The whole thing is really worth your time to read:

https://goldsonlawoffice.com/consumer-protection/how-experian-tricks-people-into-signing-away-their-rights/

If you are having trouble sleeping one night but don’t mind a possible nightmare of being crushed by a multi-billion dollar corporation, you can read Experian’s Terms of Use Agreement here:

https://www.experian.com/help/terms-and-conditions.html

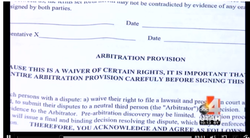

So to reiterate – if you have a problem with Experian, you would have to air your grievances in arbitration, not any court. If you are not familiar with arbitration, you can think of it as a fake court that has been found to be very unfair in favor of businesses (who pay them). If you’re interested, you can learn more about how unfair forced arbitration is here https://www.consumeradvocates.org/for-consumers/arbitration/ or here

https://www.citizen.org/article/mandatory-arbitration-clauses-are-discriminatory-and-unfair/

This should beg the questions: Why is Experian so worried about you suing them in court? Why are they so worried about class actions? And wait… are they luring you to click through this “agreement” with the promise of a higher credit score? Yes, they are. In exchange for a higher credit score, you have to promise to never sue them in court.

And if you’re wondering whether Experian ever goes so far as to enforce their forced arbitration clauses; yes, they do . . .

RSS Feed

RSS Feed