Consumer Reports has a good article on how car dealers rip you off on loans.

Well worth a read if you ever consider buying a car.

ProTIP: If you can't pay cash and must finance a car purchase, separate the loan deal and the car deal; never do them together with financing from the dealer.*

Get your loan approval from your own credit union or bank before you go car shopping so you can know exactly how much you can afford and the dealer can't bamboozle you by negotiating both deals at the same time. And, of course, you have to be willing to walk away from the lot without buying anything. And never buy any used vehicle without having your own independent mechanic to a complete pre-purchase inspection and test drive of the vehicle; if you can't afford the pre-purchase inspection, you can't afford the car anyway.

(* With the possible exception for the case where you are buying a new car and the maker is offering zero-percent financing and you are certain that you aren't being overcharged on the car.)

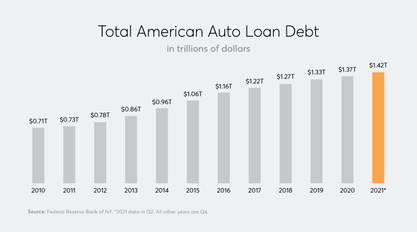

Experts say that CR’s analysis suggests a broad problem with the way car loans are arranged in this country: Dealers and lenders may be setting interest rates based not only on risk—standard loan underwriting practice—but also on what they think they can get away with. Studies show that many borrowers don’t know they should, or even can, negotiate the terms of a loan, or shop around for other offers.

Discrimination could be part of it, too. Other research suggests that people of color are more likely to be offered high-interest car loans, even when they have similar or even better credit than whites. But unlike federal data provided on mortgages, the data CR analyzed did not include any information on the borrowers’ race, age, or sex.

The auto lending industry also operates in a regulatory morass. Many states have confusing and contradictory laws regarding how high rates can be set, according to interviews with regulators in all 50 states and the District of Columbia. At the federal level, the Consumer Financial Protection Bureau has limited oversight of auto lenders.

Those who do get stuck with expensive car loans can face serious repercussions.

RSS Feed

RSS Feed