A majority of Americans (57 percent) say the higher education system in the United States fails to provide students with good value for the money they and their families spend.

A record share of students are leaving college with a substantial debt burden... a quarter say it has made it harder to buy a home (25 percent); and about a quarter say it has had an impact on their career choices (24 percent).

Nearly every parent surveyed (94 percent) says they expect their child to attend college... most young adults in this country still do not attend a four-year college. The main barrier is financial.

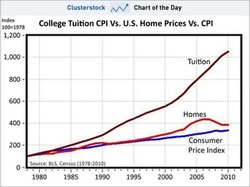

Over the last 18 years, every dollar added to the cost of a college degree has only put 14 cents of annual income in a graduate's pocket.

Bottom line: No young person should be taking new student loans without being very well advised on the upside and downside risks, which are substantial, and having a well-researched "Plan B" for how to avoid a lifetime of crushing debt obligations if the typical young adult's version of Plan A ("Get in debt up to my eyeballs, graduate, get great job, get out of debt easily") doesn't turn out to work.

RSS Feed

RSS Feed