Growing wave of Social Security imposters overtakes IRS scam

By Emma Fletcher

April 12, 2019

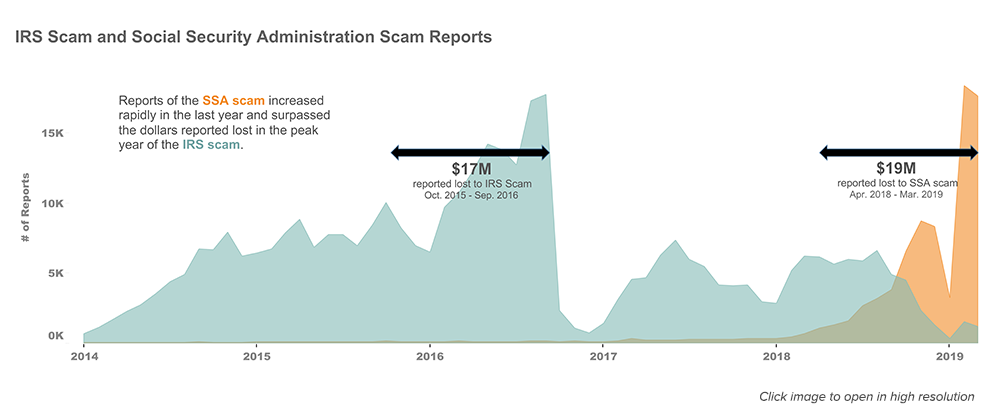

Claiming to be a government authority is a tried and true way that scammers trick people into sending money. Among the most common government imposters have been scammers pretending to be the IRS – until now. In the past few months, the FTC’s Consumer Sentinel Network database has seen Social Security Administration (SSA) imposter reports skyrocket while reports of IRS imposters have declined sharply. In the shady world of government imposters, the SSA scam may be the new IRS scam.

SSA imposters tell you your Social Security number has been suspended because of suspicious activity, or because it’s been involved in a crime. They ask you to confirm your Social Security number, or they may say you need to withdraw money from the bank and to store it on gift cards or in other unusual ways for “safekeeping.” You may be told your accounts will be seized or frozen if you don’t act quickly.

These scammers often use robocalls to reach people, and the message can be hard to ignore. You may be told to “press 1” to speak to a government “support representative” for help reactivating your Social Security number. They also use caller ID spoofing to make it look like the Social Security Administration really is calling. With such trickery, these scammers are good at convincing people to give up their Social Security numbers and other personal information.

As the graphic shows (top), people reported the IRS scam (in blue) in huge numbers for many years, but the new SSA scam (in orange) is trending in the same direction – with a vengeance. People filed over 76,000 reports about Social Security imposters in the past 12 months, with reported losses of $19 million.1Compare that to the $17 million in reported losses to the IRS scam in its peak year.2 About 36,000 reports and $6.7 million in reported losses are from the past two months alone.

Just 3.4% of people who report the Social Security scam tell us they lost money.3 Most people we hear from are just worried because they believe a scammer has their Social Security number. But when people do lose money, they lose a lot: the median individual reported loss last year was $1,500, four times higher than the median individual loss for all frauds.4 All age groups are reporting this scam in high numbers, with older and younger adults filing loss reports at similar rates.5

People report sending money in unconventional ways. Most often, people say they gave the scammer the PIN numbers on the back of gift cards. Virtual currencies like Bitcoin come in a distant second to gift cards: people say they withdrew money and fed cash into Bitcoin ATMs. With both methods, the scammer gets quick cash while staying anonymous, and the money people thought they were keeping safe is simply gone.

Here are some tips to deal with these imposters:Report government imposter scams to the FTC at FTC.gov/complaint.

- Do not trust caller ID. Scam calls may show up on caller ID as the Social Security Administration and look like the agency’s real number.

- Don’t give the caller your Social Security number or other personal information. If you already did, visit IdentityTheft.gov/SSA to find out what steps you can take to protect your credit and your identity.

- Check with the real Social Security Administration. The SSA will not contact you out of the blue. But you can call them directly at 1-800-772-1213 to find out if SSA is really trying to reach you and why.

- Talk about it. People recognize the IRS scam, but many are getting caught off guard by these new imposters. You can help by telling people that the SSA scam is a new version of the IRS scam.

To learn more, visit ftc.gov/imposters.

FN1 FTC was unable to collect reports directly from the public during the government shutdown. Reports collected during that period were provided by Sentinel data contributors.

FN2 From October 1, 2015 to September 30, 2016, about 140,000 reports of IRS imposter scams were filed and collectively indicated $17 million of loss.

FN3 For comparison, 2.8% of IRS scam reports filed from January 2014 through March 2019 indicated a loss. In 2018, 25% of all fraud reports indicated a loss.

FN4 Median loss calculations are based on reports submitted in 2018 that indicated a monetary loss ($1 - $999,999). The median reported individual loss to all frauds was $371 in 2018.

FN5 Age comparison based on the number of Social Security imposter reports that indicated a monetary loss per million population by age. People who said they were 20 – 59 filed loss reports at a rate of 8.9 reports per million people in this age group, while people who said they were 60 and over filed 10.0 loss reports per million people in this age group. Population numbers obtained from the U.S. Census Bureau: U.S. Census Bureau, Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States, States, Counties and Puerto Rico Commonwealth and Municipios (June 2018). Not all reports include usable age information.

|

0 Comments

I really, really hate fast operators who prey on the elderly. I have a close friend, an elderly woman, who shares all the scam mail she gets with me, so I have a window into a world that most working-age folks are totally unaware of.

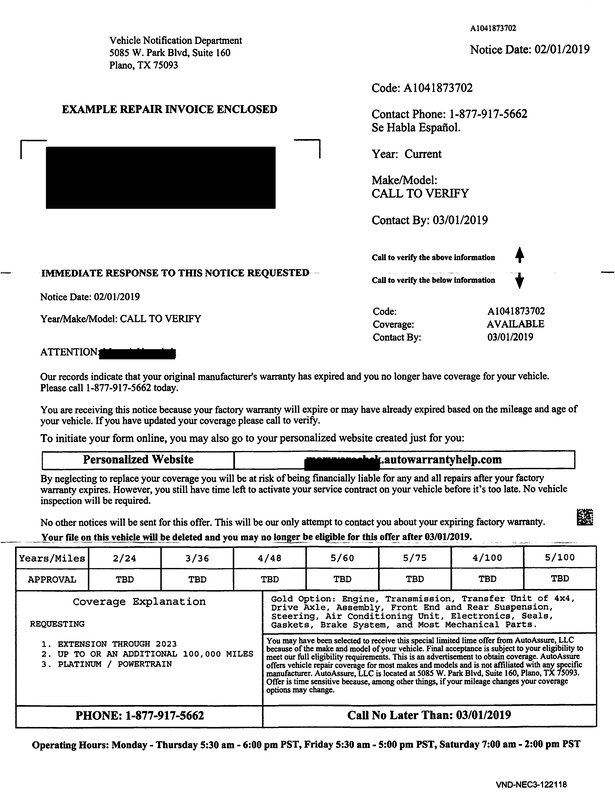

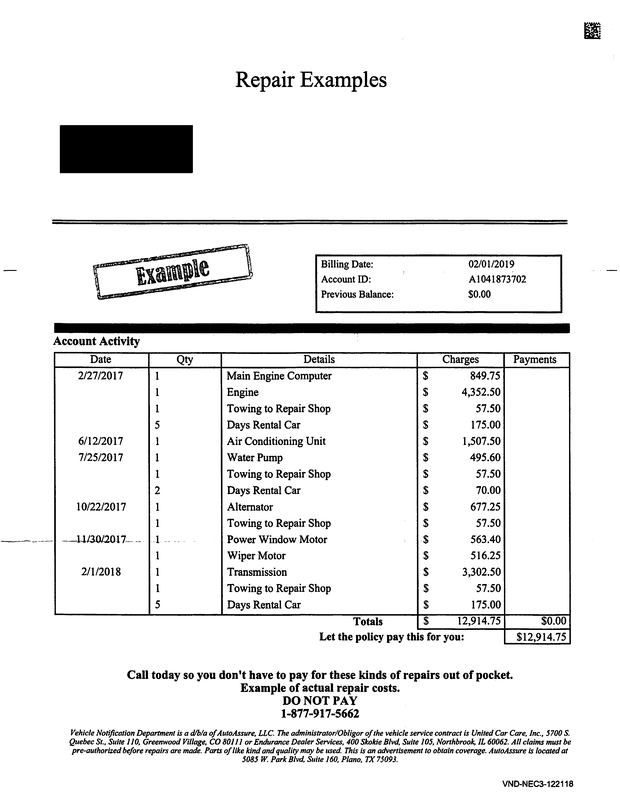

Below is an example of a really nasty bit of business, an offer pitching what is supposedly a way to buy an extended warranty on your old car (it's not really a warranty but a service contract, but most people call it a warranty or extended warranty). What it really is instead is a way for them to hook a suction line up to your bank account and drain it. I know this for several reasons. One is that my friend's car is a mid-1990s sedan. There is no way in hell that anyone honest will sell her a service contract to fix problems with a car of that age. It would never pencil out. Two is that, while I was born at night, it wasn't last night. I have had countless elders come to me to complain about "warranties" that refused to pay when the coverage the elder thought they had purchased was invoked. This whole offer, and especially the table on the back, is the work of sophisticated con artists who know that if they can get elders on the phone, the elders are often vulnerable to sales pitches that play on the fixed-income elder's fear of unexpected/unplanned expenses. The people who staff the phones for these come-ons are really, really good at being convincing and sounding utterly sincere and honest. They will talk your ear off about the high cost of auto repairs, and how their "product" would give the caller "peace of mind." That's what this scam is about -- playing on the fear that folks on fixed incomes have of repair bills, just like the horrible "water supply line" warranties that were being sold around here a few years ago. Believe me, that supposed "example" on the second page of the piece is PURE FICTION and is intended to give the reader the FALSE impression that they are selling something that would PAY for those repairs. (It is a lie, in in other words.) If you EVER get an offer like this that tempts you to respond, DON'T DO IT. Send it to me instead -- I'll gladly review it and discuss it with you at no charge if you let me use it as a consumer education example to help others. And if you can ever show me a mass-mailing come-on that targets the elderly that actually proves to be actually be a good deal after I look into it, I'll not only tell you it seems legit, but I'll give that company a public pat on the back for offering elders a fair deal that benefits them, and not just the company trying to take their money.

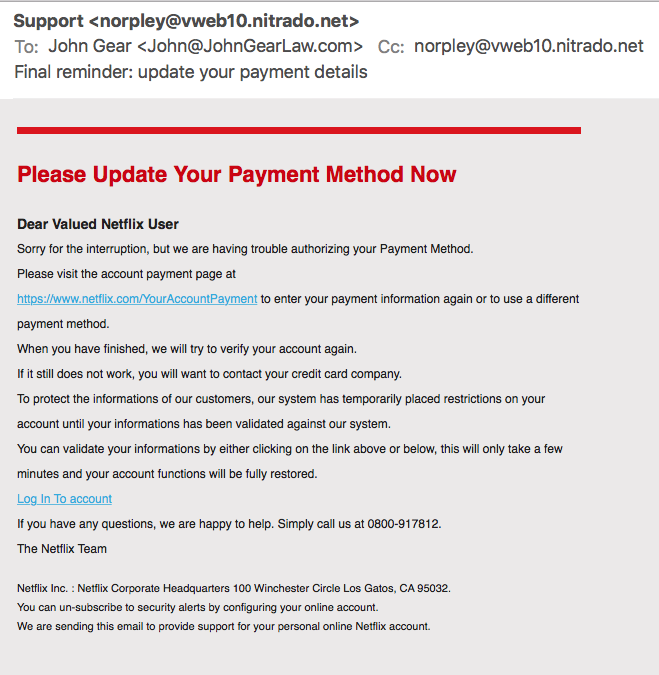

I have had a number of very unhappy consumer victims of scams where they received very convincing calls from someone with an authoritative voice who told them that they were going to be arrested/audited/exposed as a liar/cheat/unfit parent/tax fraud unless they went to Apple (or Google or Wal-Mart) and bought gift cards and gave the codes from the cards to the person calling. It's easy for you and I to sit back and say "That's an obvious scam" but it's not obvious sometimes, when you're tired and don't expect someone to call and threaten you. Once your amygdala fear response kicks in, your reasoning declines dramatically. So just remember -- just like money never calls you on the phone, only scammers demand payment in gift card codes. Never buy a gift card because someone threatened you! (Unless it's your wife.) Scammers demand gift cards | Consumer Information The short answer to "How do criminals steal from the elderly?" is "by phone, mostly." And new phone-based payment services that let you send money to others without even leaving your house make it crucial that you remember this key survival rule: MONEY NEVER CALLS YOU ON THE PHONE. And if you think you've found the exception to this rule, call an attorney or a trusted friend with good sense to discuss the offer before you do ANYTHING that the caller suggests. If you have truly found the exception to the rule, it'll wait for you to conduct a thorough investigation. If you feel ANY pressure to seize the opportunity at all, that's the clearest sign of all that it's a SCAM. Remember, the phone and internet means just one thing for sure: Every criminal in the entire world is just one click or phonecall away from you. In years past, you pretty much only did business with people nearby; now you can be ripped off by someone from a country you can't even pronounce just as easily as by someone who calls you from a boiler-room scam operation in your own hometown. How Criminal Steal $37 billion a year from the elderly In Oregon as in Arizona and New Mexico -- Never take your eyes off the dealer (the car dealer)8/27/2018  Remember -- you have EVERY RIGHT to take the paperwork home from a car dealer so you can get help reading and understanding it at your leisure before you sign! A car salesman who says "I can't hold this car for you if you leave" is a liar trying to pressure you into signing on the dotted line without having help reviewing the contract. FTC press release: Not all dealers play by the rules. In a case announced today, the FTC alleges that Tate’s Auto Center of Winslow, Inc. — as well as related dealerships in Arizona and New Mexico and their owner and manager, Richard Berry -- * used deceptive advertising to get people in the door, * failed to disclose required financing terms, and * frequently falsified consumers’ income and down payment information in an effort to close the deal. Instead of using the income information people gave, Tate’s often inflated numbers to make it look like people had higher monthly incomes. https://www.ftc.gov/news-events/press-releases/2018/08/ftc-charges-auto-dealerships-arizona-new-mexico-falsifying What "Spearfishing" looks like -- how hackers get you to give them your passwords and logins1/8/2018 Note the ways to tell this is phony -- the "Noreply" email is misspelled, and the "simply call us at" phone number is bogus.

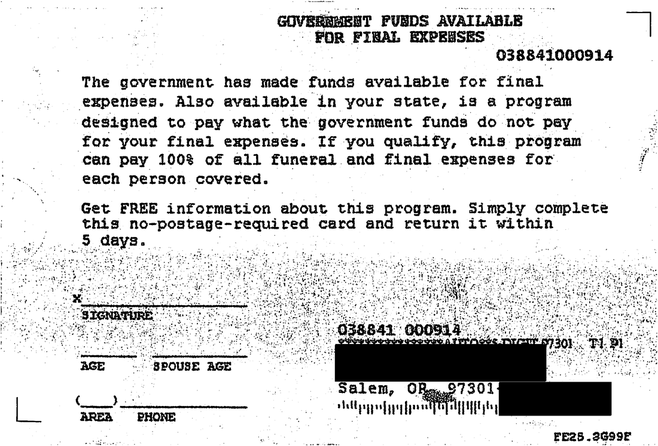

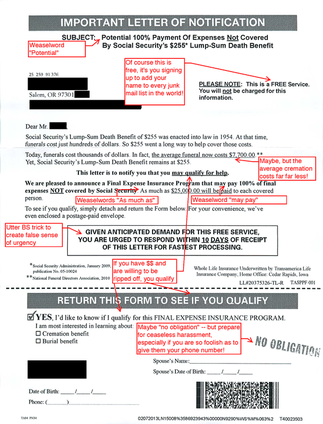

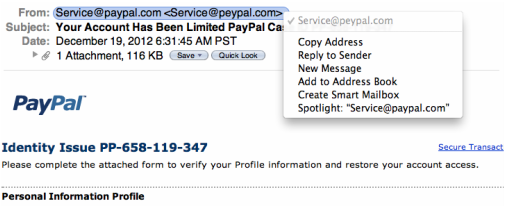

The most important tip, though, is to ALWAYS look at the sender id: norply@vweb10.nitrado.net is NOT Netflix. Legit businesses do NOT send this kind of thing. If you were to click on those links, you'd be taken to a very convincing phony website that would collect your attempts to log in, which would capture your actual netflix login and username. It helps that I don't have a Netflix account, but it's important to recognize all spearfishing attacks.  These scammers trying to pry your personal information out of you by making it appear that they're from the government. On this one, note the barely readable small print disclosure that they're not, which is at the bottom and is about 1/20th as dark as the typeface that says "GOVERNMENT FUNDS AVAILABLE FOR FINAL EXPENSES" that appears at the top, next to the Pennsylvania Avenue address in Washington DC ( a nice touch, don't you think?) Note the deceptive wording of the interior: The government has made funds available for final expenses. Also available in your state, is a program designed to pay for what the government funds do not pay for your final expenses. If you qualify, this program can pay 100% of all funeral and final expenses for each person covered. The comma after in your state is a nice touch for illiteracy.  Note the attempts to make it seem to come from a government source The folks who prey on the elderly -- the Elderscammers -- never tire of trying to make their scam letters appear to come from an official source (anything that will get you to open them). When you get mail in an envelope that looks like this, your best bet is probably to recycle it immediately without even opening it. If you are really torqued about their deceptive technique and want to make it a bit more expensive for them, here's one thing you can do: Open the envelope, but only so that you can find out if there is a postage-prepaid "Business Reply Envelope" inside (there often are). If there is a BRE, take a dark marker and write "STOP SENDING ME JUNK" on the reply card, and draw a big X over the part where they want you to give them all your personal information. Then stuff everything they sent you into the BRE, seal it, and drop it in the mail. This has proven remarkably effective at getting them to stop sending me any such junk. Sadly, all my elderly neighbors and friends keep me well supplied in examples of this kind of scam. (This one was another come-on for funeral expenses insurance, the biggest ripoff this side of waterline insurance plans.)  Mixed in with the many honest businesses, I'm sad to say that there are a TON of ethically challenged businesses out there too. They especially prey on elders, offering them outrageously overpriced goods and services, using all the time-tested tricks of the trade, trying to make it look like they are doing you a favor, and that you might have to "qualify" to do business with them -- when the only qualification is excessive trust in strangers by you, and a willingness to give out private information to total strangers. These people will use any information they can get to take advantage of you (and they will sell and trade that information to similarly exploitation-minded outfits -- along with the key fact, that you were so foolish as to respond to their mailing). There's a good saying that "Good deals don't call you on the telephone" and the same goes in spades for junk mail like this. Honest businesses don't try to make money off you by selling you wildly overpriced insurance. I wish there was a way to require outfits like this to put a skull-and-crossbones watermark on every page of every letter they send out, because then you'd have a chance of realizing what pirates they are.  Take special notice of how this works: you get a very official looking email from "Service@paypal.com" -- And that address (Service@paypal.com) is all that appears in the email reader. It's only when you right-click on it to make it reveal the full address is the bogus actual address (peypal.com) revealed ... and some folks would miss the shift anyway (peypal vs. paypal). "Phishing" is where the scammer doesn't steal your information directly -- rather, the scammer "fishes" for information in such a way as to lure you into GIVING it to him/her. Don't fall for it! Remember, simple online safety rule #1: Observe the same safety precautions online as you do on the telephone. Just as you would never give out personal information to someone who called you (RIGHT??), you should never give account information about yourself or your digital world to anyone who initiated the contact with you, particularly through an email.  I'm skeptical of any bright-line rule that says that a nonprofit is no good because it spends too great a percentage of its revenue on administrative overhead. In fact, what I tend to see is the exact opposite: nonprofits that starve their administrative side in an effort to please the raters, which only sets them up for terrible problems of the gravest sort, including embezzlement, failure to find or retain good people, employment and wage claims, etc. The bottom line is that nonprofits are small businesses, and running small businesses is not easy, especially newer and smaller ones. So bright-line cutoffs are usually to be taken with a big grain of salt. Ok, that said, here are some outfits that require a charitable interpretation of the word "charity" just to be considered as one. In other words, these aren't close -- these are the stinkers that cause good nonprofits such problems, because when the public gets a whiff of these stinkers, all nonprofits get a bad name. The best thing to do with this list is check it before you write your end-of-year gift checks -- and make sure you avoid these outfits. I'll just give the top three -- download the full list of 20 below. Organization Average Annual Percent Spent Expenditures Charitable Cause Law Enforcement Education Program $2,299,994 2.7% Troy, MI Shiloh International Ministries $846,340 3.2% La Verne, CA American Medical Research Organization $783,217 4.2% Sarasota, FL (I'm pleased to note that there are no Oregon nonprofits among this "Worst 20" list, although sad to see several in Everett, Washington.)

My elderly neighbor called me today with a question about a man who had approached her while she was raking leaves. He offered to remove the moss from her roof for $150 -- told her he would remove all the moss and leaves, and haul everything away and put an "EPA-Approved" chemical on the roof to keep the moss from coming back. Luckily, my neighbor is getting wily and she had the sense to tell the guy that she needed to check on him -- she called me, and some things she told me about the guy didn't add up, so I looked for a Construction Contractors Board registration, and I found that he was not a registered landscape contractor even though he was going under the name of a landscaping company (which show up under CCB). I also called the Attorney General's Consumer Protection office. More importantly, the guy also shows up in the photo listings of Marion County parole violators. The take-home lesson: NEVER let anyone start working for you, especially on your roof or inside your house, without checking on them first. (You don't want an unlicensed, uninsured person up on your roof, even if they don't intend to rip you off.) Also, never do a handshake deal with a door-to-door service provider; make them give you a written contract showing exactly what they are going to do for you and how much it will cost. If a business is so fly-by-night to not even have contract forms, they are obviously too fly-by-night to hire. (Conversely, don't be fooled by slick brochures and spiffy forms -- just because they have a truck with signs and matching shirts and slick materials doesn't mean that they aren't also crooks.) BOTTOM LINE: Every legitimate service provider -- whether it's a pressure wash of your driveway or removing moss from your roof or washing your windows -- will not object if you say that you want to take their business card and you will call them back if you decide to hire them after you've had a chance to check them out. Anyone who insists that they're only going to be in your neighborhood today, or that their registration is "too new to show up" or that they'll be too busy to come back later is setting you up. Send them packing, and call the Construction Contractors Board and the Attorney General to report them.  It's disgusting that there are plenty of people who crawl out of their holes after every natural disaster and prey on people whose generosity and concern for others causes them to overlook the warning signs that they are being scammed. But there it is. So don't be one of the scammed.  So, this is interesting. Because I've posted warnings for consumers (such as here) about the perils of entrusting your household goods to one of the many scammers who infest the interstate moving game, some sloppy online marketing company apparently thinks I'm a moving company (see screenshot of email, click on it to enlarge it). That email may not seem like much, but it's really quite revealing: it shows that, when you do a typical Google search for long-distance moving companies, the sites you are most likely get from your search are precisely those sites where the scammers buy their leads (that would be you). They buy leads from these facade websites, and when you call them, you don't realize that you're already halfway to being scammed. The only surefire way I know of to avoid these moving scammers is to NOT find your mover via an internet search; I'm afraid it's just asking to be ripped off. Remember: The interstate moving game is entirely unregulated Somalia hiding in plain view in the middle of America. Every year, thousands of Americans are victimized, and they shake their heads and wonder how it's possible that there are organized crime gangs operating in interstate commerce in America and the feds do nothing. Long story short, we're getting another taste of the bitter harvest from the deregulation mania, the delusion that if streamlined, smart regulation is good, no regulation at all must be even better. When the Gingrich Congress killed the Interstate Commerce Commission, they killed the only agency with a mandate to prevent the interstate moving scams; in theory the FBI should be on the case, but they're too busy infiltrating peaceful demonstrations. Bottom line: You have no reliable protection from any government against these scammers. You're on your own, so the only smart thing to do is avoid them in the first place. Ask anyone who's been ripped off by the moving scammers; they'll tell you that it's much better to pay more up front to a reputable mover than to pay the same or even more to the scammer who may or may not eventually decide to give you your goods back after a anguishing months- or even years-long battle. Summertime is when people like to move. That's also when scam moving companies like to catch big fish. Don't be one of them.

Boy, maybe the only thing worse than falling for a scam is having passed it onto your family and friends! See this report from Consumerist: We recently told you about scammers tricking consumers into sharing sensitive information by telling them a federal stimulus plan will pay their power bill for a month; they just need your SSN and bank routing number. If you think that no one would fall for such an obvious ruse, then you might be surprised to know that not only were thousands of people in New Jersey taken in by the scam, but they passed it along to their friends because they thought it was a good deal . . . The basic rule is this: Whenever anyone contacts YOU, NEVER give them any information (account numbers, your birthday, or social security numbers, etc.) that they could use to steal your identity. No reputable business calls you and asks for this info, or sends you an email asking for it. Only share such sensitive information over the phone (if ever) when you call a business that you have found in a reputable public directory. Passing on this warning from your friendly neighborhood IRS. I'm not a tax lawyer, and you can't rely on this warning to avoid any penalties the taxman might hit you with should you run afoul of this scheme (or make any other tax errors). Best advice: don't fall for the too-good-to-be-true offers, especially where the IRS is supposedly passing out free money. The (very) few tax breaks in the tax code that benefit ordinary people in the 99% are well-known and widely publicized. So if you get told something by one guy that seems like a great deal but you've never heard of it before, be sure to check it yourself by running the idea past a few other independent sources, like your local library or senior tax volunteers service.

IR-2012-29, March 2, 2012 WASHINGTON –– The Internal Revenue Service today warned senior citizens and other taxpayers to beware of an emerging scheme tempting them to file tax returns claiming fraudulent refunds. The scheme carries a common theme of promising refunds to people who have little or no income and normally don’t have a tax filing requirement. Under the scheme, promoters claim they can obtain for their victims, often senior citizens, a tax refund or nonexistent stimulus payment based on the American Opportunity Tax Credit, even if the victim was not enrolled in or paying for college. In recent weeks, the IRS has identified and stopped an upsurge of these bogus refund claims coming in from across the United States. The IRS is actively investigating the sources of the scheme, and its promoters may be subject to criminal prosecution. “This is a disgraceful effort by scam artists to take advantage of people by giving them false hopes of a nonexistent refund,” said IRS Commissioner Doug Shulman. “We want to warn innocent taxpayers about this new scheme before more people get trapped.” Typically, con artists falsely claim that refunds are available even if the victim went to school decades ago. In many cases, scammers are targeting seniors, people with very low incomes and members of church congregations with bogus promises of free money. The IRS has also seen a variation of this scheme that incorrectly claims the college credit is available to compensate people for paying taxes on groceries. The IRS has already detected and stopped thousands of these fraudulent claims. Nevertheless, the scheme can still be quite costly for victims. Promoters may charge exorbitant upfront fees to file these claims and are often long gone when victims discover they’ve been scammed. The IRS is reminding people to be careful because all taxpayers, including those who use paid tax preparers, are legally responsible for the accuracy of their returns, and must repay any refunds received in error. To get the facts on tax benefits related to education, go to the Tax Benefits for Education Information Center on IRS.gov. To avoid becoming ensnared in this scheme, the IRS says taxpayers should beware of any of the following:

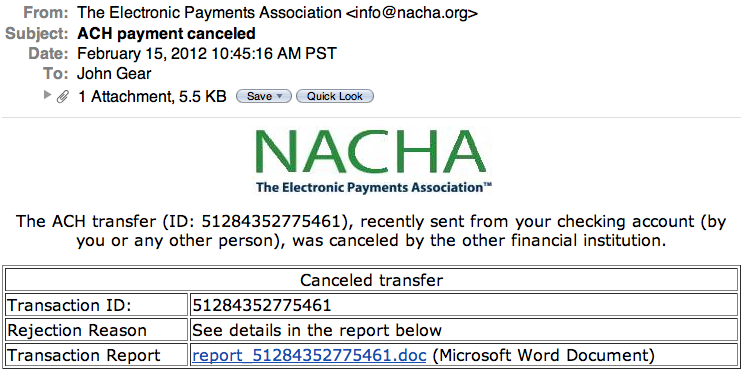

For additional information on tax scams, see the 2012 Dirty Dozen list. In the never-ending Darwinian struggle of predators and their intended prey, the phishing scammers (the people who try to gull you into revealing sensitive information to them by sending you a convincing but deceptive email that baits the trap so that you will click on a weblink or download a destructive file) are getting better and better, meaning that those of us who don't want to be prey need to more perceptive and careful all the time. Below is today's first scam.

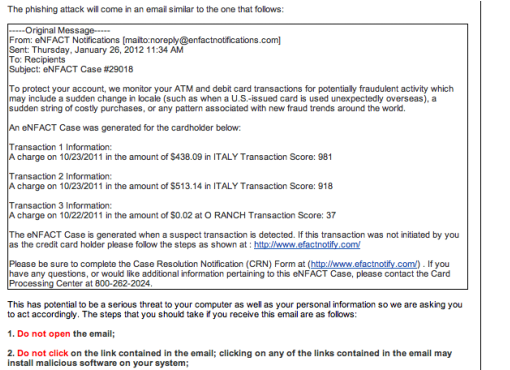

What's interesting is how good the email looks -- but when you hover your mouse over the baited link (DON'T CLICK UNKNOWN LINKS, hover over them with the mouse to see where they will take you if you are unwise enough to click on them), it reveals a URL from Brazil (carlosbrusman.com.br).  This is a very good example of how to do it right when you try to alert customers or stakeholders about a "phishing" attempt. "Phishing" is where the scam artist dangles a lure and tries to lure you to bite on what appears to be a safe-looking link that actually leads you to a specially-disguised website, where they get you to give them your private data, all while making it appear that they are helping you). Willamette Valley Bank is a local institution, and this email (complete text below, image above) is a well-done warning. Some phishing warnings are so poorly planned that you can't tell whether it's a genuine warning or more phishing. The text of the WVB warning: Dear Client & Friend, We recently received a communication alerting us to the fact that there may be an attempted phishing attack in progress. Because we care about the safety of our clients, we are providing you with information and steps to take if you receive this fraudulent email. Phishing is a form of fraud that is used as an attempt to acquire personal information such as usernames, passwords, and credit card details. The most common way this is attempted is through email. Emails have been received that reference the "eNFact" product. These emails have been directing recipients to click on a link (shown in the e-mail sample below) which will take them to a mock-Fiserv site which is believed to be installing malicious software onto computers. The phishing attack will come in an email similar to the one that follows: [see image above] 1. Do not open the email; 2. Do not click on the link contained in the email; clicking on any of the links contained in the email may install malicious software on your system; 3. If a link is clicked, steps should immediately be taken to protect your computer and/or network; 4. Delete the email from your "Inbox" and "Sent Items. Please rest assured that your personal information stored on Willamette Valley Bank computers is secure and this threat does not compromise that information. If you have any questions about this at all feel free to contact us: From a public-spirited attorney in Washington, Peter Fels, who passes on this warning from a Spokane attorney, Dick Sayre. No reason to think it stops North of the Columbia River. Folks, the Attorney General is accepting complaints about VA scams which are spreading over Washington like a small plague. They are working with the VA, who is not at all amused by these goings on. Of particular interest to the AG are non lawyers selling insurance products and/or irrevocable trusts to disabled seniors with a purpose of shielding assets from VA so as to gain acceptance for Aid and Attendance benefits, but lawyers here and in other states taking part in the scams are also a target of their investigations. As most of you know, VA does not have a lookback or penalty for gifting assets, making this what appears to be an easy sale for the annuity sellers, who charge for the 'service' and get commissions from the trusts and annuities. That will likely change as a consequence of this practice. As many of you know, clients are being talked into making gifts to children, who then either put the funds into an irrevocable trust or buy an annuity 'to keep the funds safe'. They then apply for Aid and Attendance benefits but, of course, when they later need Medicaid, they are faced with a huge penalty period and extended ineligibility. DSHS will deny eligibility or deem assets to be in a constructive trust; however, often the client cannot get them back - it's the worst of all worlds. I have dealt with a number of these cases, and everyone ended badly for the clients. Here in Spokane, the VA experts are approaching AFH's and nursing homes for presentations, and are being given a warm welcome given that the money goes to the facility. When the next one of these goes bad, I'll be visiting with some of the litigators on this list about the forseeability of injury when the facility sets these creeps up as experts for financial gain. The agents pass themselves off as VA experts and have business entities with snappy titles. They make huge profits for advice and healthy commissions from crappy annuities sold to desperate people without any warning of the consequences of this approach. As most of you also know, the VA helps people apply for A&A without cost. If you have complaints, please direct them to Brooks Clemmons or file a complaint as set out below. Here is contact information for Brooks: brooksc@atg.wa.gov and (509) 456-3282 (direct line) It would be helpful to the AG if people filed a complaint online at www.atg.wa.gov as those complaints go straight into their bank of complaints and are coordinated with similar complaints. The AG would like to find out if there are persons or families that have been approached or have been taken in as a consequence of these unethical and fraudulent practices. In Brooks words: It is our fervent desire to stop this practice and stop others from being harmed. I have filed several complaints, and I know others have as well. I've also created some havoc with annuity companies, but most won't budge absent litigation. Meanwhile, the client is without services or money. It is now reaching epidemic levels, and I ask you all to refer cases to the AG so we can prevent more people from being irreparably harmed. Dick Sayre Sayre & Sayre, PS Spokane The other day I warned you about a company that has all the hallmarks of a scam debt relief con -- much like this one in NC (bolded points emphasis is mine):

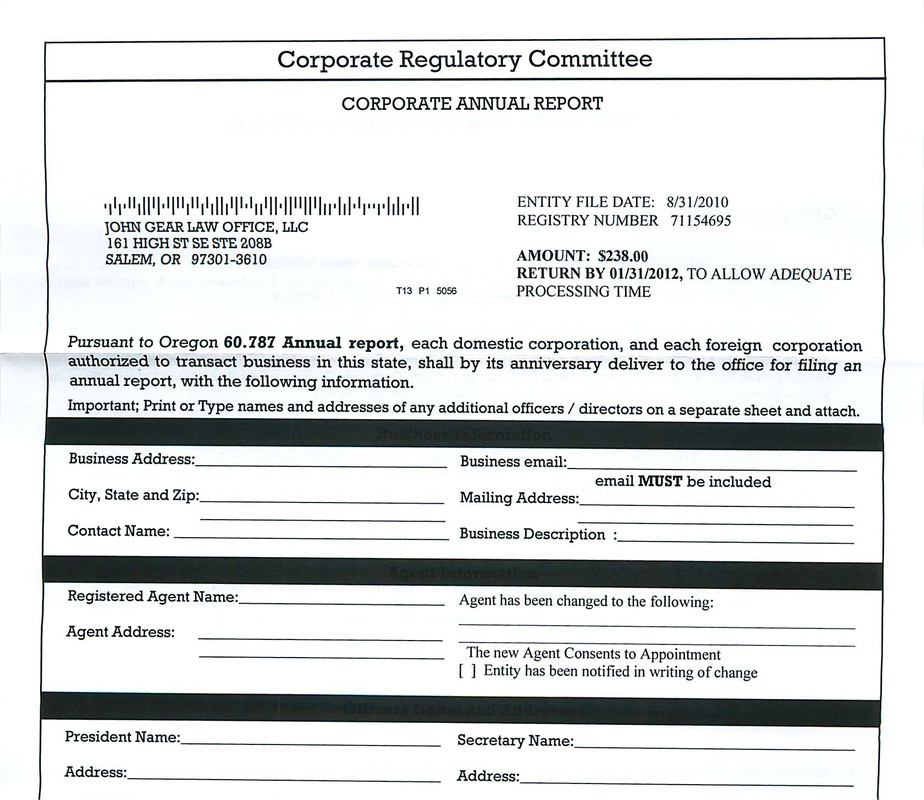

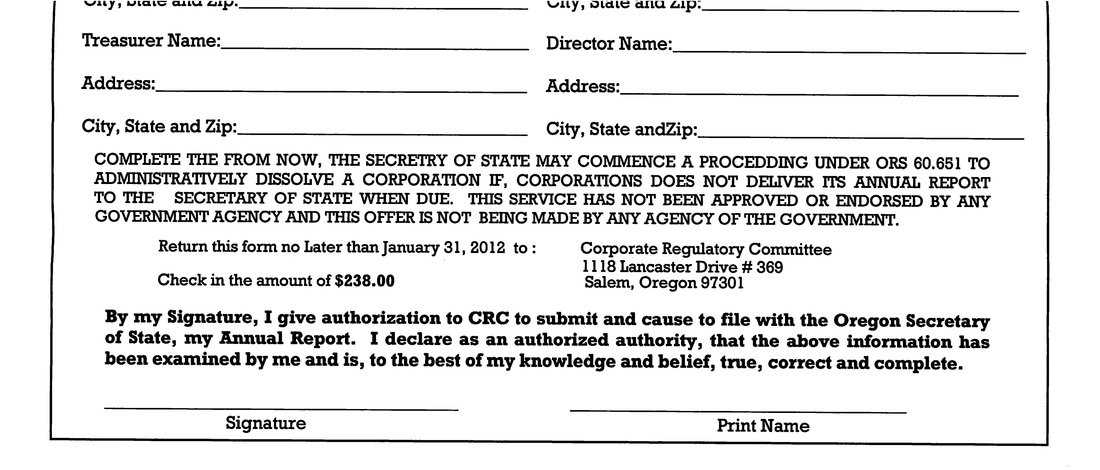

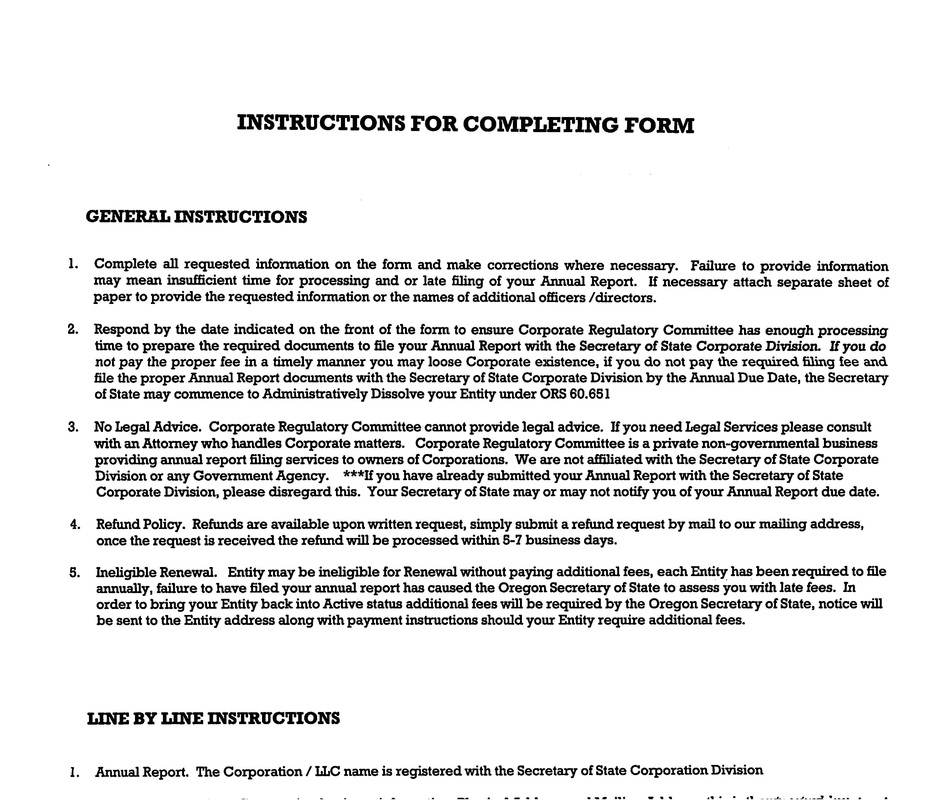

RALEIGH, N.C. -- A bogus Florida law firm, which claimed it would reduce consumers’ debts by more than half, has been barred from debt-relief work in North Carolina. Attorney General Roy Cooper announced Tuesday that under a consent judgment approved by Wake County Superior Court Judge Howard Manning, The Consumer Law Group of Boca Raton has agreed to pay $600,000 in refunds to North Carolina customers who paid the company for help getting out of debt. “Debt relief scams take advantage of struggling consumers, adding to their burden instead of helping them get out of debt,” Cooper said. “I’m pleased that we’ve been able to win money back for these consumers, money that can hopefully help them pay off bills and get on better financial footing.” The $600,000 payout is on top of approximately $600,000 worth of charges the company agreed not to collect from North Carolina customers. An additional $50,000 will help cover the state's costs for work on the case. The judgment bars CLG from marketing, soliciting or offering a debt-settlement or debt-negotiation services in North Carolina. CLG is also prohibited from claiming that its services are government-sponsored, performed by attorneys, or provide legal representation for consumers. Cooper’s office filed suit against CLG in October 2010 after a probe determined that more than 650 North Carolina consumers had paid CLG for debt-relief work but gotten little or no help in return. People can continue to file complaints about CLG or other debt-relief companies by calling the attorney general’s Consumer Protection Division at 1-877-5-NO-SCAM toll-free within North Carolina, or filling out a consumer complaint form at www.ncdoj.gov. “Don’t pay an upfront fee for help getting out of debt,” Cooper said. “For real help getting your debts under control, meet with a qualified non-profit credit counselor in your local community, who won’t charge you a big fee.” For help finding an accredited, non-profit credit counselor, contact the National Foundation for Credit Counseling at 1-800-388-2227 or www.nfcc.org. _A very non-descript white #10 business envelope with a see-through address window came in my mail this morning from something I'd never heard of called "Corporate Regulatory Committee" at 1118 Lancaster Drive #369, Salem OR 97301."

"Looks official. Who's that?" I wondered. Turns out to be a variant on the old phone directory billing scam, where people you've never heard of send you an oh-so-official looking letter that very much makes it seem like you already owe them money. Somewhere buried in the verbiage of all these things (amidst all the humorous spelling mistakes, like "procedding" -- how many can you find?) is usually some sort of phrase that explains, to the alert reader, that you don't actually owe anything and that this whole thing has no real connection to the organization that the rest of the hit piece is intended to make you think it's from. Plenty of people get scammed by these sorts of things, even some pretty bright but busy people. Don't be one of them. If you get a letter like this, do not pay, of course, but also do not throw it away. Instead, keep it, and alert the Attorney General and the Secretary of State. (No doubt you'll not be surprised to find that 1118 Lancaster Drive is a private mailbox business, so there's another violation, this one of postal rules, which are that PMBs are supposed to put PMB in their return address.)  The image they're selling is a lot different than the reality most people experience from "debt relief" schemes like this _ WARNING -- DEBT RELIEF OPERATION OUT PROSPECTING FOR NEW VICTIMS -- THE BOTTOM LINE IS THAT THESE FIRMS CHARGE A LOT OF MONEY, UP FRONT, TO "NEGOTIATE" ON YOUR BEHALF, AND YOU HAVE NO WAY TO KNOW WHAT, IF ANYTHING, YOUR MONEY WENT FOR (and they write the contracts in a way that guarantees that they get paid whether you get any debt relief or not). Remember, unsecured debt is just that -- it's debt that you can eliminate in bankruptcy, they can't repossess the goods you bought with the credit cards. THAT is your leverage with the credit card companies, NOT the fact that some GFS-like outfit is in the picture. Reputable financial counselors don't use the same sales pitch techniques (the supposedly testimonial note from "Nancy Harper," the blizzard of exclamation points!!, the pitch to get you to give them all your financial info before they tell you anything of substance) that the credit card companies use. If you are in over your head in debt, the best thing you can do is contact an attorney licensed to practice law in your state, or programs like Legal Aid in your community -- stay away from internet come-ons offering fantastic tales of debt elimination. =========== This really works for people! It worked for me! I have tried for a long time. To get out of debt! Until one day, I heard about debt settlement! It is an aggressive way to get out of debt ,and fast!!! So I had a free consultation from one of global financial analyst’s. They sent me a free debt kit to look over all the options out there. With all the pros and the cons of each. I had over $43,000 in credit card debt.. I went with Global Financial Services program and saved close to $18000, and was out of debt in 22 months. It was amazing for me and my two boys! I have extra money in my pocket every month and I don’t have to worry about not being able to make my minimum payment every month. Thank you so much GFS, you really changed my life! Cindy Harper If you’re struggling to keep up with your monthly credit card bills you’re not alone, millions of Americans are heavily in debt and having trouble making the minimum payments on their credit cards. We understand what you’re going through, and we’re here to help! Our debt negotiation program is designed to show consumers how to get out of debt as quickly and smoothly as possible. Debt settlement is a proven system through which unsecured debt is negotiated down to a fraction of what is owed. In exchange, the creditor agrees to forgive the balance, and the account is settled in full. Debt settlement is the most viable option for consumers to get out of debt in the shortest period of time and for the least amount of money. Simply click on the link below and submit your contact information for your FREE Debt Relief Information Kit and a FREE consultation from one of our Trained Financial Analyst. One click could change your life http://www.globalfs.org/debt_kit_landing.php Best regards, Henry Harvey Regional Director Global Financial Services |

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

||||||

RSS Feed

RSS Feed