an institutional setting, like a nursing facility. This is the choice most people want to make even if they need services and support to do so. |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed