From Paul Bland of Public Justice:

There are a couple of things about this case, as explained in the video, that are striking.

First, the corporate behavior – a payday lender misleading customers, getting them into a cycle of debt, lying about its nature, abusing the law – is truly ugly. Nearly every American should hate this kind of behavior, and see why it’s important for the legal system to address it.

Second, the video explains how the civil justice system, and class actions, got real justice for the consumers: tens of millions of dollars in refunds to consumers, illegal debts wiped away, and peoples’ credit records fixed.

Third, the video focuses a great deal on Mr. Inetianbor, showing that the class action wasn’t just a lawyer-driven thing, but that the consumer played a huge role in protecting other consumers and working to fight this problem.

Finally, the video helps explain how vile a system forced arbitration is, and why the defendants’ efforts to use forced arbitration were a real scam.

|

0 Comments

There's a website where you can find out whether the safety recalls for a used car you're considering have been performed on that car. You just need the VIN (Vehicle Identification Number, the unique 17-digit vehicle identifier that is tied to the vehicle history reports). What you need to remember is that this is something the car industry could have done years before. But the government had to do it because the basic busines model of the used car industry is to sell crap cars for much more than they are worth to unsuspecting buyers fooled by promises of "125 point inspections" and other nonsense. Remember! If you can't afford to have your own independent mechanic do a thorough top-to-bottom pre-purchase inspection on a car you're thinking of buying, you can't afford the car anyway so get the hell away from it before it sinks you financially. Really. If the $100-$150 for a rigorous, independent inspection is too much for you to pay, then how are you going to possibly pay for all the problems that arise when your "as is" piece of junk suddenly demonstrates its true condition to you, soon after purchase? NHTSA recall check site This is another in a series of articles published by the National Consumer Law Center (NCLC). If you are an Oregonian and you are being pursued for old criminal justice debts

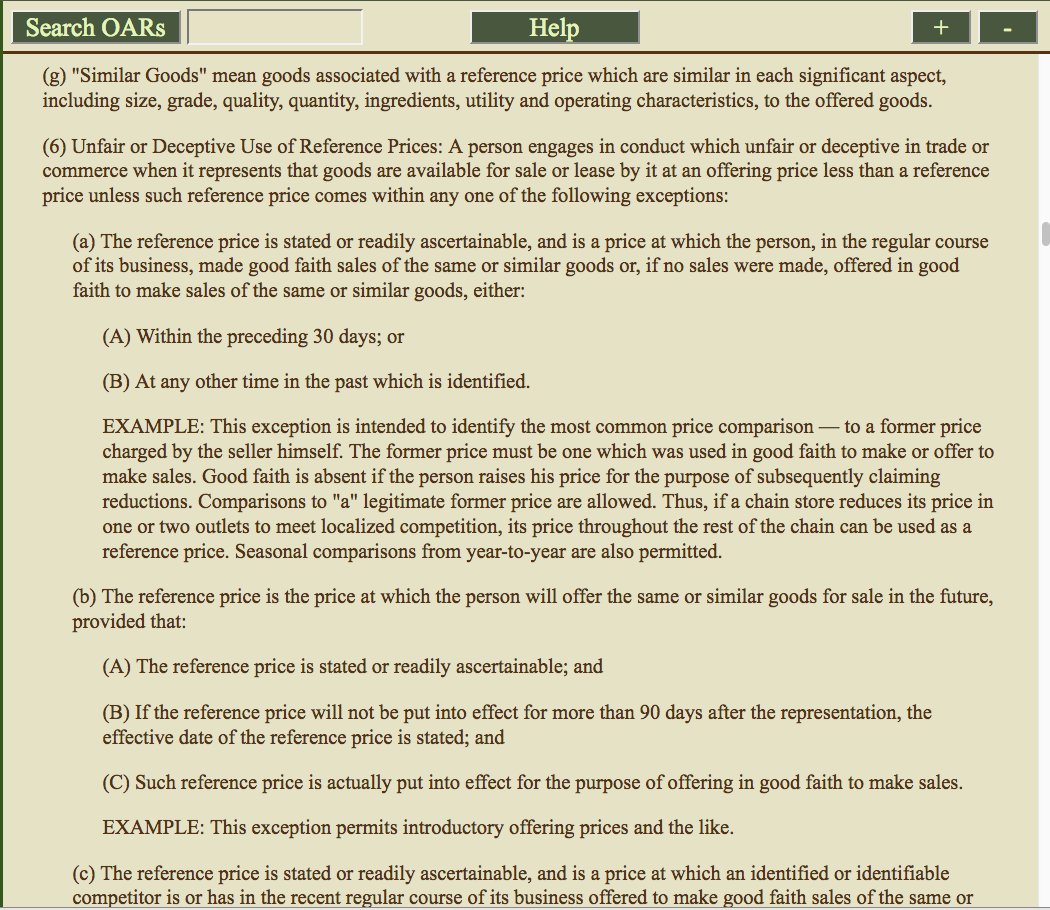

It's difficult to win even the strongest case against businesses willing to rip you off or provide shoddy goods or services. Shady businesses start out with a bunch of the inherent advantages and success against them is by no means a slam dunk. But even the strongest, best imaginable case can turn into a sure loser if you have outsmarted yourself by buying or leasing something (car/truck/boat/RV/ATV/motorcycle, vacation rental, phone service, timeshare, computer, etc.) but then getting cute by putting the purchased/leased goods in the name of your business, thinking that this will let you deduct costs of the item from your business taxes or let you avoid insuring the goods yourself, etc. The first, obvious problem is that this is that you may be doing tax fraud that way. But there is a less-obvious problem that is potentially far more harmful in most cases: Consumer protection laws generally only help you if you are a consumer -- meaning that you bought/leased the goods, services, or real estate for "personal, family, or household purposes." Every now and then I have to tell a prospective client who has clearly been wronged with defective goods that I can't help them. And it's all because of a decision they made when they bought that big-ticket item: they put it in the name of their business. As this doozy of a decision below from another state shows, this can be a VERY costly mistake. Bottom line: Don't fool around trying to make things seem different than what they are. The universe has a way of making you pay for that. 1) If it's your personal car/boat/truck/RV/ATV/motorcycle/computer/timeshare/etc., pay for it with your own money and title it in your own name. 2) If it's a business car/boat/truck/RV/ATV/motorcycle/computer/timeshare/etc., put it in the business name and pay for it with the business money, and don't use it for personal use, or you may lose your ability to deduct those payments as business expenses. (Extra credit if you also conclude that the bottom line should have a third point, "3) Never buy an RV, period" -- but the first two points above apply to more than just RVs.) Knopick v. Jayco, Inc.  Thanks to Zach Stark of Wagon Wheel Web Development in Eugene (and to prior genius work by Salem's Dick Yates, developer of the amazing software behind Gleanweb.org), Oregonians again have access to a readable, human-friendly presentation of the Oregon Administrative Rules, which the Secretary of State publishes but only makes available in a very hard-to-read format without any indentations or other reading aids. Compare the two presentations of the same text below:

Tell Legal Aid: Divest NOW from Bank Whose Crimes Hurt and are STILL Hurting Real Oregonians7/3/2018 Wells Fargo -- the bank with the getaway vehicle for a logo -- blames its widespread criminal conduct not on its management but instead on thousands of rank and file employees who weren't in charge of anything.  The Legal Aid Services of Oregon (LASO) employees union rightly wants LASO to pull its money out from a rapacious criminal bank that is still working to screw over real, ordinary Oregonians every day. They're spending millions on new branding advertising, claiming that they were "Established 1858, and re-established in 2018" but at the same time they are still fighting all over the country to deny consumers any chance to have their day in court. LASO executives continue to ignore the LASO workers union, so we're holding a rally to show our support -- money donated to help real people should NOT be invested in large scale criminal enterprises like Wells Fargo until they have made a complete accounting for all their crimes and they stop trying to force the victims of their crimes into secret forced arbitration rackets. "Monopoly Man" Amanda Werner (above) from Public Justice is flying in from Washington DC to lead our march on July 30 at noon in Portland's Pioneer Square. Good Summary of the Wells Fargo scandals from Wikipedia. www.DivestFromWellsFargo.com This is one of the most frequent and difficult problems I run into - calls from people who are shocked to see their paycheck reduced by a wage garnishment or who are suddenly bouncing checks and getting hit with overdraft fees for debits and failed payment fees because their bank accounts were garnished ... This problem is why you should NEVER ignore a demand letter or a lawsuit -- the problem you cause yourself when you do is always exponentially larger and more expensive to solve than the one you started with.

|

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

RSS Feed

RSS Feed