Since 1995, the Department of Health and Human Services’ Office of the Inspector General has published warnings and reports outlining the misuse of the hospice benefit. Last year, it listed hospice fraud as the government’s top area for criminal recoveries, after the pharmaceutical and home health sectors. “It’s an open secret that hospice is one of the poster children for fraud and abuse in Medicare,” said David Grabowski, a health policy professor at Harvard who serves on MedPac, the federal advisory panel on Medicare spending.

Some hospices boost profits by signing people up regardless of whether they are dying. Marketers present the program as free home health care or steal personal information to enroll “phantom patients.” Others target assisted living facilities and nursing home residents whose life expectancy exceeds six months.

This guide can help you research your hospice provider and spot common signs of hospice fraud. It is adapted from the Senior Medicare Patrol National Resource Center, a grantee of the Administration for Community Living at HHS, that assists Medicare beneficiaries, families and their caregivers to prevent, detect and report health care fraud, errors and abuse.

Click Read the rest to see the whole thing

|

https://www.propublica.org/article/how-to-research-your-hospice-and-avoid-hospice-fraud

0 Comments

There is an alert sent to elder law attorneys that you might want to review if you are low income and are paying premiums for your Medicare Part D (Prescription) coverage: Excerpts from the alert (available for download below): "You May be Overpaying for Part D Prescription Drug Coverage" "Every year hundreds of thousands of Medicare enrollees with the Low-Income Subsidy (LIS or “Extra" "Help”) overpay for Medicare prescription drug coverage. In 2021, for example, thirteen percent (800,000) of" "LIS enrollees were expected to pay an average of $27/month for Part D premiums in plan year 2022 if they did not switch to a premium free plan. In many cases, the reason these individuals are paying premiums is inertia. People who qualify for the full Medicare Part D LIS do not pay premiums if they enroll in plans with “benchmark” prescription drug premiums. Benchmark plans have premiums at or below a cut-off in each region, which is set yearly by the Centers for Medicare and Medicaid Services (CMS). LIS recipients who are enrolled in a Prescription Drug Plan (PDP) or Medicare Advantage plan with Part D premiums above the CMS cut-off must pay the difference between the benchmark premium and the premium charged by the plan. Sometimes, PDPs lose benchmark status. For LIS recipients who were auto-enrolled in a benchmark plan by CMS, CMS will also automatically move them to a different plan when their current PDP loses benchmark status the following year. However, LIS recipients who pick a plan at any point in their Medicare eligibility (called “choosers”) are not moved automatically if their plan’s costs are above the benchmark in any subsequent year. If these LIS recipients do not affirmatively choose a new benchmark plan, they will have to pay the difference between the benchmark premium and the premium charged by their current PDP. "Choosers receive a notice in early November on tan paper (the “tan notice”) informing them of their new premium and offering them a list of plans available with no premium liability. The tan notice goes to any chooser who will pay a premium for the first time or whose premium will go up. Choosers do not receive the tan notice if they already are paying a premium and that premium stays the same or goes down. "•" ARE YOU PAYING A PREMIUM? If you are not sure, review your options with a State Health Insurance Assistance Program (SHIP) counselor. You can also get help through 1-800-Medicare or on the Medicare.gov website. The best time to review coverage options is during the Open Enrollment Period from October 15 through December 7.

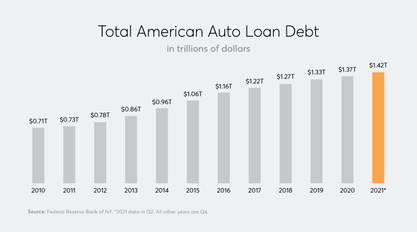

Revealing National Public Radio piece on how many auto dealers operate. https://www.npr.org/sections/money/2022/08/30/1119715886/inside-the-rise-of-stealerships-and-the-shady-economics-of-car-buying Recently, my truck was stolen, forcing me to get some new wheels. And, for the first time in my life, I've been looking to buy a new car. The process has involved hours of searching. Painful haggling. And encounters with many dealerships that, quite frankly, have been downright duplicitous. The whole thing has been kind of a nightmare.  A fellow consumer lawyer does a great job exploding how Experian is setting traps for consumers to trick you out of your rights. The whole thing is really worth your time to read: https://goldsonlawoffice.com/consumer-protection/how-experian-tricks-people-into-signing-away-their-rights/ If you are having trouble sleeping one night but don’t mind a possible nightmare of being crushed by a multi-billion dollar corporation, you can read Experian’s Terms of Use Agreement here:  After a decade of research, the Federal Trade Commission has issued draft rules to combat the plague of auto-dealer misconduct throughout the sales process. You can help make sure the FTC adopts the strongest possible version of the rules by telling the FTC about your car-buying experiences. The car dealers lobby will be pushing back against pro-consumer rules, so we need everyone who has been subjected to abuse from a car dealer to build the strongest possible case about why the strongest possible rules are so vital. So, please, if you have ever had a bad experience buying a car, turn that bad experience into good by telling the FTC what happened to you. Your story can help the FTC write the strongest regulations. Stick up for consumers by sharing your experiences at this link. And if you are a consumer advocate, urge the FTC to issue stronger car buyer protections on regulations.gov.  Consumers' Checkbook, a consumer-oriented site, has a very good article on "certified" used cars -- if you are considering one, you will want to read the whole article carefully before you go shopping. Short excerpt below ... https://www.checkbook.org/puget-sound-area/used-car-certifications-often-not-meaningful/ Used-Car Certifications Often Not Meaningful The current meltdown in "cryptocurrency" (more aptly named griftocurrency) demonstrates that ordinary consumers have no business messing with it.

Here's a great website that keeps track of the KNOWN loot scammed from people via griftocurrency plays https://web3isgoinggreat.com/ Today, the New York State legislature passed an electronics Right to Repair bill: As of mid 2023, manufacturers who sell “digital electronic products” in New York will have to make parts, tools, information, and software available to consumers and independent repair shops. We still await a final signing by the governor, but advocates don’t expect a challenge. . . . Friend of John Gear Law Office and outstanding consumer attorney Young Walgenkim, along with a stellar cast of other consumer protection experts, has filed a petition with the FTC to stop one of the worst abuses in the entire US market system, the yo-yo sales scam that auto dealers use. The yo-yo sale is so bad it reminds you of the old saying that "If you think the illegal stuff is bad, take a look at what's legal." Basically, a yo-yo sale is where you are stuck with the bargain you made but the dealer gets to revoke it … in other words, they get you psychically invested into and committed to the car you bought and often into sinking money into the car, and then they pull it back (the yo-yo) and demand that you, the consumer accept a worse deal or give the car back. And, believe it or not, today, that's legal. It’s absolutely a shocking and abusive predatory practice that ought to be outlawed in auto sales just like all other forms of consumer contracts. If the deal isn't binding on them, it shouldn't be binding on you. Read the rulemaking petition below and then contact your congressional rep and your Senators and tell them you agree: If an auto dealer isn't bound by the contract, the consumer shouldn't be either. If a deal's a deal, then it should be binding on both sides or neither side. End Yo-Yo Auto Sales!

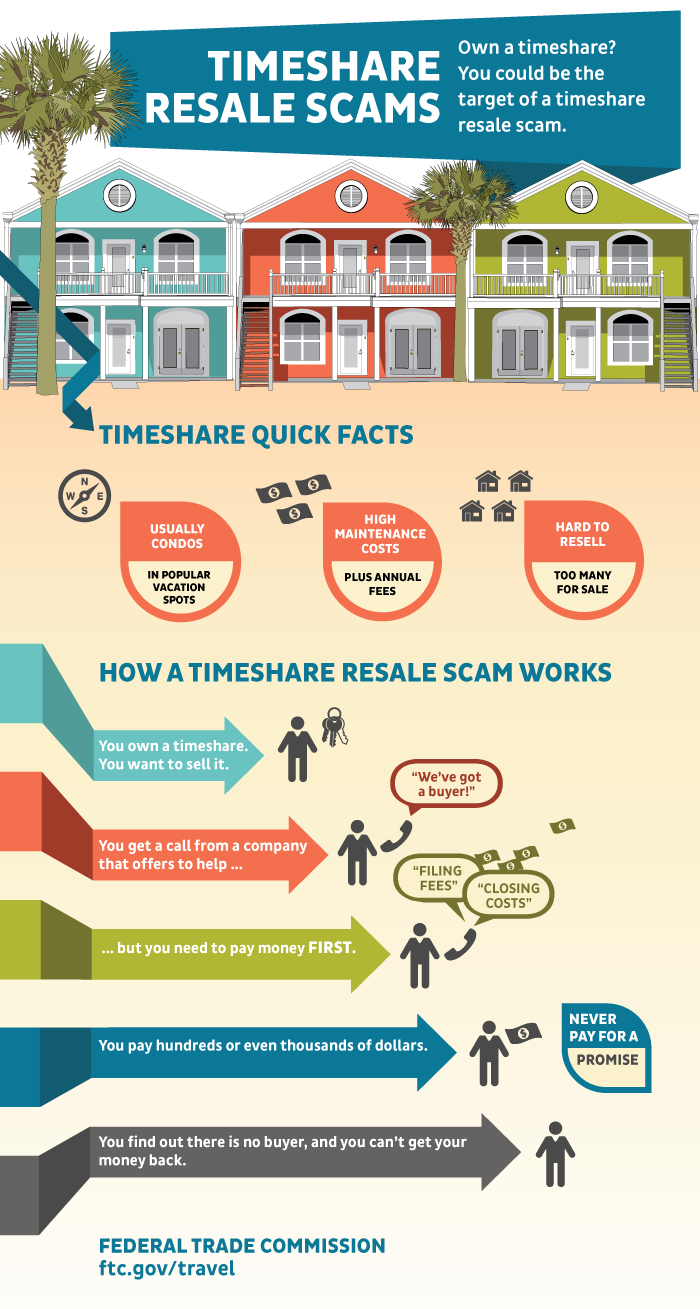

Very helpful article from The Verge below with step-by-step directions on how to avoid getting jobbed out of your right to join a class action against Venmo (which is, in practical terms, probably the only way you'd ever be able to have a hope of dealing with a problem with them that they won't fix for you). Excellent deeper analysis of how Venmo is hoping you won't bother so they've made the process absurd, from the Credit Slips blog. How to opt out of Venmo’s new arbitration clause  "Surprise, surprise, surprise" as Gomer Pyle used to say. Consumer Reports has a good article on how car dealers rip you off on loans. Well worth a read if you ever consider buying a car. ProTIP: If you can't pay cash and must finance a car purchase, separate the loan deal and the car deal; never do them together with financing from the dealer.* Get your loan approval from your own credit union or bank before you go car shopping so you can know exactly how much you can afford and the dealer can't bamboozle you by negotiating both deals at the same time. And, of course, you have to be willing to walk away from the lot without buying anything. And never buy any used vehicle without having your own independent mechanic to a complete pre-purchase inspection and test drive of the vehicle; if you can't afford the pre-purchase inspection, you can't afford the car anyway. (* With the possible exception for the case where you are buying a new car and the maker is offering zero-percent financing and you are certain that you aren't being overcharged on the car.) Experts say that CR’s analysis suggests a broad problem with the way car loans are arranged in this country: Dealers and lenders may be setting interest rates based not only on risk—standard loan underwriting practice—but also on what they think they can get away with. Studies show that many borrowers don’t know they should, or even can, negotiate the terms of a loan, or shop around for other offers. Why You Should Never Use Your Debit Card Based on the number of people who call me seeking help with timeshares they are unhappy with, I can safely say that, other than herpes, timeshares are just about the worst possible thing you can acquire on a vacation. Maybe the only thing worse than getting involved in a timeshare in the first place is then getting ripped off again while trying to get out of one. The "timeshare exit" field is full of pirate scammers who are only too happy to have another shot at separating you from even more of your money and preying on your desperation to unload what has turned out to be a horrible idea. The FTC has some good guidance you should check out (click the link or download the document below the graphic) if you are even thinking of getting within 100 miles of a timeshare sales pitch, or if you have already been snared and are thinking of trying to unload your timeshare. Urge Congress to Support a Congressional Review Act Resolution to Overturn the OCC's "Fake Lender" RuleDear friends and allies, Congress has a short window of time to pass a resolution under the Congressional Review Act to invalidate the Office of the Comptroller of the Currency’s (OCC’s) "fake lender” rule. The fake-lender rule enables predatory consumer and small business lenders charging 179% APR or more to evade state- and voter-approved interest rate caps. ACT NOW! Email your senators and representative to ask them to support the resolution (S.J. Res. 15 or H.J. Res. 35) to overturn the OCC's "fake lender" rule. The rushed “fake lender” took effect in December and protects “rent-a-bank” schemes whereby predatory lenders (the true lender) launder their loans through a few rogue banks (the fake lender), in order to claim that it is a “bank loan” exempt from state interest rate caps. The fake lender rule overrides 200 years worth of caselaw allowing courts to see through usury evasions to the truth, and replaces it with a pro-evasion rule that looks only at the fine print on the loan agreement. Congress can use the Congressional Review Act to overturn the rule with only a simple majority vote in the Senate -- no filibuster. But the deadline is approaching, so Congress must act soon. Please also urge your members of Congress to support the Veterans and Consumers Fair Credit Act, which would stop predatory cost rent-a-bank loans by extending to all lenders, including banks, the 36% APR rate cap that currently protects active duty servicemembers. Tell Congress to overturn the OCC's "fake lender" rule! Thank you! Lauren Saunders Associate Director National Consumer Law Center The author of this piece says "almost never" -- I will go further and say that should be "never" for consumers. Why You Should Almost Never Buy a Salvage or Rebuilt Title Car

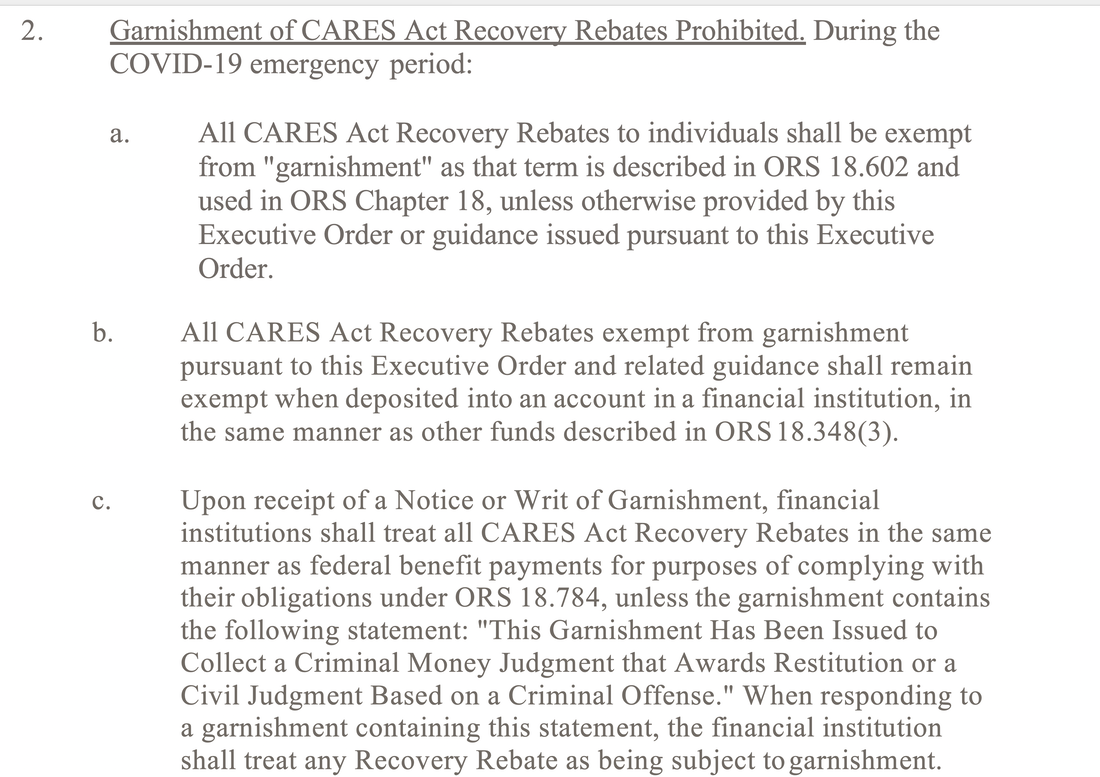

The Governor has wisely ordered that any Oregonian's CARES check be free from garnishments by creditors (except for restitution garnishments for criminal justice debts) during the COVID-19 emergency. The top picture is the key provision. If you want the full text and all the details and definitions, the full order is shown below that and you can download it by clicking on the down-facing arrow. Kudos to Gov. Brown for acting to help Oregon families survive this crisis in this critical period.  The heroes at the National Consumer Law Center (NCLC.org) have made their comprehensive 50th Anniversary guide for debtors called “Surviving Debt” available at no charge for ANYONE. This is an outstanding resource for ordinary folks who don’t want to try to read law books or statutes etc. It’s in clear, plain English. I have given away more than two dozen copies to friends and clients and it’s usually the first book I reach for when someone has a question about how to manage their debts of ANY kind. While you isolate in place, if you are worried at all about your finances, take the time to read the first 10 short chapters and then the chapters for your type of debts. So you don't have to read it all -- just the first couple chapters and then the chapters that pertain to your type of problem. (And if you yourself are able to make a contribution to NCLC, they would welcome it and put it to good use.) Find it here: https://library.nclc.org/SD

State issues grace period order for insurance deadlines REMEMBER: Federal law prevents businesses from sticking fine print into their contracts that prohibits you from writing or posting a negative review of the business! (The Consumer Review Fairness Act (“CRFA”) became law in March 2017.)

The Federal Trade Commission recently slapped three companies who had form contracts that said the consumers could not post negative reviews about the products or services from the businesses. Worse, these form contract also had confidentiality clauses -- those said that the consumers would PAY money damages to the businesses if the consumers disclosed information they got while using the products or services was confidential.  Reuters has a must-read story with implications for everyone in America: "That evidence was clearly compelling: In a 2004 ruling, Judge Stephens rejected Purdue’s motion that he dismiss the case and sided with the state’s assertion that the material could convince a jury that Purdue’s sales pitch was full of dangerous lies. But Stephens sealed the evidence on which he relied in that ruling. And when Purdue and the state reached a settlement that year, before the case went to trial, the evidence remained hidden, out of sight to regulators, doctors and patients. Over the next few years, as OxyContin sales and opioid-related deaths climbed, more than a dozen other judges overseeing similar lawsuits against Purdue took the same tack, keeping the company’s records secret." Read the whole thing here: https://www.reuters.com/investigates/special-report/usa-courts-secrecy-judges/ There are no “quick fixes” to clean up your credit Mortgage Closing Scams: How to protect yourself and your closing funds By Melissa Yu – JUN 03, 2019 Your Mortgage Closing Checklist Closing is one of the most important stages of buying a house. Learn how to prepare and what to expect so you can close with confidence. Closing on a new home can be one of your most memorable life moments. It’s the final and one of the most critical stages in the home-buying journey, but with the exchange of key paperwork and a sizable down payment, it can also be a stressful experience, especially for first-time homebuyers. The FBI has reported that scammers are increasingly taking advantage of homebuyers during the closing process. Through a sophisticated phishing scam, they attempt to divert your closing costs and down payment into a fraudulent account by confirming or suggesting last-minute changes to your wiring instructions. In fact, reports of these attempts have risen 1,100 percent between 2015 and 2017, and in 2017 alone, there was an estimated loss of nearly $1 billion in real estate transaction costs. While it’s easy to think you may not fall for this kind of scam, these schemes are complex and often appear as legitimate conversations with your real estate or settlement agent. The ultimate cost to victims could be the loss of their life savings. Here’s what you should know and how to avoid it happening to you. How it works Scammers are increasingly targeting real estate professionals, seeking to comprise their email in order to monitor email correspondences with clients and identify upcoming real estate transactions. During the closing process, scammers send spoofed emails to homebuyers – posing as the real estate agent, settlement agent, legal representative or another trusted individuals – with false instructions for wiring closing funds. How to avoid a mortgage phishing scam

What to do if it happens to you

While it can be easy to think you’ll never fall for a scam of this nature, the reality is that it’s becoming more and more common, and the results can be disastrous for eager homeowners. By being mindful and taking a few important steps ahead of your closing, you can protect yourself and your loved ones. To learn more about the closing process, including how to prepare for your closing and common pitfalls to avoid, check out our Mortgage Closing Checklist. For information and resources for the each stage of the home-buying journey, visit the Bureau’s Buying a House tool. The resources on mortgage closing scams are part of the Consumer Financial Protection Bureau’s work to protect consumers from unfair, deceptive, or abusive practices. We arm people with the information, steps, and tools that they need to make smart financial decisions.

|

AuthorJohn Gear Law Office - Categories

All

Archives

December 2022

|

||||||||||||||||||

RSS Feed

RSS Feed