|

Some shady folks look at disasters and see dollar signs. Oregon DOJ has some useful information to help you keep from becoming a victim to those folks. You can download them below.

0 Comments

Coder-turned-Attorney Robb Shector has further enhanced his first big online laws project from his law school days, the excellent online Oregon statutes depository (Oregonlaws.org). Robb has made that even more valuable by coming up with a way to provide a very smooth integration with the statutes from his version of the online Oregon Administrative Rules (OARs). Robb's OARs database now provides hotlinks to statutes so you can easily go check the statutes as you are researching the rules and then easily return to the rules.

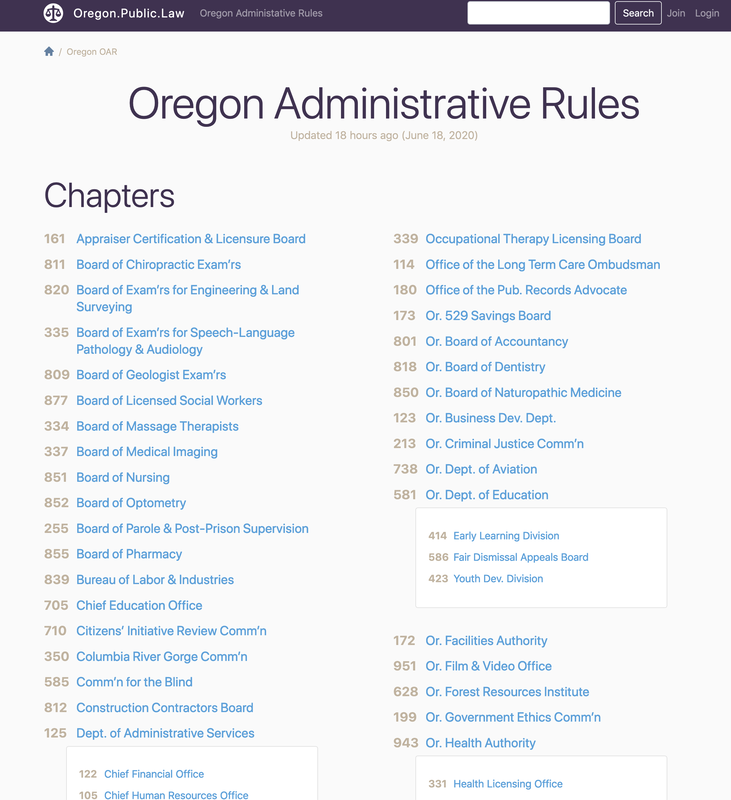

You can see Robb's administrative rules set here: https://oregon.public.law/rules (photo below of the entry page). Having worked with others (I don't have the technical chops to do the coding myself) to bring readable OARs to Oregonians for a long time (see OregonAdminRules.org tab at top of page), I know Robb put in an awful lot of work. Hats off to Robb for bringing this home at last. It's pathetic that the State of Oregon publishes statutes and rules in such a poorly designed format (all left-justified text that is all but impossible to use without extensive manual reformatting). It would require little or nothing by the state to give Oregonians these important publications in a clear, always-up-to-date, easy to use form, as Robb has shown. REMEMBER: Federal law prevents businesses from sticking fine print into their contracts that prohibits you from writing or posting a negative review of the business! (The Consumer Review Fairness Act (“CRFA”) became law in March 2017.)

The Federal Trade Commission recently slapped three companies who had form contracts that said the consumers could not post negative reviews about the products or services from the businesses. Worse, these form contract also had confidentiality clauses -- those said that the consumers would PAY money damages to the businesses if the consumers disclosed information they got while using the products or services was confidential. Bankruptcy Exemption Limits (what you can keep) Amounts Going Up

Mick Mulvaney is the Darth Vader of the Trump Administration when it comes to hating real people and worshiping at the feet of his Emperors, the corporate masters who own him. Mulvaney hates the very idea of a Consumer Financial Protection Bureau that a bought and sold Congress cannot neuter because it is funded independently like the Federal Reserve and EVERY OTHER financial agency. Mulvaney wants to make CFPB like the FCC and FTC and all the other agencies that have been totally neutered and rendered impotent by a Congress in hock to campaign contributors who crack the whip and watch their minions jump. A consumer attorney in Ohio isn't having any of this, and has put the entire CFPB consumer complaints database online outside the CFPB's control, and promises to keep it updated -- so even as Mulvaney tries to hide the complaints, this new database will ensure that real people will be able to access it. DannLaw launches "Scoundrels, Scams and Cheats" database to ensure public access to CFPB consumer complaint reports  The National Association of Consumer Advocates (NACA) offers consumers a great free tool to download and review before shopping for a motor vehicle. You can access the app on your desktop or laptop by going to www.USLemonLawLawyers.com. Or take it with you to the dealer's by downloading it from the Apple App Store or the Google Play Store (Android).  From The Oregonian: The settlement, announced in February, sets aside $1.5 billion for direct payments to about 2 million borrowers nationwide whose homes were foreclosed between 2008 and 2011 by one of five participating mortgage servicers: Ally/GMAC, Bank of America, Citi, JPMorgan Chase and Wells Fargo. But nearly 10,000 Oregon residents haven't filed claims since notices were sent out in September. The deadline for claims is Jan. 18. In Oregon, payments would be at least $840, though it depends on the number of claims. Claims can be filed by returning the forms mailed in September, or at nationalmortgagesettlement.com.  The Oregon Court of Appeals has ruled that the hydra known as MERS -- the monstrous placeholding dummy with a million phony vice-presidents, which the mortgage servicing industry created to attempt to evade the requirement (and the fees) that all transfers of interests in mortgages be recorded -- cannot use the streamlined, fast-track nonjudicial foreclosure process in Oregon! Niday v. GMAC Mortgage, LLC et al, "[T]he import of our holding is this: A beneficiary that uses MERS to avoid publicly recording assignments of a trust deed cannot avail itself of a nonjudicial foreclosure process that requires that very thing-- publicly recorded assignments." The nonjudicial foreclosure process was created in the old days when lenders held onto their mortgage loans, which were actually underwritten thoughtfully. Fast forward to the slice-and-dice fast-money 1990s-2000s, when the banksters and money men started financializing everything and you suddenly had a tool that was being used against homeowners in ways never intended, by an entity never imagined by the law, a weird hybrid creature that pretended to be both the beneficiary of the loan (when useful to MERS) and not the beneficiary (again, when useful to MERS). Hurrah for the Oregon Court of Appeals. BULLSEYE! Seems likely the MERS scammers will appeal but, for now, a true shining example of Oregon flying with her own wings and reaching the right conclusion despite a number of other states having missed the mark widely on this issue.  Filing Consumer Complaints for Mortgage Problems, Auto Fraud and More Keep this list handy so you’ll know who to turn to when it comes time to register a complaint related to a shoddy consumer product or practice. Note that some agencies offer direct assistance to resolve complaints while others track information for use by law enforcement officials. Also, for all online complaints registered with the CFPB, the bureau will forward your client’s complaint to the company, issue a tracking number, and keep you or you updated regarding the status. Auto Loans or Other Consumer Loan Complaints (other than mortgage and student loan problems) Consumer Financial Protection Bureau (CFPB) Auto Dealer Complaints FTC Complaint Assistant Bank Account or Bank-Related Service Complaints Consumer Financial Protection Bureau (CFPB) Credit Card Complaints Consumer Financial Protection Bureau (CFPB) Mortgage Complaints

Consumer Financial Protection Bureau (CFPB) Other Consumer Fraud & Scams

_ I have been working for months now on a project that has the potential to provide ample, sustainable, non-general-revenue funding for legal aid services so desperately needed by ordinary folks in Oregon these days, as Oregon and the feds keep cutting their support, and more and more people are ground up by the legal system simply because there is nowhere for them to turn. Imagine if the $13 BILLION that the big banks made reinvesting money lent to them at near-zero interest by the Feds had gone to support legal aid services.

(That's right, banks got huge piles of free money from the Feds at the Federal Reserve discount windows and then turned around and LENT that same money back to the federal government at interest, using the profits to pay bonuses that already exceed the pre-crash-year bonuses of 2007 and 2008. Whoever said there is no free lunch meant "for real people" -- because the banks sure as hell have enjoyed a lavish free endless banquet at our expense.) Stay tuned here this year, I hope to have good news on this front in 2012. Meanwhile, a good essay by a top consumer lawyer. Equal Justice under the Law An Essay by O. Max Gardner III

Training without travel for mid-valley nonprofit leaders!

Friday Fundamentals for Flourishing Nonprofits Eight carefully designed, targeted 90-minute workshops, with attendance limited to eight nonprofit leaders, so you will get the personal attention to the questions that matter to you and your nonprofit. Training that gets right to the point, right here in Salem, created and presented by an attorney focused on helping nonprofits do more good while having more fun. 9/9 “First things first? So how do we know what’s first?” (Priority-setting for nonprofit leaders) 9/23 File, forget, and flounder. (Using minutes to help make better use of your hours.) 10/7 By law or not by law? (Bylaws for the bewildered.) 10/21 “Procedures? We don’ need no stinking procedures!” (How and why nonprofits can learn to love doing things “by the book.”) 11/4 What taxes? I thought we were a nonprofit! (“Excuse me, your unrelated business income is showing.”) 11/18 “We do the Lord’s work, so why do they act like Satan?” (Conflict on boards.) 12/2 “We love mankind. It’s the employees who drive us mad.” (Employment law for nonprofits.) 12/16 “But Judge, . . . !” (How to raise funds without having a lawyer on speed-dial.) Each workshop will be at 11 am on Fridays in downtown Salem. Tuition is just $35 for each one (paid in advance) or $40 (paid day of) – or guarantee your seat by enrolling for all eight for just $250 (save $30). Workshop creator and leader is John Gear of the John Gear Law Office, LLC. See http://JohnGearLaw.com for more information. To enroll or for questions, call John at 503-339-7787. For those trying to understand or navigate the state court system on their own. (H/t to Oregon Legal Research blog.)

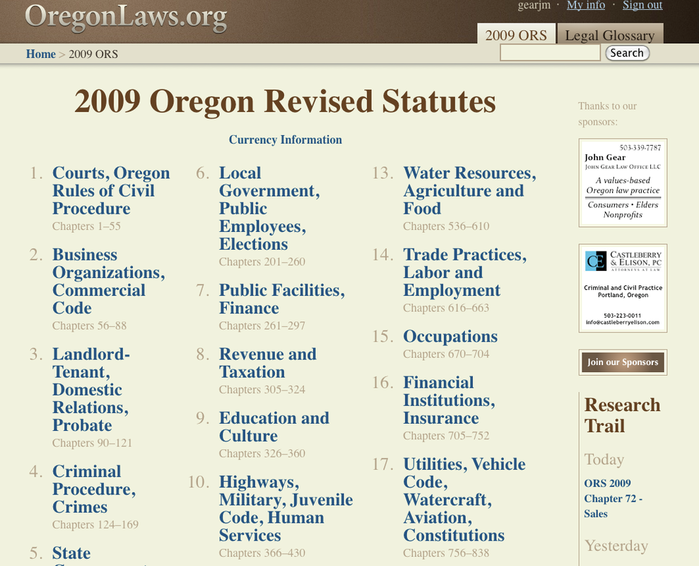

One thing though: If you're trying to research the Oregon Revised Statutes, OregonLaws.org is a lot better format that is a lot easier to use. One other thing: It's the cheap person who usually winds up spending the most. Some of the most expensive cases I saw when I worked at an appellate court were started by people who tried to save a couple hundred bucks in attorney fees and wound up having to litigate for years. There are definitely a few things you can do for yourself in the legal system but, as a general rule, it's not a system set up to support self-helpers. Grab your favorite piece of "legal" software and read the fine print -- the first thing it says is that it is not intended to replace qualified legal counsel. Of course that's utter BS; nobody would buy the software if it wasn't sold as the solution to your legal problems at big savings. But it's an important point to remember -- if a licensed attorney screws up your matter, there's a bar association Client Assistance Office and a bar complaint process ready to help you. The software companies refer all their consumer complaints to Helen Waite, as in "Go to . . . . " Just sayin'. OregonLaws.org is such a great service -- it lets "civilians" (non-lawyers) find the statutes and see them presented in an intelligent, useful format. I like it so much that this office is only the second OL.org sponsor ever. But you can sponsor or assist too! Before John Gear Law Office opened, I was contributing a measly $2 a month to OregonLaws.org, just because it is such a cool project. If you ever turn to the site for help, consider becoming a participating member -- surely it's worth $2 a month to have access to the laws in a clear, helpful format.

Dear Colleague,

In July 2010, Congress created a new federal agency to protect American consumers. The Consumer Financial Protection Bureau will be a cop on the beat, working to make consumer financial markets work better for American families. As the first new consumer agency of the 21st century, we can communicate directly with the people we serve. Today, that work is just beginning. We’re moving quickly—building a terrific team, finding office space, and unpacking a lot of boxes. Things aren’t all in place yet, but we don’t want to delay reaching out to the people who care about this agency. We’re excited to announce the launch of our website, ConsumerFinance.gov, for one very important reason – to start a conversation with you. With the launch of our site, we will be Open for Suggestions. We hope you are eager to learn what this new agency will do and how it might affect you. In turn, we are definitely eager to hear what you have to say. Starting today, you can use the Internet to send us your best suggestions and questions for the bureau: If you have a video camera, record a YouTube video and upload it as a response to our welcome video at http://www.youtube.com/CFPB. If you like Twitter, tweet your suggestion using the hashtag #CFPB. You can also follow us at http://www.twitter.com/CFPB. If you are on Facebook, you can “Like” us at http://www.facebook.com/CFPB, and post your suggestion on our wall. If you want to use our website, you can post suggestions at http://www.consumerfinance.gov/openforsuggestions. In the coming days and weeks, staff who are building this new agency will record direct video responses to some of the most frequent questions and most interesting suggestions. You’ll see the faces and meet the people who come to work every day to make a difference for the American people. We look forward to getting to know a little more about you, too. More is coming, so be sure to check back at http://www.consumerfinance.gov/openforsuggestions throughout the coming weeks. Open for Suggestions is just one way that we plan to keep our conversation going with you. Be funny! Be creative! Most of all, be real about what matters to you. This is a great chance to go into your community with a camera, laptop, or mobile phone, or just a pen and paper, and help others participate. Involve your friends, your family, your colleagues and classmates, your faith community, and anyone you know who might be counting on this agency for information and help. If you aren’t ready with a specific comment, that’s OK. Just let us know you are there—and stay in touch. We can’t do it without you. Thanks, Elizabeth Warren Attorneys have a variety of databases at their disposal for researching the law. But what about you, the regular person? Where can you go to find the Oregon statutes? Alas, the state website is horrible, because the Legislature ignores everything we've learned about printing and displaying information intelligently since Gutenberg brought movable type printing to the Europe.

To the rescue comes a law student, Robb Shecter and his partner in making law accessible for the people, Lisa. They have done an amazing job posting the Oregon Revised Statutes at OregonLaws.org, and presenting them in a thoughtfully formatted way that makes completely and effortlessly readable and usable. Hats off to them both! John Gear Law Office, LLC is very proud to be just the second paid sponsor/supporter of OregonLaws.org. Sponsorships for OregonLaws.org help make this site the best way for you to find out just what the law says. OregonConsumer.org -- a great resource.

|

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

Lawyerly Fine Print:

John Gear Law Office LLC and Salem Consumer Law. John Gear Law Office is in Suite 208B of the Security Building in downtown Salem at 161 High St. SE. That is right across High Street from the Elsinore Theater, a half-block south of Marion County Courthouse.

John Gear is only licensed to practice law in Oregon. This site may be considered advertising under Oregon State Bar rules. There is no legal advice on this site so do not take anything you read here as advice for your particular problem or situation. And I do not represent you and I am not your attorney unless you have hired me with a representation agreement. While I do want you to consider me when you seek an attorney, you should not hire any attorney based on brochures, websites, advertising, or other promotional materials. All original content on this site is Copyright John Gear, 2010-2022. |

RSS Feed

RSS Feed