About Us I am not a bankruptcy attorney, but I have helped many clients understand when they should look into bankruptcy and when there is no need for a bankruptcy filing because the clients have no assets that creditors can reach. If you are concerned that you are drowning in debt and don't know a good bankruptcy attorney to consult, you can make an appointment with my assistant and discuss your situation; I will be happy to refer you to good consumer bankruptcy attorneys if we decide that bankruptcy is appropriate for your situation. Below is another article in the terrific series by the National Consumer Law Center on this important subject. Deciding Whether to File for Bankruptcy: Consumer Debt Advice from NCLC

HOW YOU CAN COMMENT: This is one of the most frequent and difficult problems I run into - calls from people who are shocked to see their paycheck reduced by a wage garnishment or who are suddenly bouncing checks and getting hit with overdraft fees for debits and failed payment fees because their bank accounts were garnished ... This problem is why you should NEVER ignore a demand letter or a lawsuit -- the problem you cause yourself when you do is always exponentially larger and more expensive to solve than the one you started with.

The federal student loan system has become so bloated and rife with abuse of borrowers by debt collectors that I'm forced to conclude that the only people who should borrow to pay for schooling are those who could afford to pay for the schooling without borrowing if they chose. This story tells the tale, a ruthless firm that gets nice contracts to squeeze student-loan debtors, complete with morals that make the Sopranos enforcers look like choirboys. A student loan expert writes:  Don't. Really. Just don't. Here's just one story of thousands about what can happen if you ignore this advice.  The good folks at the National Consumer Law Center have just issued a new report that addresses a lot of the problems with student loan lending (pdf download), particularly the problems caused by for-profit "education" mills that really seem to be about something quite different than education. A frustrated lawyer in Alabama sums it up eloquently:

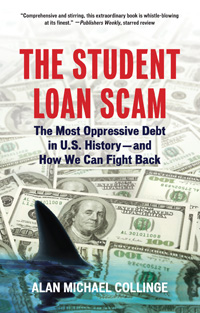

This whole area of law is completely out of control. We are creating a subclass of educated (and some not-so-educated) poor people. We are basically creating a class of indentured servants who were essentially unknowingly induced into loans that they cannot repay. Many were sold a bill of goods that they could get good jobs upon graduation and repaying their loans would not be a big issue, then the economy tanked. This is a worse crisis than the mortgage crisis. At least with a mortgage, once they foreclose, you can walk away - student loans are making American citizens slaves to debt collectors and banks - two of the most unscrupulous entities in our society. The taking of 80 year olds' social security money to pay on 30 year old student loan debt is beyond inhumane. I am shocked there has been no rioting or occupy movements based on the outrageous laws Bush signed into law making student loans super-liens on par with, or maybe even above, the IRS. Our founding fathers would not have stood for this type of treatment of their American people. This is a shameful time.  THE SCOOP ON STUDENT LOANS Whether you saw the cover story in the New York Times, or chuckled as President Obama advocated the issue on Late Night with Jimmy Fallon, student loans continue making headlines. With interest rates for Stafford Loans possibly doubling in July, now is an excellent time to inform yourself about this issue. For further reading, try The Student Loan Scam. This analysis of the $85-billion industry covers the history of student loans, exposes how universities have profited at students’ expense, and shares the stories of people whose lives have been shattered as a result. The Boston Globe calls “The Student Loan Scam passionate and informed.” Also: Read chapter 3, "Collection Abuses" from The Student Loan Scam. Read a recent Salon.com article featuring Alan Michael Collinge. Visit Alan's website for more information. $20.00 Paperback (Blurb above from a Beacon Press promo email. Beacon Press is one of the best.) _Thanks to our Champion in Congress, Rep. Hansen Clarke, Student Loan Borrowers finally have good reason to hope this holiday season: that real help is on the way!

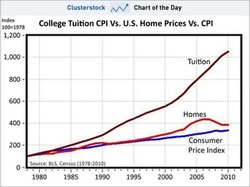

Please take a moment of your time to watch Congressman Clarke's brief, yet inspiring remarks on the House Floor yesterday by clicking here: http://www.youtube.com/watch?v=TaStPo-aPHg Amidst all the chaos and dysfunction in Washington, D.C. these days, especially yesterday, at least one Member of Congress goes to work each morning and returns home each night with the plight of student loan borrowers at the forefront of his mind. And, thanks to the more than 650,000 people just like you who signed the petition supporting Rep. Clarke's efforts, your voices ARE being heard! Keep the faith, and please know that your active participation in this movement is making a difference. Please share this video far and wide and, together, let's make sure that all student loan borrowers begin to feel that sense of hope during this holiday season that real change is on the way! Thank you, as always, for your continued support. From ForgiveStudentLoanDebt.com to all of you - Merry Christmas, Happy Hannukah, and a Happy, Healthy and Hopeful New Year! Sincerely, Robert Applebaum Founder - ForgiveStudentLoanDebt.com  GENERATION DEBT -- HOBBLED BEFORE THEY START . . "It's going to create a generation of wage slavery," says Nick Pardini, a Villanova University graduate student in finance who has warned on a blog for investors that student loans are the next credit bubble — with borrowers, rather than lenders, as the losers. Full-time undergraduate students borrowed an average $4,963 in 2010, up 63% from a decade earlier after adjusting for inflation, the College Board reports. What's happening: •Defaults. The portion of borrowers in default — more than nine months behind on payments — rose from 6.7% in 2007 to 8.8% in 2009, according to the most recent federal data. •For profit-schools. The highest default rates are at for-profit schools that tend to serve lower-income students and offer courses online. The University of Phoenix, the nation's largest, got 88% of its revenue from federal programs last year, most of it from student loans. "Federal student loans are like no other loans," says Alisa Cunningham, research chief at the Institute for Higher Education Policy. "The consequences are so high for making a mistake."  Forgive student loan debt?! What kind of a cockamamie idea is that? Why should we do that? OK, since you asked: 1) There's no better way to immediately put a little more money in the hands of people who need it most, and will spend it immediately. 2) A huge portion of the student loan debt now crushing people was taken when student loans were able to be discharged in bankruptcy. Then, years later, the companies that make these loans -- at virtually no risk, and with VERY high profit rates -- gave enough money to Congress to buy themselves a change in the law to prevent student loans from being discharged in bankruptcy. In other words, the rules of the game changed in a crucial way AFTER people had taken these loans. 3) Kneecapping young people with huge debts might feel good in a "you oughta pay your debts" way, but it's penny wise and pound-foolish. One of the reasons our economy is struggling is that young people cannot afford to start new ventures, because they have huge loan payments to make. We need a total rethink of our system for financing higher education, one that makes the colleges and universities have a lot more skin in the game. Right now, the student loan business is a lot closer to loan sharking than it should be. A jubilee (debt forgiveness) would not only help millions now, but it would also give us the opportunity to start over with a much more far ======================= Thank you for signing the petition to Forgive Student Loan Debt as a Means of Economic Stimulus! Thanks to so many people sharing, posting, emailing and tweeting, as well as MoveOn.org's promotion of the petition, nearly 400,000 people have signed it! There's absolutely no doubt that we're making waves and getting noticed, but this campaign is really just beginning. There's more work to be done! Today, I'm asking you to take a few moments of your time to remind those who purport to represent us in Washington that we truly care about this issue and that we're not going away! Therefore, I'm asking everyone to please call your Senators and Representatives in Congress TODAY and ask them to support H.Res 365 and the efforts of Rep. Hansen Clarke with respect to student loan forgiveness. Signing a petition is one thing, but flooding the Congressional switchboard with calls from every state in the nation and from all political stripes and backgrounds is quite another. It's extremely important to remind Congress that there's a human being behind every single one of the nearly 400,000 signatures we've obtained thus far, and that every single one of them is truly suffering under the weight of their student loan debts, preventing them from spending, starting businesses or families and buying homes - the very things we need middle-class and working-class Americans doing right now to help re-build the economy that was nearly destroyed 3 years ago. To quickly and easily find out who your Senators and Representatives are and to obtain their D.C. office telephone numbers, please click here. Then, simply type in your address and/or zip code and 3 names should immediately pop up - your state's two Senators, as well as your Member of Congress. Call all three at their D.C. offices today and implore them to listen to the voices of the American people who are speaking up loudly on the issue of crushing student loan debt. To whatever extent possible, please try to stick with calling their Washington, D.C. offices so as to make the greatest impact possible. If we can jam up the Congressional phone lines - all the better! Thanks again for all of your help in making this petition such a huge success! Let's keep the momentum building! Sincerely, Rob Applebaum, Esq. Founder, ForgiveStudentLoanDebt.com The Best Possible Gift For Your HS Graduate: A realistic understanding of Student Loan Debts6/14/2011  Gary Liberson, Huffington Post - The PEW Research Center looked at the issue of college pricing in their report,"Is College Worth It?" Their findings validate the tensions caused by the high cost of a college education: A majority of Americans (57 percent) say the higher education system in the United States fails to provide students with good value for the money they and their families spend. A record share of students are leaving college with a substantial debt burden... a quarter say it has made it harder to buy a home (25 percent); and about a quarter say it has had an impact on their career choices (24 percent). Nearly every parent surveyed (94 percent) says they expect their child to attend college... most young adults in this country still do not attend a four-year college. The main barrier is financial. Over the last 18 years, every dollar added to the cost of a college degree has only put 14 cents of annual income in a graduate's pocket. Bottom line: No young person should be taking new student loans without being very well advised on the upside and downside risks, which are substantial, and having a well-researched "Plan B" for how to avoid a lifetime of crushing debt obligations if the typical young adult's version of Plan A ("Get in debt up to my eyeballs, graduate, get great job, get out of debt easily") doesn't turn out to work. Photo credit: Student loan collection agency folks on the hunt. Huffington Post piece:

Obama caves in to for-profit colleges on rules The Obama administration on Thursday issued a series of highly anticipated regulations aimed at cracking down on for-profit colleges and other career training programs that leave students saddled with unmanageable debts and contribute to an unequal share of federal student loan defaults. The final rules issued by the Department of Education, however, are significantly less stringent than a draft version released last year, giving college programs an additional three years to come in line before possibly losing access to lucrative federal student aid dollars. The changes come after an unprecedented lobbying and campaign finance offensive over the past year by the for-profit college industry, which derives a vast majority of revenues from federal student loan and grant programs and has sought to protect that income by gaining influence in Washington. My advice: Do NOT take any student loans with anyone unless you speak with someone who can explain to you exactly what you are getting into and you have found the institution's current placement and payback history. My nephew was just approached for an outrageous scam, a "sound tech" school -- you know, the guys who become roadies and set up the stages for traveling performers. This "school" wants him to borrow OVER $80,000 (that's right EIGHTY THOUSAND DOLLARS) for a "career" that involves sporadic work and usually requires no real education to enter anyway. Bottom line is that, until proven otherwise, you should treat all for-profit, private educational institutions like a time-bomb that someone is trying to strap to your back. It's not even clear that student loans make sense anymore for public, nonprofit institutions, but at least their business model isn't 100% dependent on the flow of student loan monies. The scoundrels' usual attempt to avoid meaningful regulation: the voluntary code of conduct4/22/2011 The for-profit "education" institutions are at least educated enough to be able to read the writing on the wall and know that the days of being able to bilk far too many people out of far too much money entirely unmolested are drawing to a close.

Thus, the usual tactic of the wrongdoer caught with both hands in the cookie jar and crumbs all over his chin: Propose a voluntary (read: meaningless) code of conduct. In other words, as soon as it will no longer fly to say that you weren't doing anything wrong, propose a toothless "code" of mush that says "and we won't do it any longer." From the linked AP article: The Coalition for Educational Success, a Washington, D.C.-based group that represents career colleges serving 350,000 students at nearly 500 campuses, announced the Standards of Responsible Conduct, but won't release the complete code until this summer. The industry group said it will cover areas ranging from standard disclosures of tuition costs and job placement rates to more transparent financial aid policies. Managing director Penny Lee said the standards will provide a "new level of accountability." "We know concerns have been raised and we take them very seriously," she said. "This is a significant step for the sector." The announcement comes as another industry group battles the U.S. Department of Education in federal court in a bid to block new regulations of for-profit higher education institutions. The industry has lobbied heavily in Washington against a proposed "gainful employment" rule that could limit schools' access to federal financial aid if graduates' debt levels are too high or too few students repay loans. AP story on debt includes this worrisome section:

Despite the rising costs, 85 percent of students and recent grads say college is worth the time and money. In overwhelming numbers, they express satisfaction with the education they've received. And they have wide expectations for that education: Most say it's very or extremely important that colleges broaden students' knowledge and expand their minds, help them gain life skills, expose them to new experiences and train them for a career. All true. But now, the worrisome part: Nine out of 10 expect to find a job in their field. And for most, that's the bottom line. Fifty-five percent say an education that focuses on success in the working world is more valuable than one focused on general knowledge and critical thinking. With that pragmatic attitude, many treat education like a commodity to be shaped to fit their needs and budgets. The big problem with this attitude is that crystal balls are in short supply -- there are plenty of unemployed people who chased software jobs, thinking that focusing on the work world (that they hoped would still be there upon graduation) would assure them a place among the comfortably employed. Oooooops, major blunder. The bottom line is that the most necessary skill in any field of work is critical thinking: figuring out how to know when you're being lied to or asked to cooperate in a delusion, in both rhetoric and in numbers. A working BS detector, in other words. The huge need for this is best shown by the horrific levels of unmanageable student debt, young people who accept rosy promises about their future employment prospects uncritically and use that as motivation to take ever higher amounts of student debt. The most encouraging sign: the high number of students recognizing that the grossly underused later years in high school can be put to much better use: On the other hand, lots of students are racing to the finish in order to save money. About 4 in 10 college students hope to graduate in less than four years. To get a jump start, 58 percent of students took college-credit courses in high school. And about half earned credits at a community college before moving on to a more expensive bachelor's degree program. If you are a parent or an adult thinking about how to finance a college or continuing education for yourself, a child, or grandchild, niece, nephew, etc., I'd be happy to meet with you for an hour for 1/3 of my usual rate to lay out the options and the benefits and risks of student loans (federal and private).  Project on Student Debt's report . Includes interactive map to compare the debt levels of individual states and institutions.  Great website here to deliver an important message: http://www.protectstudentsandtaxpayers.org/ Taxpayer-funded federal financial aid should not go to wasteful career education programs that consistently leave students buried in debt they cannot repay. Read more about this site. The for-profit ed industry often leaves students staring up at a mountain of debt, deep in a hole, and shackled to a ball and chain of debt that they can never pay off because their "school" was better at putting kids into loans than into gainful employment. If you or someone you care about has or is considering taking out loans to attend private, for-profit institutions, you owe it to yourself to check out this website. Another story pointing out how for-profit schools target prospective students more on the basis of ability to pay than on their ability to benefit from the for-profit school offers. Hat-tip to Bloomberg BusinessWeek magazine for story and graphic:

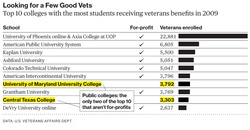

Online Colleges Target Veterans GI benefit-rich veterans help Kaplan and other universities avoid federal financial aid rules Keith Melvin, a disabled and decorated Iraq War veteran, wanted to go to a traditional college until a recruiter for the online, for-profit Kaplan University began courting him. She assured him, he said, that he could trust Kaplan because it's owned by Washington Post Co. (WPO), and because the Post's board boasts such luminaries as Warren Buffett and Melinda Gates. "I was more familiar with Jimmy Buffett than I was with Warren Buffett," Melvin says. After learning the difference between the Sage of Omaha and the Sage of Margaritaville, Melvin enrolled at Kaplan last year. Invoking Buffett and Gates is one of many ways Kaplan attracts veterans—and the public funds used to pay their tuition. Federal spending on veterans' education will more than double this year, to $9.6 billion from $4.2 billion, says the U.S. Veterans Affairs Dept., largely because of a more generous GI Bill that took effect in August 2009. It pays veterans' tuition up to the level of their state's most expensive public university. Kaplan ranked third in 2009 in the number of students funded by veterans' benefits, behind two other for-profits, Apollo Group's (APOL) University of Phoenix and American Public Education's (APEI) American Public University System. Eight of the top 10 colleges were for-profits. "These schools are after the monetary gain of a healthy benefits package, not necessarily what's in the best interest of students," says Donald D. Overton Jr., executive director of Veterans of Modern Warfare, a service group with 5,000 post-1990 veterans as members. Kaplan spokeswoman Melissa Mack says: "Kaplan has received significant interest from veterans because of our military-friendly practices." She says recruiters aren't encouraged to use the names of Buffett and Gates. Enrolling veterans helps for-profit colleges exploit a loophole in a 1992 law capping the proportion of revenue they can derive from federal student aid at 90 percent. Tuition paid to for-profit colleges under the GI Bill counts as nongovernment revenue. Kaplan University, which derived 87.2 percent of its revenue in 2009 from taxpayer-funded education aid such as Pell Grants for poor students, may have exceeded 90 percent if revenue from the GI Bill and U.S. Defense Dept. tuition assistance for active-duty military was added, says Bradley Safalow, chief executive of PAA Research, which analyzes higher education stocks. U.S. Education Secretary Arne Duncan, whose department is pushing tighter regulation of for-profit colleges, expressed concern in September that some schools may violate the spirit of the law, which was meant to ensure that they offer an education good enough that some students are willing to pay for it out of their own pockets. For-profit colleges should have "some skin in the game beyond our dollars," Duncan said. Veterans often don't complete degrees or land lucrative jobs after attending for-profit schools. At Kaplan University, only 30 percent of two-year students and 33 percent of four-year students graduate. Spokesman Ron Iori says Kaplan's graduation rates are higher than many traditional schools that also serve a predominantly low-income student body like its own. Iraq vet Scot Reynolds, who earned a bachelor's degree in management from Kaplan University in 2009, now works as a telemarketer for $8 an hour plus commission—less than he made before he graduated. "My income has drastically dropped," he says. "Kaplan was extremely limited with help in finding work." Iori says Kaplan provides a wide array of job placement services. Kaplan, long known for preparing high school students for the SAT college admissions exam, derived 64 percent of its revenue in the quarter ended July 4 from its higher education division. The unit includes predominantly online Kaplan University, with 75,000 students, as well as Kaplan colleges, which have 37,000 students on 60 campuses. About 11,000 Kaplan University students, or 15 percent of its enrollment, are veterans, active-duty service members, or military spouses, up from 8,500 a year ago. The school targets the more than 1.2 million veterans of the Iraq and Afghanistan Wars, who are eligible for richer benefits under the revised GI Bill, by advertising in military-related magazines such as Army Times and G.I. Jobs, exhibiting at job fairs for current and former service members, and sponsoring events held by Amvets, the country's fourth-largest veterans' organization. Veterans "can virtually go to Kaplan with no out-of-pocket expenses," Kay Houghton, Kaplan director of corporate alliances, said as she handed out brochures at the Amvets national convention in Louisville in August. The bottom line: Washington Post Co.'s for-profit college, Kaplan University, has used the prestige of its parent to attract veterans and their federal aid. This is why you should not suffer in silence if you are being harassed or abused over a debt: because there are laws to protect your family and your dignity from abusive collection practices, regardless of any financial reversals you have suffered that make it hard to pay your debts. The firm below operated all over the state. If you or someone you care about is being harassed or abused over a debt, contact an attorney. You do have rights, debts or no debts.

EUGENE-AREA LAW FIRM SHUT DOWN FOR UNLAWFUL DEBT COLLECTION PRACTICES March 17, 2011 Derrick E. McGavic must pay $70,000 and cease practicing law Attorney General John Kroger today announced an agreement that shuts down a Eugene-based law firm that was the subject of dozens of complaints about its debt collection practices. In addition to closing down McGavic & Finney PC, the settlement requires founding partner Derrick E. McGavic to pay $70,000 and surrender his license to practice law. "At a time when many Oregonians are struggling to manage their debt, the Department of Justice is committed to holding unscrupulous debt collectors accountable," said Keith Dubanevich, Chief of Staff and Special Counsel to Attorney General Kroger. The Department of Justice started investigating McGavic and his partner Kristan Finney after receiving more than 90 complaints against their law firm. McGavic was simultaneously undergoing an investigation by the Oregon State Bar. McGavic & Finney specialized in representing national debt collectors that buy defaulted consumer obligations in massive quantities on the secondary market – often for pennies on the dollar. Consumer complaints filed with the Oregon Department of Justice accused McGavic of systematically ignoring debtor protections and rights afforded under the Oregon and Federal Debt Collection Protection Acts. For example, McGavic allegedly misidentified or purposefully confused the identity of creditors in documentation to delay consumers' response and thus increase fees and interest payable to McGavic and his clients. Notices issued by McGavic allegedly omitted specific information related to the amount of the defaulted debt and failed to provide proper verification of debts when requested by consumers. Similarly, McGavic allegedly repeatedly called debtors who had requested in writing not to be called. The Department of Justice's investigation also uncovered McGavic's pattern of falsifying fee affidavits in Motions for Default Judgments by claiming services he did not perform. In addition, McGavic allegedly provided his office staff with a schedule to be used to arbitrarily increase the fees claimed - depending on the amount of money claimed or the venue of the action. The agreement filed March 16 in Lane County Circuit Court requires Derrick McGavic to pay $70,000 to the Oregon Department of Justice to reimburse the cost of the investigation; dissolve the law firm of McGavic & Finney, PC; and resign from the Oregon State Bar. McGavic is further prohibited from acting as a debt collector or operating a law firm or a collection agency in the State of Oregon. Kristan Finney may continue to operate under a different business or firm, subject to numerous stringent injunctive provisions specified in the settlement agreement. Senior Assistant Attorney General Gregory Smith handled the case for the Oregon Department of Justice. Attorney General John Kroger leads the Oregon Department of Justice. The Department's mission to fight crime and fraud, protect the environment, improve child welfare, promote a positive business climate, and defend the rights of all Oregonians. Contact: Tony Green, (503) 378-6002 [email protected] | Sallie Mae that is. An excellent link dropped in one of the comments to this letter to the editor in the Statesman-Journal (text below).

There is not a week that goes by that I don't see people who found out that, when they weren't even old enough to buy a beer, they signed up for a lifetime of outrageous above-market interest rates and backbreaking fees, all courtesy of the student loan-sharks who are not taking any risk on student loans, since the government guarantee eliminates the risk! This is the kind of legalized piracy that threatens our nation's future -- oppressing people following the conventional wisdom ("Get an education") is like pouring gasoline all over the barn floor and lighting matches randomly. Every year the debt tsunami floods out more and more young-- and now middle aged people -- who have been carrying these absurd loans for years and still wind up facing bigger balances than ever. This is highly toxic stuff for a democracy. I spoke at the recent town hall meeting with Rep. Kurt Schrader about how consumer protections need to be restored to student loans. If you get in over your head with credit cards, you can get a fresh start with bankruptcy. If you can't afford your home, you can give it back to the bank. Student loans are the only loan that it is impossible to get out from under when you can't afford to pay them. Lenders can garnish wages, pensions or disability payments. You can be forced to pay no matter how low your income or whether you are old or disabled. After I spoke at the meeting, two member of the audience turned around in their chairs and thanked me for my comments. Another asked to read my notes. These laws really need to be changed. There is no protection for consumers who could not find better jobs and afford to pay off their debt. — Jessica Hopkins, Salem |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed