The biggest problem is that people drawn to serve nonprofits and religious organizations are often those whose hearts are so big and trusting that they don't realize that not everyone is like them. And these big-hearted, trusting people tend to shy away from the kinds of financial controls and policies and procedures that are needed to "keep honest people honest."

One of the ways that I help nonprofits deal with this issue is by discussing with them how terrible it is for the volunteers and employees of the nonprofit when fraud is discovered. Not only are nonprofits frequently the victims of fraud, but the employees who are unfairly suspected of it are also victimized by fraudsters, often with loss of a job when the organization closes its doors. And, of course, the donors who supported the organization are victims, because their gifts didn't go to the purposes intended. Finally, the people that the nonprofit wanted to serve are victimized, not only by the diverted resources but also (often) by the complete closure of the plundered organization.

Bottom line: Good employees and volunteers welcome good financial controls because they help the organization thrive, and keep those same employees and volunteers from falling under a cloud of suspicion.

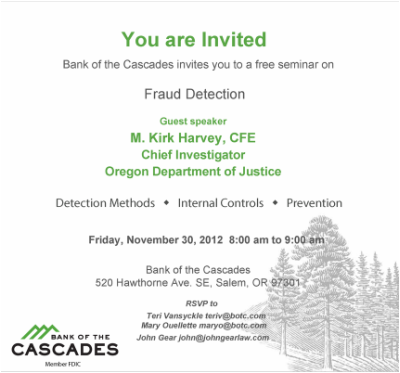

As a nonprofit leader, your responsibility to provide good financial controls (strong enough to deter fraud in most cases, and effective enough to detect it rapidly in the rest) is not just a legal duty; it's also a duty you owe to the people you recruit and the people who rely on the benefits your organization offers. If you don't know what these good financial controls are, why not attend this free workshop and hear from Kirk Harvey, the Oregon Department of Justice's chief investigator.

Seating is limited, please RSVP in advance to assure your seats. Bring your whole team.

RSS Feed

RSS Feed