Growing wave of Social Security imposters overtakes IRS scam

By Emma Fletcher

April 12, 2019

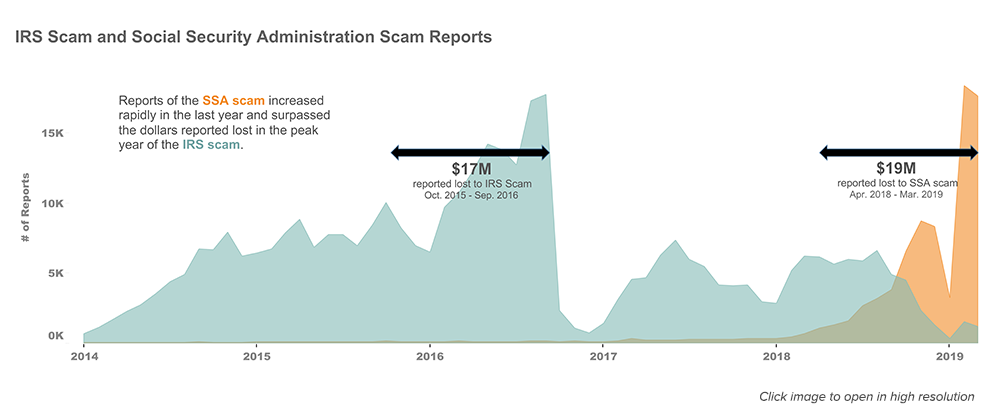

Claiming to be a government authority is a tried and true way that scammers trick people into sending money. Among the most common government imposters have been scammers pretending to be the IRS – until now. In the past few months, the FTC’s Consumer Sentinel Network database has seen Social Security Administration (SSA) imposter reports skyrocket while reports of IRS imposters have declined sharply. In the shady world of government imposters, the SSA scam may be the new IRS scam.

SSA imposters tell you your Social Security number has been suspended because of suspicious activity, or because it’s been involved in a crime. They ask you to confirm your Social Security number, or they may say you need to withdraw money from the bank and to store it on gift cards or in other unusual ways for “safekeeping.” You may be told your accounts will be seized or frozen if you don’t act quickly.

These scammers often use robocalls to reach people, and the message can be hard to ignore. You may be told to “press 1” to speak to a government “support representative” for help reactivating your Social Security number. They also use caller ID spoofing to make it look like the Social Security Administration really is calling. With such trickery, these scammers are good at convincing people to give up their Social Security numbers and other personal information.

As the graphic shows (top), people reported the IRS scam (in blue) in huge numbers for many years, but the new SSA scam (in orange) is trending in the same direction – with a vengeance. People filed over 76,000 reports about Social Security imposters in the past 12 months, with reported losses of $19 million.1Compare that to the $17 million in reported losses to the IRS scam in its peak year.2 About 36,000 reports and $6.7 million in reported losses are from the past two months alone.

Just 3.4% of people who report the Social Security scam tell us they lost money.3 Most people we hear from are just worried because they believe a scammer has their Social Security number. But when people do lose money, they lose a lot: the median individual reported loss last year was $1,500, four times higher than the median individual loss for all frauds.4 All age groups are reporting this scam in high numbers, with older and younger adults filing loss reports at similar rates.5

People report sending money in unconventional ways. Most often, people say they gave the scammer the PIN numbers on the back of gift cards. Virtual currencies like Bitcoin come in a distant second to gift cards: people say they withdrew money and fed cash into Bitcoin ATMs. With both methods, the scammer gets quick cash while staying anonymous, and the money people thought they were keeping safe is simply gone.

Here are some tips to deal with these imposters:Report government imposter scams to the FTC at FTC.gov/complaint.

- Do not trust caller ID. Scam calls may show up on caller ID as the Social Security Administration and look like the agency’s real number.

- Don’t give the caller your Social Security number or other personal information. If you already did, visit IdentityTheft.gov/SSA to find out what steps you can take to protect your credit and your identity.

- Check with the real Social Security Administration. The SSA will not contact you out of the blue. But you can call them directly at 1-800-772-1213 to find out if SSA is really trying to reach you and why.

- Talk about it. People recognize the IRS scam, but many are getting caught off guard by these new imposters. You can help by telling people that the SSA scam is a new version of the IRS scam.

To learn more, visit ftc.gov/imposters.

FN1 FTC was unable to collect reports directly from the public during the government shutdown. Reports collected during that period were provided by Sentinel data contributors.

FN2 From October 1, 2015 to September 30, 2016, about 140,000 reports of IRS imposter scams were filed and collectively indicated $17 million of loss.

FN3 For comparison, 2.8% of IRS scam reports filed from January 2014 through March 2019 indicated a loss. In 2018, 25% of all fraud reports indicated a loss.

FN4 Median loss calculations are based on reports submitted in 2018 that indicated a monetary loss ($1 - $999,999). The median reported individual loss to all frauds was $371 in 2018.

FN5 Age comparison based on the number of Social Security imposter reports that indicated a monetary loss per million population by age. People who said they were 20 – 59 filed loss reports at a rate of 8.9 reports per million people in this age group, while people who said they were 60 and over filed 10.0 loss reports per million people in this age group. Population numbers obtained from the U.S. Census Bureau: U.S. Census Bureau, Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States, States, Counties and Puerto Rico Commonwealth and Municipios (June 2018). Not all reports include usable age information.

|

0 Comments

Where's my VIN?Look on the lower left of your car's windshield for your 17-character Vehicle Identification Number. Your VIN is also located on your car's registration card, and it may be shown on your insurance card. What this VIN search tool covers

If you want to increase governmental accountability and transparency in its most important application, ask your representatives to support Oregon House Bill 3224 (HB 3224). There is a hearing tomorrow! Today you can send comments in support to the Committee at hjud.exhibits@oregonlegislature.gov. Here's the letter I sent:

Turns out I'm not alone in recognizing that most used car dealers (not all, but most) are really just shady payday lenders disguised as merchants. But I've been too optimistic! Below is a quoted comment from an auto industry expert in the midwest. And this ins't me talking or another consumer attorney. This is a car industry guy talking - someone who helps dealers! BHPH = "buy here, pay here" -- the classic small independent car lot. He warns that even the big chain used car places have the same practices! For used car dealers, the car is just the bait for the important part -- selling you an outrageous loan and optional "extras" that give the dealer much more profit than the car ever could. (Because, think about it -- the only reason 99% of the customers step onto the lot at one of these places is that they have such poor credit that they have to buy the car that someone else felt good about getting rid of.) With the horrible increase in economic inequality in the US, this isn't going to change anytime soon. But at least understand what you're dealing with -- if you feel like you have to buy a used car from a dealer, do everything possible to GET YOUR OWN FINANCING first, before you get anywhere within 100 miles of a dealer. Know what you are approved for IN TOTAL as well as in weekly or monthly payments, and walk away the minute the dealer tries to sell you financing. Dealers are pushing out financing terms to absurd lengths to make used cars "affordable," but that just puts you into a negative equity trap (you owe much more than the car is worth) at trade-in time ... if the car even lasts long enough for a trade to be possible.

|

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

RSS Feed

RSS Feed