|

One of the best things about my job is getting to meet nice folks from all over the state, including the one who just sent me some photos of the elk visible from the back porch in Pendleton.

0 Comments

About Us Bankruptcy Exemption Limits (what you can keep) Amounts Going Up

Welcome to Consumers Rising Join the Campaign. Make a Difference. For years, consumers have been under attack from all angles -- financial fraud and deceit, invasions of privacy, roadblocks to our day in court. From predatory lenders to crooked banks and debt collectors, it seems like bad corporate actors are always looking for ways to rip us off and get away with it. That's why our work begins today. Your voice and your experiences are the most powerful tool we have to help change things for the better. CLICK to Join Consumers Rising and get ready to take back control. Your Finger on the Pulse of the Biggest Consumer Stories Do you want to pitch in to hold corporate wrongdoers accountable? Keep up with the latest in consumer protection and how it can impact you. Get the scoop from us and find out how you can protect yourself from predatory business practices and stand up for your rights. First Steps

I really, really hate fast operators who prey on the elderly. I have a close friend, an elderly woman, who shares all the scam mail she gets with me, so I have a window into a world that most working-age folks are totally unaware of.

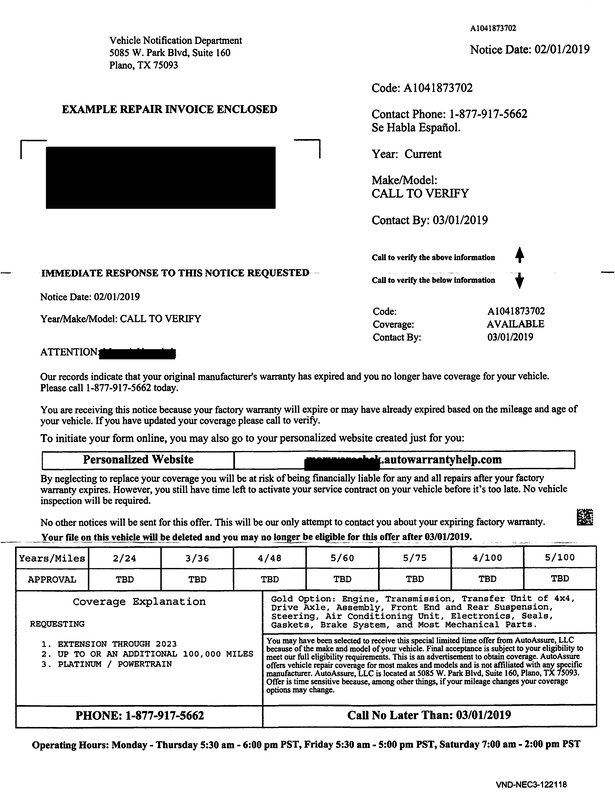

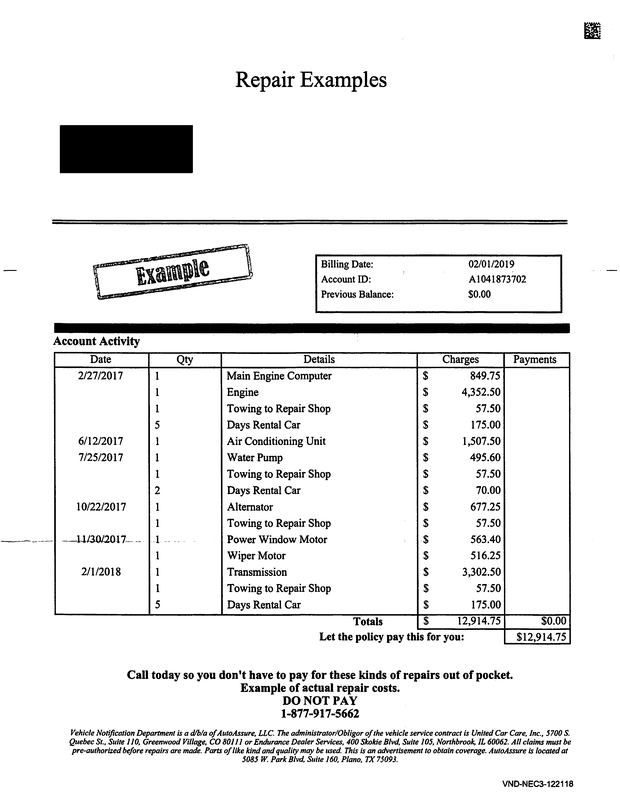

Below is an example of a really nasty bit of business, an offer pitching what is supposedly a way to buy an extended warranty on your old car (it's not really a warranty but a service contract, but most people call it a warranty or extended warranty). What it really is instead is a way for them to hook a suction line up to your bank account and drain it. I know this for several reasons. One is that my friend's car is a mid-1990s sedan. There is no way in hell that anyone honest will sell her a service contract to fix problems with a car of that age. It would never pencil out. Two is that, while I was born at night, it wasn't last night. I have had countless elders come to me to complain about "warranties" that refused to pay when the coverage the elder thought they had purchased was invoked. This whole offer, and especially the table on the back, is the work of sophisticated con artists who know that if they can get elders on the phone, the elders are often vulnerable to sales pitches that play on the fixed-income elder's fear of unexpected/unplanned expenses. The people who staff the phones for these come-ons are really, really good at being convincing and sounding utterly sincere and honest. They will talk your ear off about the high cost of auto repairs, and how their "product" would give the caller "peace of mind." That's what this scam is about -- playing on the fear that folks on fixed incomes have of repair bills, just like the horrible "water supply line" warranties that were being sold around here a few years ago. Believe me, that supposed "example" on the second page of the piece is PURE FICTION and is intended to give the reader the FALSE impression that they are selling something that would PAY for those repairs. (It is a lie, in in other words.) If you EVER get an offer like this that tempts you to respond, DON'T DO IT. Send it to me instead -- I'll gladly review it and discuss it with you at no charge if you let me use it as a consumer education example to help others. And if you can ever show me a mass-mailing come-on that targets the elderly that actually proves to be actually be a good deal after I look into it, I'll not only tell you it seems legit, but I'll give that company a public pat on the back for offering elders a fair deal that benefits them, and not just the company trying to take their money. |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed