Online Colleges Target Veterans

GI benefit-rich veterans help Kaplan and other universities avoid federal financial aid rules

Keith Melvin, a disabled and decorated Iraq War veteran, wanted to go to a traditional college until a recruiter for the online, for-profit Kaplan University began courting him. She assured him, he said, that he could trust Kaplan because it's owned by Washington Post Co. (WPO), and because the Post's board boasts such luminaries as Warren Buffett and Melinda Gates. "I was more familiar with Jimmy Buffett than I was with Warren Buffett," Melvin says.

After learning the difference between the Sage of Omaha and the Sage of Margaritaville, Melvin enrolled at Kaplan last year. Invoking Buffett and Gates is one of many ways Kaplan attracts veterans—and the public funds used to pay their tuition. Federal spending on veterans' education will more than double this year, to $9.6 billion from $4.2 billion, says the U.S. Veterans Affairs Dept., largely because of a more generous GI Bill that took effect in August 2009. It pays veterans' tuition up to the level of their state's most expensive public university.

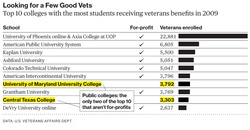

Kaplan ranked third in 2009 in the number of students funded by veterans' benefits, behind two other for-profits, Apollo Group's (APOL) University of Phoenix and American Public Education's (APEI) American Public University System. Eight of the top 10 colleges were for-profits. "These schools are after the monetary gain of a healthy benefits package, not necessarily what's in the best interest of students," says Donald D. Overton Jr., executive director of Veterans of Modern Warfare, a service group with 5,000 post-1990 veterans as members. Kaplan spokeswoman Melissa Mack says: "Kaplan has received significant interest from veterans because of our military-friendly practices." She says recruiters aren't encouraged to use the names of Buffett and Gates.

Enrolling veterans helps for-profit colleges exploit a loophole in a 1992 law capping the proportion of revenue they can derive from federal student aid at 90 percent. Tuition paid to for-profit colleges under the GI Bill counts as nongovernment revenue. Kaplan University, which derived 87.2 percent of its revenue in 2009 from taxpayer-funded education aid such as Pell Grants for poor students, may have exceeded 90 percent if revenue from the GI Bill and U.S. Defense Dept. tuition assistance for active-duty military was added, says Bradley Safalow, chief executive of PAA Research, which analyzes higher education stocks.

U.S. Education Secretary Arne Duncan, whose department is pushing tighter regulation of for-profit colleges, expressed concern in September that some schools may violate the spirit of the law, which was meant to ensure that they offer an education good enough that some students are willing to pay for it out of their own pockets. For-profit colleges should have "some skin in the game beyond our dollars," Duncan said.

Veterans often don't complete degrees or land lucrative jobs after attending for-profit schools. At Kaplan University, only 30 percent of two-year students and 33 percent of four-year students graduate. Spokesman Ron Iori says Kaplan's graduation rates are higher than many traditional schools that also serve a predominantly low-income student body like its own.

Iraq vet Scot Reynolds, who earned a bachelor's degree in management from Kaplan University in 2009, now works as a telemarketer for $8 an hour plus commission—less than he made before he graduated. "My income has drastically dropped," he says. "Kaplan was extremely limited with help in finding work." Iori says Kaplan provides a wide array of job placement services.

Kaplan, long known for preparing high school students for the SAT college admissions exam, derived 64 percent of its revenue in the quarter ended July 4 from its higher education division. The unit includes predominantly online Kaplan University, with 75,000 students, as well as Kaplan colleges, which have 37,000 students on 60 campuses.

About 11,000 Kaplan University students, or 15 percent of its enrollment, are veterans, active-duty service members, or military spouses, up from 8,500 a year ago. The school targets the more than 1.2 million veterans of the Iraq and Afghanistan Wars, who are eligible for richer benefits under the revised GI Bill, by advertising in military-related magazines such as Army Times and G.I. Jobs, exhibiting at job fairs for current and former service members, and sponsoring events held by Amvets, the country's fourth-largest veterans' organization. Veterans "can virtually go to Kaplan with no out-of-pocket expenses," Kay Houghton, Kaplan director of corporate alliances, said as she handed out brochures at the Amvets national convention in Louisville in August.

The bottom line: Washington Post Co.'s for-profit college, Kaplan University, has used the prestige of its parent to attract veterans and their federal aid.

RSS Feed

RSS Feed