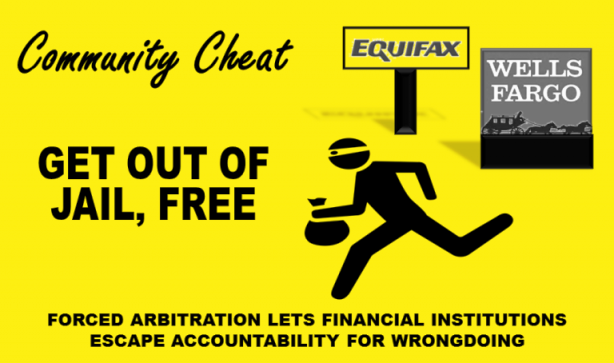

America is now just like any Third-World Banana Republic -- complete with impunity for big companies, who can do anything they want to you More from Public Justice's Paul Bland about the shameful Congressional vote to let criminal corporations bar ripped-off consumers from joining together to hold them accountable: If you are not sure you understand just how badly Congress has sold you out and ensured that you and your family will be unable to do anything about ripoffs by big companies, here is a menu of stories.

In “Wet Kiss” for Wall Street, Congress Overturns Rules Allowing People to Sue Banks for Misconduct Democracy Now: October 26, 2017 An Open Call for Trump to Veto Anti-Consumer Bill Common Dreams: October 26, 2017 Frank and Raskin: Why Is Congress Hurting Consumers? Duke Today: October 26, 2017 Count on a Political Backlash to the Banks’ Victory in the Senate The New York Times: October 25, 2017 Republicans Just Caved to the Big Banks and Exposed Trump’s Sham Populism The New Yorker: October 25, 2017 Congress Lets Consumers Down Bloomberg: October 25, 2017 Why Consumers Should Care About the Dismantling of Class-Action Lawsuits Market Watch: October 25, 2017 Republicans Scramble to Help Banks, Undercut Rule for Consumers MSNBC: October 25, 2017 What Is the CFPB Arbitration Rule? The Senate Repealed the One Provision That Let You Hold Companies Accountable Bustle: October 25, 2017 Populist Hero Mike Pence Casts Tie-Breaking Vote to Protect Banks from Lawsuits Vanity Fair: October 25, 2017 Congress Just Killed a Rule That Would Have Made It Easier for Consumers to Sue Banks — Here’s Why People Are So Upset Business Insider: October 25, 2017 Battle Over Fine Print: Why GOP Is Risking Consumer Ire to Support Banks The Christian Science Monitor: October 25, 2017 The US Senate Is Preventing Companies Like Equifax Being Held Accountable for Major Screw-Ups Quartz: October 25, 2017 It’s Good to Be a Bank in the Trump Era Slate: October 25, 2017 As the saying goes, "No matter how cynical you get, you just can't keep up" Paul Bland of Public Justice writes: Senate Grants Immunity to Financial Industry Rip-Offs, Scams and Abuses Just like you should always have a shopping list and stick to the list when you go to the grocery store, you should never go to an auto dealer's lot without a list of the minimum features you need in a car, and you should stick to that list -- in other words, you should REFUSE TO ADD anything that wasn't on your list before you talked to the salesman. If they want to sell you a car that already has more accessories or features than you were looking for, that's one thing -- but NEVER let an auto dealer talk you into buying add-ons and "protection plans" and accessories -- most are wildly overpriced nonsense, and the extra financing burden can cause you to lose the car you bought! NCLC Report Finds Discretionary Pricing and Racial Disparities in Auto Add-on Products Sold by Car Dealers

CarMax sells cars under recall without repairing the problem, report warns

Forced arbitration seems to be significantly more lucrative for Wells Fargo than other financial institutions. As one might suspect based on the CFPB data, Wells Fargo was awarded more money in arbitration than it was ordered to pay consumers between 2009 and the first half of 2017, despite creating 3.5 million fraudulent accounts during that same period. The average consumer that arbitrated with Wells Fargo was ordered to pay the bank nearly $11,000.10 Great letter from the Economic Policy Institute to the Senate Banking Committee, which is considering whether to override the proposed ban on forced arbitration clauses in consumer finance contracts that prohibit consumers from bringing class action suits against institutions that practice wholesale fraud and deception, such as Wells Fargo.

Click here to read it all. |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

||||||||||||

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed