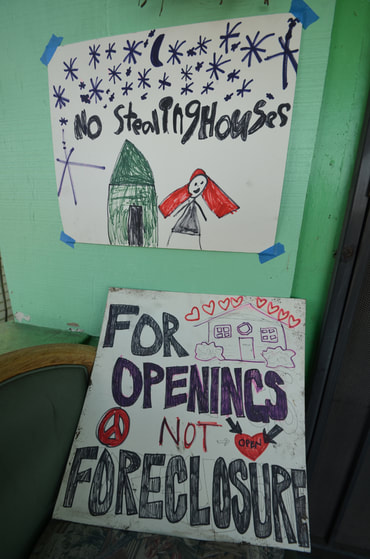

If you are low/moderate income and face any COVID-related financial hardship that threatens your homeownership (defaults, lender refusals to modify your loan, etc.) you should seek if OHLA can help you by calling

Oregon Homeowner Legal Assistance: 1-855-503-2598.

RSS Feed

RSS Feed